There are some really good reasons to file for early Social Security benefits. But those only apply in some circumstances — and more often than not, people’s reasons to file early can be downright stupid.

That sounds harsh, but think about it with an open mind: we’re talking about maxing out your available retirement income so you can make the most of this stage of your life. You don’t want to make a mistake here, especially a silly one you could have easily avoided.

Still, even when I give people the information they need to know about filing appropriately for their specific situation, some people just don’t get it.

Take my recent video on “The Best Age to File for Social Security” as an example.

In the video, I laid out a few decision points that someone should work through when deciding if they should file for early Social Security or if they should delay until later. As of today, it’s been viewed over ONE MILLION times and has received nearly two thousand comments!

And I tend to read all those comments (and yes, you need some thick skin to make it through YouTube comments!). Even though some people are less than polite, I really love these comments because it tells me what my viewers and readers are thinking.

Based on some of the comments on that Best Age to File video, there are some deep-rooted ways of thinking about filing early for Social Security that are just not right.

I’m certainly not implying that the people who made those comments are stupid or ignorant. But I am saying that they may be making some decisions without having all the facts — which leads to some less-than-smart reasons for taking certain actions.

Here are 3 of the most common (and yes, most stupid) reasons why people tend to file for early Social Security.

Stupid Reason #1: There’s a Government Conspiracy to Get You to Wait

Yes, some people believe that filing early is some sort of conspiracy.

After viewing my video, someone suggested that I probably work for Social Security and I want people to hold off from filing — so they die before they can claim their benefits.

Yikes. But it actually gets better:

This commenter goes on to say, “[Social Security is] broke[n] and the Fed [is] taking money. Do what you want, but I’m taking mine at 62.”

Unfortunately, the “it’s a conspiracy” reasoning attracts quite a following.

Another person leaves a similar comment, saying, “They hope you die before they can write the check.” Yet another commenter says, “Haha, are you for real? Or a government SSN employee or cheesy paid actor trying to feed us horse crap? Come on, Goober. Not rocket science. There are many reasons to start taking SSN at 62.”

You get the gist. The thought is that the government wants you to wait to file for benefits so they won’t have to pay out as much.

For anyone who thinks advice suggesting to file at any other age besides the earliest possible age at which to file is a government conspiracy, let’s go back and do a quick history lesson.

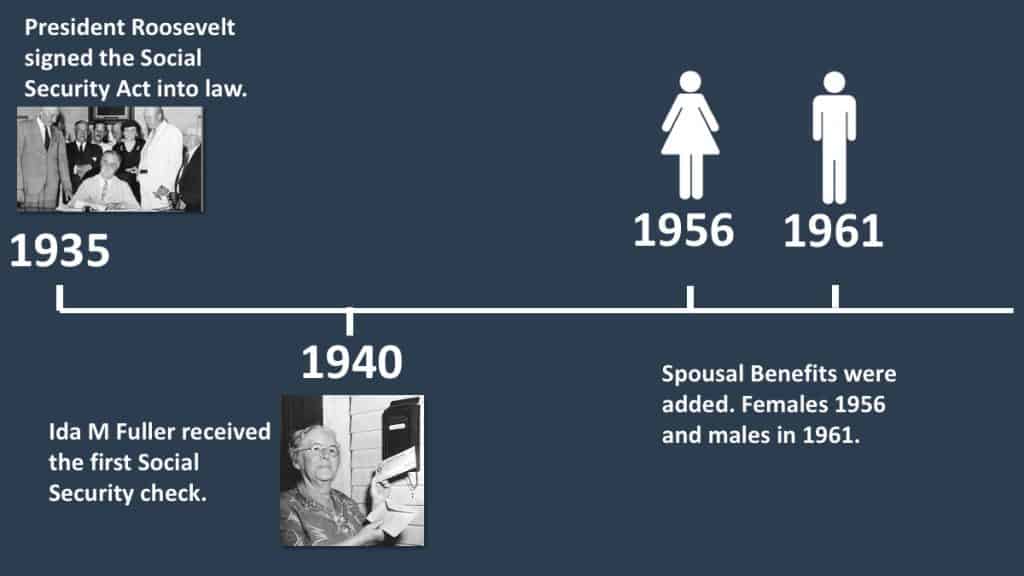

In 1935, the Social Security Act was signed into law. Then in 1940, Ida May Fuller received the first of the monthly checks that went out. It wasn’t until 1956 that filing early before full retirement age was even allowed (and even then only women could file at age 62). In 1961, the law was amended yet again to allow men to file early.

