Wondering how much income you’ll get from Social Security when you retire? You might be surprised to discover that the average retiree receives one-third of their total income from Social Security, according to the Social Security Administration.

In other words, 33% of retirement income comes from Social Security, and the remaining 67% comes from other sources, like pensions and retirement savings.

While 33% is a significant amount, the statistic includes people who depend on Social Security for 100% of their retirement income and people who have so much money that they don’t notice the monthly Social Security deposits.

The often quoted 33% might be an arithmetic average, but one thing is sure — it isn’t the norm for most people.

Social Security skews the data

Mark Twain was fond of saying, “There are three kinds of lies: lies, damned lies, and statistics.”

This Social Security’s statistic is a perfect example of what Twain meant.

For nearly 18 years, I’ve had a front-row seat to the inner workings of thousands of retirement plans as a financial planner specializing in this area. I see how my clients’ income sources and retirement savings produce an income stream during retirement.

Over the years, I’ve had a few clients that didn’t need their Social Security income. But for most, Social Security played an essential role in producing the income needed to meet their goals.

When breaking down the data, Social Security breaks it down into five income groups, three of which are categorized as middle class:

- Low Income: First Group

- Middle Income: Second, Third, and Fourth Group

- High Income: Fifth Group

Let’s look at a breakdown of the data to see the real reliance on Social Security and how skewed the 33% average actually is.

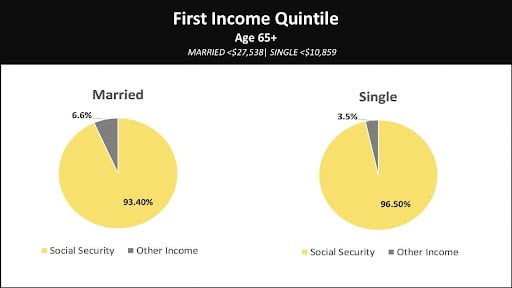

First income group: Low income

The first income group is made up of singles who make less than $10,859 and married couples who make less than $27,538.

Overall, Social Security income comprises almost all of this group’s income. For married couples, Social Security is 93.4% of their income. It’s 96.5% of a single person’s income.

As such, it’s no surprise that these low-income individuals receive a high percentage of cash flow from Social Security benefits — they didn’t have an opportunity to save, invest or create other retirement income streams.

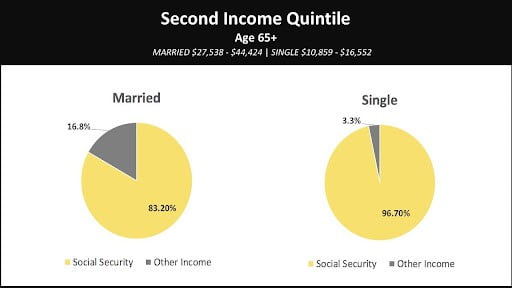

Second income group: Middle income

The second group includes singles with income ranging from $10,859 to $16,552 and married couples with income between $27,538 to $44,424.

In this group, Social Security makes up 83.2% of a married couple’s income and 96.5% of a single person’s income.

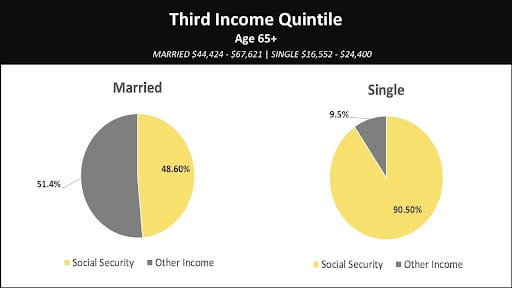

Third income group: Middle income

In the third income group, you’ll see married couples with income from $44,424 to $67,621 and single individuals with income from $16,552 to $24,400.

Social Security makes up 48.6% of a married couple’s income and 90.5% of a single person’s income in the third group.

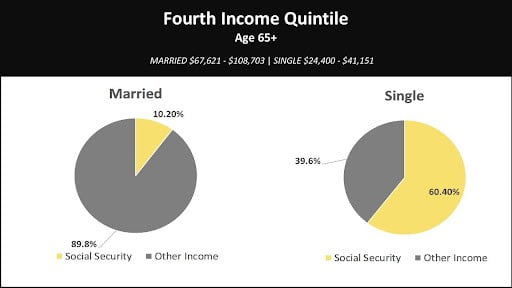

Fourth income group: Middle income

The fourth income group includes married couples with income between $67,621 and $108,703 and single individuals with income from $24,400 to $41,151.

Social Security makes up 10.2% of a married couple’s income and 60.4% of a single person’s income in the fourth group.

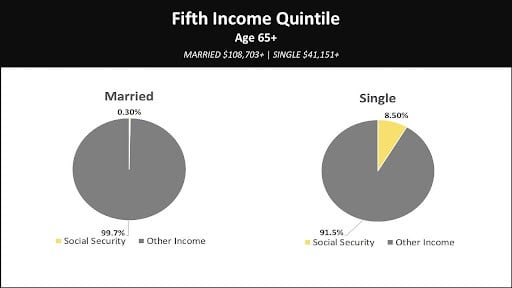

Fifth income group: High income

Finally, the fifth income group has married couples with incomes over $108,703 and single individuals with incomes higher than $41,151.

Social Security makes up a meager 0.3% of a married couple’s income and 8.5% of a single person’s income in the fifth group.

What the financial planning industry still doesn’t understand

The extreme data from the fifth group is what knocks the data out of whack and drives the average down. When viewed by income group it’s clear that for most retirees Social Security is a significant and critical income source.

But many financial planners don’t understand Social Security in enough detail to apply the nuanced and complex rules to your situation. Sadly, some don’t even think it is all that important to consider how a filing strategy could have a substantial impact on the amount of taxes you pay in retirement. The result is that That means you may not get every benefit dollar you deserve.

Finding someone to help with retirement accounts is easy — there’s an advisor on every street corner. However, most do not advise on Social Security benefits because they don’t fully understand it.

But you want to maximize every available income stream in retirement, including adjusting for inflation. So, it is crucial to work with an expert with Social Security.

Get help with Social Security

If you are planning to file for Social Security, and want to make sure you get all the benefits you deserve, you need to realize this is not a DIY project. There are thousands of possible filling combinations and nuanced rules that make each situation different and in most cases, you only get one chance to make a good decision.

There’s no way around it…you need to get professional help before you file. You can get started with a free 15-minute consultation from my team of Registered Social Security Analysts. They’ll listen to your unique situation and let you know how a strategic plan can cut through all the complexity and give you clear direction on your filing strategy. Schedule your call today!