The Social Security cost of living adjustment has been a hot topic in the news lately.

If you do a quick internet search for the term “Social Security” you’ll find that more than half of the articles are covering the forecasts of the upcoming benefits increase.

It’s no wonder: The upcoming cost of living adjustment will likely be the fourth largest in the history of Social Security.

As interest in this topic has grown, individuals are learning more about how these increases are calculated. And not everyone is happy about it.

Many of the comments I’ve been seeing claim that the numbers are rigged and that the increase in the cost of living won’t even be close to inflation because the numbers will be adjusted explicitly for the purpose of lowering the annual increase.

Some of this skepticism comes from the time period used in how the cost of living adjustment is calculated. While we have the inflation numbers that come out every month, it’s ONLY the months of July, August, and September that are counted for the annual increase to Social Security.

According to some, inflation goes down during those three months, then goes back up again. They suggest that if we used the entire 12-month period of data, we would get a more accurate cost of living adjustment and a larger increase.

So today, I want to tackle this head-on and look at the historical data to answer this question once and for all.

Why The Q3 CPI-W Data Is Used

Starting in 1975, Social Security started automatic annual cost-of-living adjustments. Before that, it was only through legislative action that benefits could be increased and those were not that reliable since they were subject to political gridlock.

The new law that was passed said that the automatic increases would be tied to the year-over-year change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

For the first few years they used different measuring periods to get the annual change but after 1982 it was decided that the third quarter would be used and compared against the last year’s third quarter data (or at least the last year where there was an increase). Any percentage increase would be reflected in the next year’s benefits.

Would The Full Year CPI-W Result In A Larger COLA?

So would using the 12-month period result in a larger increase than using only the third quarter numbers?

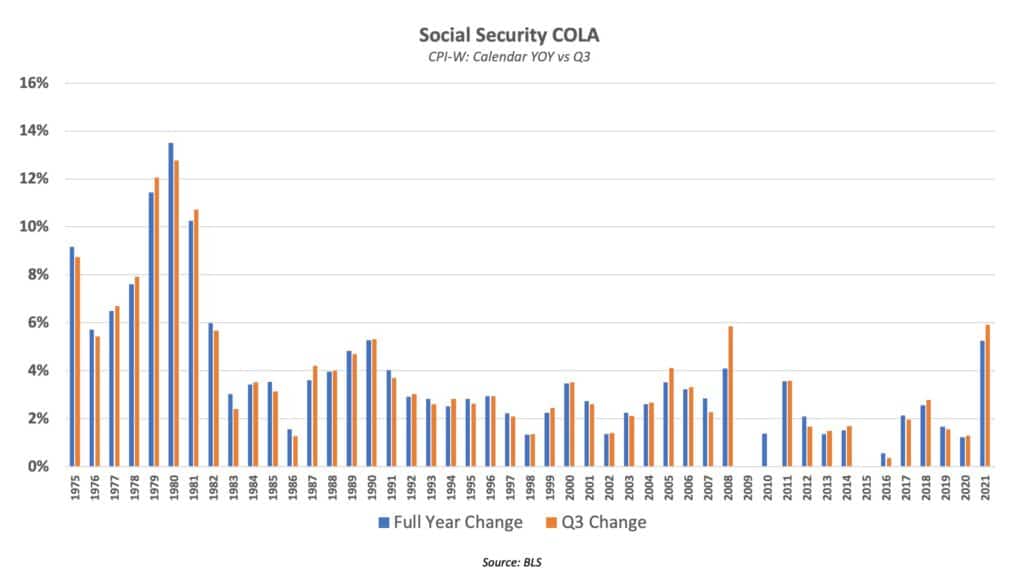

Let’s look at the data (in the chart below).

Going back to 1975 there were some years where the full 12-month period would have been higher. But there were also times when the third quarter data was higher. One notable year was 2010 where the full year would have given a 1.4% increase while the third quarter data didn’t give any increase.

When you average this out, the average COLA from using the full calendar year period was 3.7%.

When you look at the average for just the third quarter data it would be an identical 3.7%.

So the average since 1975 has been the same using either measuring period!

Some of my astute readers are going to say,”wait a minute…an average doesn’t tell the whole story.” And they are absolutely correct.

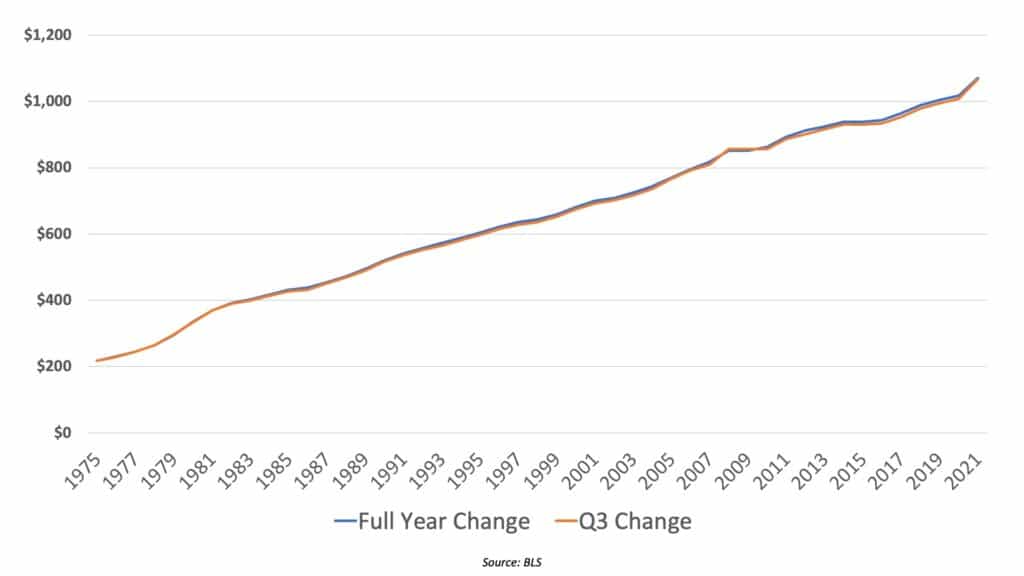

So what would be the impact to a real benefit amount using the full year of data vs. only the third quarter?

The easiest way we can examine this is to see what would have happened if someone would have received an average Social Security benefit beginning in 1975 and compare the two COLA measurement periods (see line graph below). Although it’s not easy to see, there are two lines in this chart representing the benefit payments. They are on top of each other most of the time and the end result would only be a $4 difference in benefit payments.

So is using only the third quarter data a form of stacking the deck against the people who receive Social Security? No. Ultimately, it doesn’t really make any difference if the COLA is measured using the full year of CPI-W data or only the Q3 results.

If you want to learn more about the annual increase to benefits, be sure to check out my article “5 Most Common Questions About The Annual Increase in Social Security (COLA).”

Before you leave, be sure to check out my brand new online workshop, “How To Choose The RIGHT Time To File For Social Security.”

In this workshop you’ll learn:

✔The Most Important Factors to Consider BEFORE You File for Benefits

✔How to Coordinate Your Social Security Filing Decision with Your Other Assets & Income for a Tax Efficient Distribution Strategy

✔Why This Is The Biggest Decision of Your Retirement

To access it, just click here https://www.devincarroll.com/SSessentialsonlineworkshop

[…] post Social Security COLA: Are The Numbers Rigged? appeared first on Social Security […]