If you look at the explanation of the law, it says, “The fact is that the problem of the older worker who cannot get a job continues to exist in good times as well as bad, and the Social Security program should be flexible enough to take account of this problem.”

Someone that says, “waiting to file until you reach full retirement age is a government trick they use to try to save money and avoid paying out benefits,” is someone who is badly misinformed and ignorant of the history and purpose of the program.

Stupid Reason #2: Get Early Social Security Because You May Die Early

Stupid reason number two: “You may die early. Better take what you can get when you can get it.”

Many others who watched the video and left comments seemed to buy into this reasoning, which is pretty sad. As you can see, their vision for the future is pretty bleak.

“At age 70, you’re pretty much dead. Most of the people at age 70 have just a few months left to live. Therefore, it would be smarter to retire earlier and enjoy the few years left,” says one.

The commenter goes on to add, “You don’t have any idea how many people do not ever reach retirement age. Almost all of our government plans for seniors are systems of incremental abandonment.”

This guy seems to think it’s a crapshoot either way, saying, “If you die broke, you break even so get it while you can.”

But here’s the thing: if you already had an illness, it might make sense to file for early Social Security. That means dying early is less of a doom-and-gloom outlook and more of a realistic view of your situation.

But acting on a hunch that you might die early? That’s a bunch of nonsense. If we look at the long-term trend and life expectancies, we’ll see that the average life expectancy has increased by 25 years over the last century..

Do you think that’s not going to continue? And even if you do die early, have you stopped to consider how those increased benefits that you would get from filing later could benefit the spouse you leave behind?

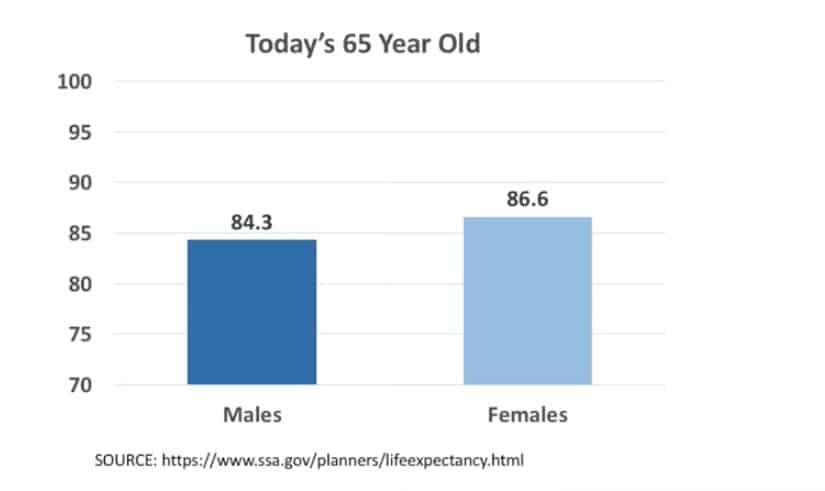

Let’s look at the actual numbers on life expectancies. This is directly from the Social Security Administration. If you’re 65 years old today, you can expect to live to about 84.3 if you’re a man and 86.6 if you’re a woman.

With these statistics in mind, it’s imperative that individuals plan their Social Security filing strategy with the mindset of ““I may live a long time” instead of “I need to hurry up and file in case I die.”

