On paper, the Social Security system has a generous payment to beneficiaries of someone who retires, dies, or becomes disabled. But what catches many people by surprise is that there’s a limit to these payments.

The Social Security family maximum benefits rule may stop you from getting the full amount you might expect.

This article takes a very deep dive into the issue to explain both the common, well-known rules around the Social Security family maximum benefits — and the more obscure rules that cause benefits to be capped to a range of 150%-188% of a retired, deceased or disabled individual’s full retirement age benefit.

We’ll also go over the calculation, and teach you how to determine what kinds of benefits to expect in your own situation.

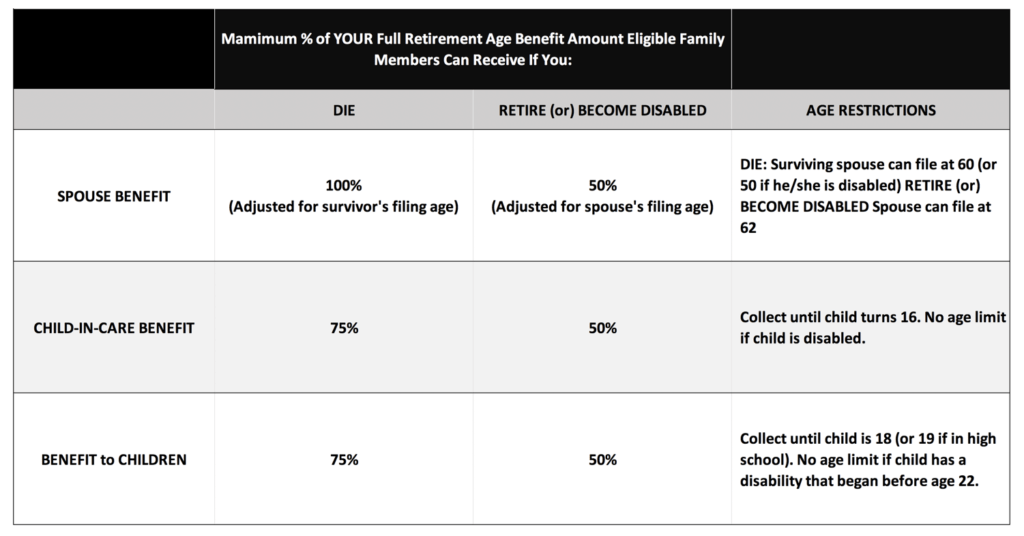

To kick things off, let’s take a quick look at the benefits available to your family members if you retired, died, or experience a disability. These benefits paid to your family are in addition to the benefit which you receive and are available to an eligible spouse (or former spouse) and children.

How Your Beneficiaries Can Receive Income from Your Work Record with Social Security

Here’s a breakdown of the individual benefits your family members can receive, depending on when you retire or if something happens to you.

If you retire or disable, then your Social Security family benefits would provide:

- An eligible current or former spouse with up to 50% of your full retirement age benefit amount at his/her full retirement age, or reduced benefits as early as 62

- A current spouse of any age with up to 50% of your full retirement age benefit if they have your child in care who is under the age of 16 (or any age if disabled)

- Your eligible children with a benefit of up to 50% of your full retirement age benefit as long as they are under the age of 18 (or 19 if still in high school) or disabled before the age of 22

Things look a little different if something happened to you and you were to pass away. In that case, here’s what Social Security benefits your family might receive look like:

- An eligible current or former spouse can receive up to 100% of your full retirement age benefit amount at his/her full retirement age, or reduced benefits as early as 60 (50 if disabled)

- An eligible former or current spouse can receive up to 75% of your full retirement age benefit if they have your child in care who is under the age of 16 (or any age if disabled)

- Your eligible children can receive a benefit up to 75% of your full retirement age benefit if they are under the age of 18 (or 19 if still in high school) or disabled before the age of 22

There are several other things to know about the benefits eligibility if you die, become disabled or retire. The two lists above simply serve as summaries.