Stupid Reason #3: Social Security Is Going Broke

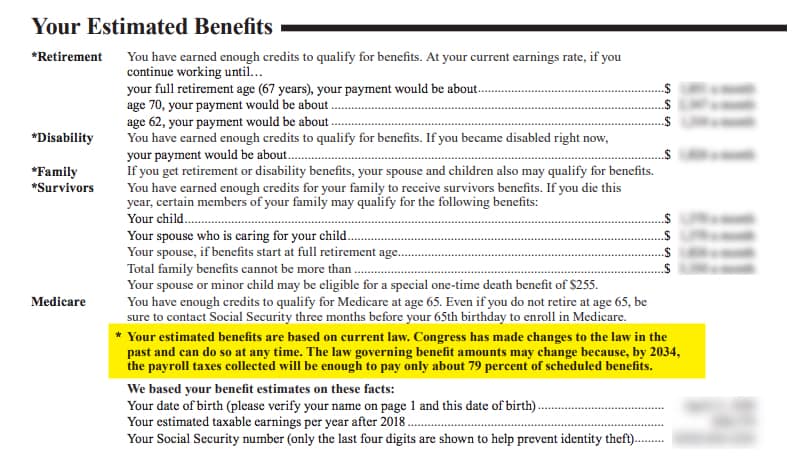

On every Social Security statement, there’s a section that contains information on your estimated benefits. If you look underneath the information about Medicare, you’ll see this:

“Your estimated benefits are based on current law. Congress has made changes to the law in the past and can do so at any time.The law governing benefit amounts may change because, by 2034, the payroll taxes collected will be enough to pay only about 77% of scheduled benefits.”

There’s no question that the Social Security Administration faces challenges ahead. But opting to file for early Social Security because you’re paranoid the system may not be there in a few years?

That argument just simply does not hold water, and I can show you why.

Let’s say that your benefit at 66 would be $2,000. At 62, your benefit is $1,500. Now, let’s further assume that there are no changes made to the Social Security law to make up for the upcoming shortfall.

In fact, let’s say we in 2034, benefits across the board are cut 77%.

Here’s the question that I have for you: Would you rather have 77% of $2,000 or 77% of $1,500? I think we know the answer to that, so not filing because you might have a benefit cut in the future… well, I’m sorry. That reasoning just doesn’t work.

There are a lot of great reasons to file early. I lay five of these out in my article 5 SMART Reasons to File for Social Security at 62.

I think most people that file early do it for the wrong reasons. I would encourage you to get informed. This is your retirement. Take charge and make great decisions about this stuff. You generally only get one shot.

One last thing before you go, if you haven’t already joined my FREE Facebook group, you should today! There are several thousand people who love to hang out and talk about Social Security.

Also…be sure to get a copy of my Social Security Cheat Sheet while its still available. This handy guide is like taking the essentials from the 100,000 page Social Security website and condensing it down to just one page.

Thanks for reading!

Of course you will live forever and not come down with a chronic debilitating illness.

When you die the balances of your personal retirement accounts go to your beneficiaries, but your with social security benefits do not and the break even point is 78, so 62 sounds good to me, no reason to wait in my opinion. Your life can be snuffed out in an instant, why take that chance?

I am taking survivor benefits ASAP, working on it now, and waiting until age 70.5 to pull my own social security benefits. I am being told disability is the way to go but although I may be 10% disabled I don’t want to forever prove a disability. Moderate to severe Asthma comes and goes with the seasons. And if I pull my wife’s benefits first as survivor benefits then my own at 70 I should still be able to live on assets earning a living on investments. Taxable income will be under $18000 unless I have an awesome investment that… Read more »

You may also want to check out filing for SS disability. Check out my article on a few things to consider when making that decision.https://www.socialsecurityintelligence.com/should-you-file-for-social-security-disability-or-retirement-3-things-to-consider/

I had to retire from my work at 57 due to an injury to my right arm. I’m taking benefits at 62 because I basically have to. Thank goodness I have a pension with a “level 62” benefit that calculates your probable SS benefit at 62 and pays you an increased benefit that will equal your (reduced) benefit at 62 plus your SS so I can make it till then.

Breakeven point for taking it out at 62 is age 78. I’d rather retire and enjoy the money when I’m younger. I’d rather pay it to a vacation planner than a hospital.

By filing early for social security there will be a loss of not getting benefits for your future life, you should have to spend more of your benefits on healthcare and many more.

What about the “I’m so tired of working “ excuse? I’m in pain all the time when I work. I’m not married and probably won’t ever be so no one to worry about but me.