For more in-depth reading, see the resources section at the bottom of this article and check out the following pieces:

- 3 Most Important Things to Know About the Social Security Surviving Spouse Benefit

- If You Die Young: How to Calculate Social Security Survivor Benefits (this is what everyone between the ages of 22-55 should know!)

- Social Security Benefits for Children: The 4 Most Important Thing to Know

- The Ultimate Social Security Cheat Sheet – The Essentials of the massive Social Security website distilled down to only two pages. Use this cheat sheet to simplify the rules and use them to your advantage! Click HERE to download your FREE copy

Beneficiaries Can Receive Up To a Certain Percentage: Where the Social Security Family Maximum Kicks In

With these benefit amounts in mind, and without knowing about the existence of the Social Security family maximum, it would be easy to grossly overestimate the amount of benefits your family members could receive.

For example, say you have a spouse who is 40. Together, you have three children under the age of 16. If you died, do you know how much would they collect?

Based on the information above, we know that your spouse would be eligible for a child in care benefit since they care for your children who are under the age of 16. This would be equal to 75% of your full retirement age benefit. Each of your three children would also be eligible for a children’s benefit of 75%.

So does this mean that there is a total family benefit of 300% of your full retirement age benefit?

75% – Spouse

75% – Child 1

75% – Child 2

75% – Child 3

= 300% total benefit to family?

Unfortunately, no. You can’t just add up the individual benefit amounts to see what the total will be. This is where the Social Security family maximum comes in to limit the total benefit paid from one individual’s benefit to a range of 150% to 188% of your full retirement age benefit.

Once the family max has been determined (we’ll cover the specifics of the calculation later in this article), the benefits to your beneficiaries are paid proportionately to each person.

If one of the beneficiaries no longer qualifies, because of age or other factors, the amount that was being paid to them will be added to the benefit of the remaining beneficiaries as long as the total doesn’t exceed the Social Security family maximum amount.

Dying vs. Retirement or Disability: How the Family Benefit Can Change

Admittedly, our own death provides a pretty morbid example most of us don’t want to think about. So what if, instead of dying, you retire or become disabled? Does that change the Social Security family maximum benefit?

Yes, because the family maximum will never result in a reduction of your benefit — only the benefits of your beneficiaries.

For example, say you reached your full retirement age — and have the same 40-year-old spouse with three children under the age of 16 that we used in the last example. Under the current rules, you receive 100% of your full retirement age benefit.

How about your family? Well, your eligible spouse can receive up to 50% of your benefit as a child-in-care benefit and each of your children can receive 50%.

100% – Your Benefit

50% – Spouse

50% – Child 1

50% – Child 2

50% – Child 3

= 300% total benefit to family, before the Social Security maximum benefit rule is applied

As in the last example, the family maximum would cap the total benefits paid. The difference here is that your benefit would not be reduced. The reductions would impact the benefits of your beneficiaries.

To illustrate this, assume that your full retirement age benefit is $2,000 and your family maximum is $3,600. In this example, the benefits would be allocated as follows:

$2,000- Your Benefit

$400 – Spouse

$400 – Child 1

$400 – Child 2

$400 – Child 3

= $3,600 total benefit to family with the Social Security family maximum rule in place

All this being said, you could have an important question if you’re not on your first marriage: What if you have an ex-spouse? Does the amount they collect from you reduce the amount your other beneficiaries receive?

Thankfully, no. This is the only case where someone can collect benefits from your work record and it does not count towards the total of the Social Security family benefit maximum. This means that neither your ex-spouses’ benefit nor the benefit of your beneficiaries will be reduced.

Does Your Filing Status Impact Family Benefits?

What if you file early for benefits? Since your benefit is lower, does this leave more to be paid to your beneficiaries?

You can ask similar questions on the flip side: What happens if you file later? Since you get more of a benefit, do your family members get less?

In both cases, the answer is no. Whether you file early or late will not affect the total family benefit amount. This is because your benefit is always assumed to be your full retirement age benefit even if you filed early or later.

The SSA uses this example:

Family Maximum Benefit Available

– Your Full Retirement Age Benefit

= The amount available to be split by eligible beneficiaries (up to the limits shown in the chart)

A Look at How the Social Security Family Maximum Impacts More Complex Cases

These are relatively straightforward examples. But what happens if a spouse has their own benefit but also receives a spousal benefit? How much of that counts towards the limit? What happens if you have minor children and both you and your spouse are retired? How does that impact their benefits?

Let’s take a look at some more complex examples so you have a more thorough understanding of how the rules around family benefits work.

When You’re Entitled to Your Benefit and Someone Else’s

An individual in this situation would be referred to as dually entitled, meaning they are entitled to benefits both on their own record and someone else’s record. This typically happens when a spouse has their own benefit that is not 50% of the higher-earning spouse’s benefit.

Since a spouse is entitled to at least 50% of the higher-earning spouse’s benefit, some of their benefit payment will be a “spousal excess” payment. It’s only this spousal excess that counts toward the family maximum.

For example, if a lower-earning spouse has a benefit from their own work of $800 and their higher-earning spouse has a FRA benefit of $2,000, the lower-earning spouse is entitled to a total benefit of $1,000.

$800 will be from their work and $200 will be from the “spousal excess” benefit. It will only be the $200 spousal excess amount that counts toward the family maximum.

Let’s continue the example and look at what happens when the higher-earning spouse retires with a $2,000 FRA benefit. The maximum family benefit would be roughly $3,500. If that individual has two adopted children under the age of 16 and a spouse who is also full retirement age, their benefits would be as follows:

$2,000 High earning spouse benefit

+$200 lower-earning “spousal excess” benefit

=$2,200 total benefit excluding children’s payments

–$3,500 total family maximum benefit available

=$1,300 remaining to be split among children ($650 goes to child #1 and $650 to child #2)

In very obscure cases, you may find that the spouse’s benefit could be reduced from the family maximum. When that occurs, only the amount the spouse is actually receiving is counted in with the family maximum. See the Parisi ruling for more information on this area.

When You’re Entitled to Benefits from More Than One Person (or, the Combined Family Maximum)

Using the same family as above, what

happens if both parents are retired and there are two children? Do those

children receive benefits from each parent? How does the family maximum affect

them here?

In the SSA terminology, this is referred to as “simultaneous entitlement” or even “triple entitlement.”

First, know that a child can only receive a benefit from one parent. This will always be the higher-earning parent unless an exception exists.

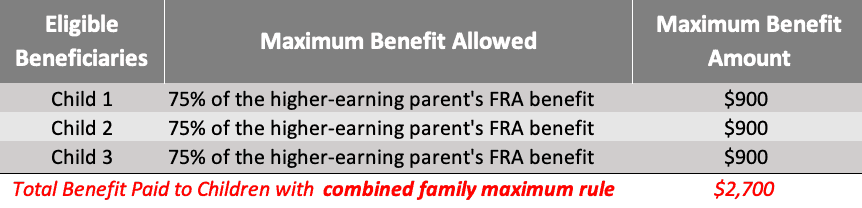

However, the combined family maximum rules are used in cases where a child is entitled to benefits from more than one person. This uses not only the maximum benefit calculation from the higher-earning parent, but also the family maximum from the other parent.

It is the sum of the family maximums applicable to each worker’s record, but it cannot go over the limits that are set each year for combined family maximums.

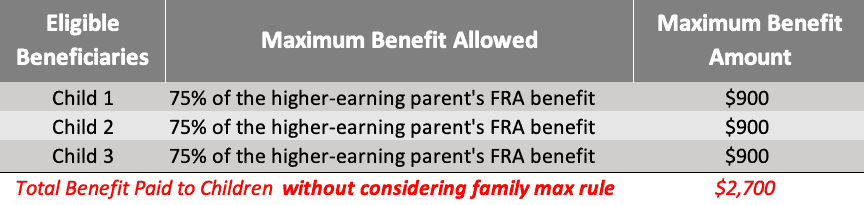

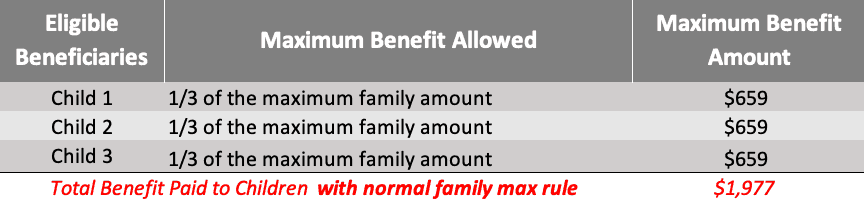

For example, consider the example of a mother and father who both die. They leave behind three children all of whom are eligible for survivors benefits on both of their parents’ work records.

To keep the math simple, let’s assume the father had a FRA benefit of $1,200 and the mother had a FRA benefit of $1,000. To illustrate this as clearly as possible, we’ll look at this example in three parts.

Part 1 is the benefit the kids would be entitled to if we did not have to apply the family maximum. Part 2 will look at benefits payable under the family maximum benefit from the father, who the benefit payments are based on. Part 3 will use the combined family maximum rules.

In this example the father would have a maximum family benefit of $1,976 and the mother would have a maximum benefit of $1,500. Combined, this would be a family max of $3,476.

Before Applying the Family Maximum Benefit Rule

After Applying the Family Maximum of $1,976 (Based on Father’s FRA Benefit)

After Applying Combined Family Maximum of $3,476 (Based on FRA Benefits of Both Parents)

In the case of the combined family maximum, the children were able to receive the full limit of the survivor benefit due to the combination of the maximum benefits.

Don’t Trust Social Security to Get Your Calculations Correct

You can see that your family members do receive benefits if you retire, become disabled, or die — but those benefits may be impacted if they hit certain caps on how much the Social Security Administration will pay to your family, or if you have a particularly tricky situation.

That’s good to know… but you can’t just trust the Administration to get things right. That would be too easy! In fact, a 2014 audit by the Office of the Inspector General found multiple cases where the SSA screwed up the family maximum.

In their random sample, they found $41 million in improper payments to spouses and children with respect to the family maximum benefit. Some of these improper payments were higher than they should have been, while some were wrongfully lower.

The SSA claims incorrect payments generally occur because they are manually calculated by their employees. Making matters worse, for more complex cases—such as spouses who receive part of their benefit from their work and part from a spouse, or a spouse who receives a “child-in-care benefit” — the Administration does not have the same automated review process as they do for almost every other kind of benefit payment.

The last thing you want to worry about is whether or not you and your family are actually receiving all the benefit payments you should — or if you’re receiving more than you should and constantly worrying about receiving an overpayment notice and correction in the mail.

For this reason, I want to make sure we take a look at how you can calculate your benefit to double-check the SSA’s work and confirm you and any of your eligible family members are receiving the correct amount.

Social Security Family Maximum Benefits Calculation If You Die or Retire

There’s an easy way to get your numbers, and a method that’s probably more accurate but requires a little work. I’ll cover both for you, below:

The Easy Way To Calculate Your Family Maximum

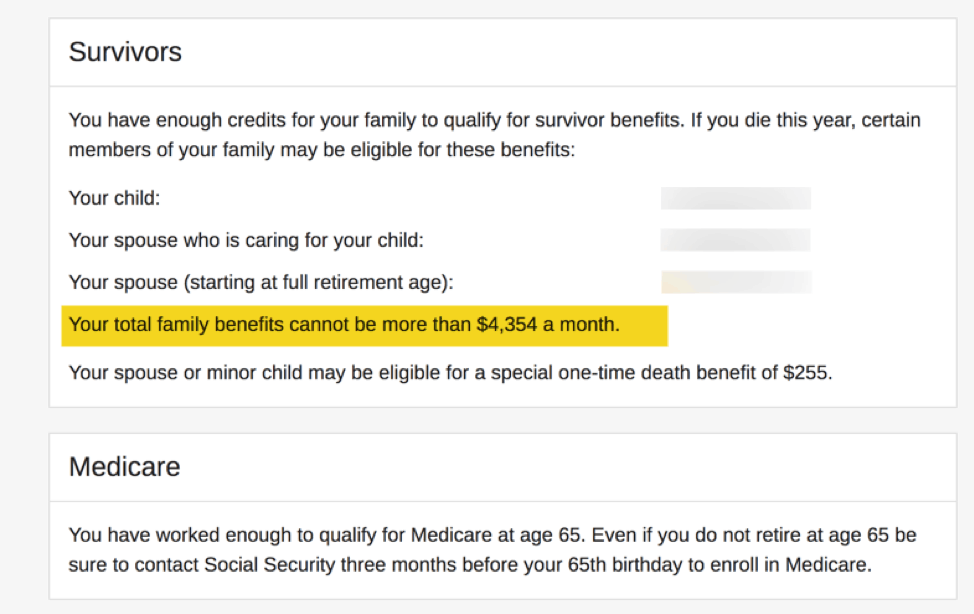

If you have a mySSA account (I hope you do! If not, pause reading on this article and set yours up now), you can quickly find an estimate of your family maximum.

Just go to the “estimated benefits” page and look in the section marked “survivors.” If you have any trouble locating this section — and I’ll admit I didn’t see it at first, either — you can simply hit the button to view your statement.

It’s really easy to find your maximum family benefit there:

This estimate is close, but close isn’t good enough for many of my readers. Plus, most of us want to fully understand the numbers behind these calculations because we don’t trust the assumptions of the Social Security Administration.

I’d be letting those folks down if I didn’t include the method of calculating for yourself, but if that truly doesn’t interest you, feel free to skip on down to the next section.

The More Accurate Way to Calculate the Family Maximum

Understanding the numbers behind the family maximum benefit calculation begins with an understanding of the basic Social Security benefit calculation steps. We won’t go through all of them in this in article because, if you need them, you can find them here: How To Calculate Your Social Security Benefits.

In that piece, I explain the three easy steps (and a few sub-steps) of taking your historical earnings with your estimated future earnings and figuring out what your future Social Security benefit will be.

You may also want to check out this article: If You Die Young: How To Calculate Social Security Survivor Benefits. Both this and the other linked here deal with a really important piece to the family benefit maximum formula, and that is your Average Indexed Monthly Earnings (AIME).

This your highest 35 years of historical earnings after they’ve been adjusted for inflation and divided by 420 (because that’s the number of months in 35 years). This AIME is what’s applied to both the standard social security benefit formula and the family maximum benefit formula.

If you’re familiar with the standard Social Security benefit formula, you’ll see the similarities in how the family benefit max formula also uses “bend points” to determine results.

For an individual turning 62 or dying in 2021, the formula takes your PIA (that’s typically the same as your full retirement age benefit) and applies it to the following bend points:

(a) 150 percent of the first $1,272 of the worker’s PIA, plus

(b) 272 percent of the worker’s PIA over $1,272 through $1,837, plus

(c) 134 percent of the worker’s PIA over $1,837 through $2,395, plus

(d) 175 percent of the worker’s PIA over $2,395

The total sum of each of those lines is rounded to the next lower multiple of $.10 if it is not already a multiple of $.10. The result is the maximum family benefit if you retire or die.

There are two important things to note here:

- The percentages in these bend points don’t change annually, but the dollar amounts will change in response to the national average wage index.

- The formula is only good for the year you turn 62 or die. To get an accurate estimate of future family maximum benefits, you’ll need to use some inflation on the bend points. The SSA projects an average of 4% annual change, but I’d personally choose to use a lower number. To see the formula for prior years, visit this page on the SSA website.

The Family Maximum Calculation for Social Security Disability

There are some differences in the calculation for the family maximum if you retire or die versus becoming disabled. They are both still based off of your AIME, but with the SSDI family max, there is no formula with bend points.

Instead, the family max is equal to 85% of your AIME — but limited to no more than 150% of your full retirement age benefit and no less than 100% of your full retirement age benefit.

Let’s assume that your AIME is $4,200. Using the current-year formula. this would give you an approximate FRA benefit of $1,880. That means your family maximum would be the smaller of 85% of AIME or 150% of your full retirement age benefit:

$3,570 (85% of AIME)

$2,820 (150% of FRA benefit)

In this example, the 85% of AIME would exceed the cap of 150% of FRA benefit so the family maximum would be $2,820.

Like many of the nuanced topics within Social Security, the rules for the Social Security family maximum benefits are not as straightforward as they seem on the surface. As such, there are a few additional resources that you may want to use to continue your learnings about this topic.

First, check out the FAQ section below. It has some of the answers to the questions I receive most often about the Social Security family maximum benefits rules. Additionally, down below you’ll find several links for the research I used in this article.

But what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Frequently Asked Questions About the Social Security Family Maximum

Q. Does this limit the benefit that my wife and I can receive if we both worked?

A. If you both worked, you’ll both be eligible for your own benefit even if the total is in excess of your family maximum benefit. The family maximum only limits the amount that can be paid from one individual’s benefit.

Q. Is the family maximum benefit the same as the maximum benefit?

A. No. The maximum social security benefit is the most that one individual can receive from work they have performed. See my article on this topic for more information.

Q. What happens when a child turns 18. Will it increase or decrease for my other children?

A. As long as the other children are not at the limit of benefits (50% of worker’s FRA benefit if worker dies or becomes disabled/75% if worker dies), the benefits should increase.

Resources:

Amount of Mother’s/Father’s Benefits

https://www.ssa.gov/OP_Home/handbook/handbook.04/handbook-0418.html

SSA research piece, “Understanding the Social

Security Family Maximum”

https://www.ssa.gov/policy/docs/ssb/v75n3/v75n3p1.html

SSA webpage on the formula for the family max

https://www.ssa.gov/oact/cola/familymax.html

POMS RS 00615.768 Adjustment

in Simultaneous and Dual Entitlement Cases

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615768

POMS RS 00615.756 Adjusting Benefits for the Family Maximum (FMAX)

https://secure.ssa.gov/poms.nsf/lnx/0300615756

RS 00615.768 Adjustment in Simultaneous and Dual Entitlement Cases

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615768

Splitting of entitlements

https://maximizemysocialsecurity.com/how-family-maximum-distributed

POMS RS 00208.000 Mother’s and Father’s Benefits (Child In Care)

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300208000

POMS RS 00615.772 Determining the SSN Upon Which Benefits Will Be Paid

https://secure.ssa.gov/poms.nsf/lnx/0300615772

RS 00615.770 Simultaneous Entitlement of Children on More Than One SSN

https://secure.ssa.gov/apps10/poms.NSF/lnx/0300615770

2014 OIG Audit “Adjustment of Monthly Benefits Under the Family Maximum Provisions”

https://oig.ssa.gov/sites/default/files/audit/full/pdf/A-09-13-13087.pdf

How Delayed Retirement Credits Affect the Family Maximum

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615695

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Cogent Advisory Group, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Cogent Advisory Group, LLC. is neither a law firm nor a certified public accounting firm and no portion of the article’s content should be construed as legal or accounting advice. A copy of the Cogent Advisory Group, LLC.’s current written disclosure statement discussing our advisory services and fees is available upon request.

[…] a limit to the amount the Social Security Administration will pay. They refer to this limit as the Family Benefit Maximum. This maximum benefit is not a set number but is about 150 to 180 percent of your full retirement […]

[…] This means that your eligible spouse and children can also receive benefits based upon your work subject to the family maximum. […]

I’m just wondering why a government agency who find a us born citizen a noncitizen

saw a couple of your you tube videos, looked you up, but no email address to ask a question. how is the best way to explain my situation and ask some questions?