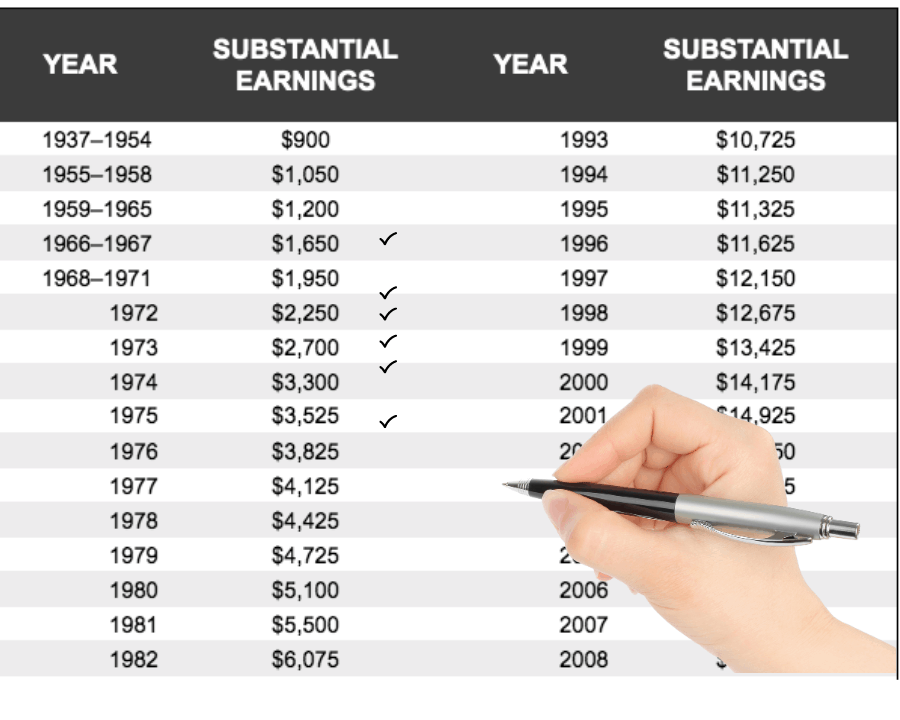

If you will be subject to the Windfall Elimination Provision (WEP), it may be possible to reduce that impact with enough years of substantial earnings. If you are planning for your retirement, you need to understand what’s on your earnings record and know how many years meet the definition of “substantial” as defined by the Social Security Administration.

Educators and other Public Servants

The Windfall Elimination Provision Repeal: What You Should Know

In April of 2021, Ways and Means Committee Chairman Richard Neal, (D-Mass.), reintroduced the Public Servants Protection and Fairness Act of 2021. This legislation was originally presented to Congress in 2019, but died without receiving a vote. But now that the balance of power has shifted in both houses of Congress, this proposal has a much higher likelihood of passage.

The goal of this Act is to provide an equitable Social Security formula for individuals with noncovered employment and to provide relief for individuals currently affected by Social Security’s Windfall Elimination Provision (also known as the WEP).

Repealing the WEP with a new formula should help ease the difficulty that individuals with noncovered pensions face when planning for retirement. Although it’s not widely known, the annual Social Security benefit estimate does not include the WEP penalty in the estimated benefit. Furthermore, most Social Security technicians – let alone financial advisors – fail to understand the nuances of how the WEP is applied. They cannot explain it adequately, and although they may be trying to help, too often only add to the confusion.

There’s no reason we need to keep going this way. It’s past time for this outdated rule to be reformed.

Why the Windfall Elimination Provision (WEP) Should be Reformed

It’s a rare day that passes without someone asking me, “Will the WEP be eliminated?”

The WEP is the Windfall Elimination Provision, and it’s a part of Social Security that can really complicate benefits for those who fall under it. This provision can reduce benefits by nearly $500 and the Social Security Administration generally can’t explain the rules around when and how the WEP will apply. Retirees who are subject to this rule are upset and ready for a change.

Although it’s been talked about for years, I don’t think we can reasonably expect Congress to pass a total WEP repeal. My official stance is that such a change is highly unlikely. However, I do think reforming the Windfall Elimination Provision is likely, and possibly in the near future.

Firefighter Pensions and Social Security: How to reduce or eliminate the impact of the Windfall Elimination Provision (WEP)

If you are a firefighter and are planning for retirement, you need to know the rules on receiving firefighter pensions and Social Security. Specifically, you need to understand how much the Windfall Elimination Provision (WEP) will reduce your Social Security payments.

This rule can reduce the Social Security benefit rules of anyone who:

1. Worked at a job where they did not pay Social Security taxes and qualified for a pension from that job

AND

2. Worked at another job where they did pay Social Security taxes, which qualified them for Social Security benefits

While these WEP rules affect anyone who has a pension from a job where they didn’t pay Social Security, there is a special nuance in these rules that could help ease the pain for many firefighters. Before we jump into that, let’s cover a few of the basics.

How YOU Can Change the Windfall Elimination Provision and Government Pension Offset

Are you an educator or public servant who currently works — and will eventually be subject to Social Security’s Windfall Elimination Provision or the Government Pension Offset? Tired of waiting on your elected officials to keep their promises and repeal the WEP and GPO that punish workers like you?

If so, I have some good news: you have the power to get these rules changed. You just need to know what actions to take, and that’s what I want to share with you in this article.

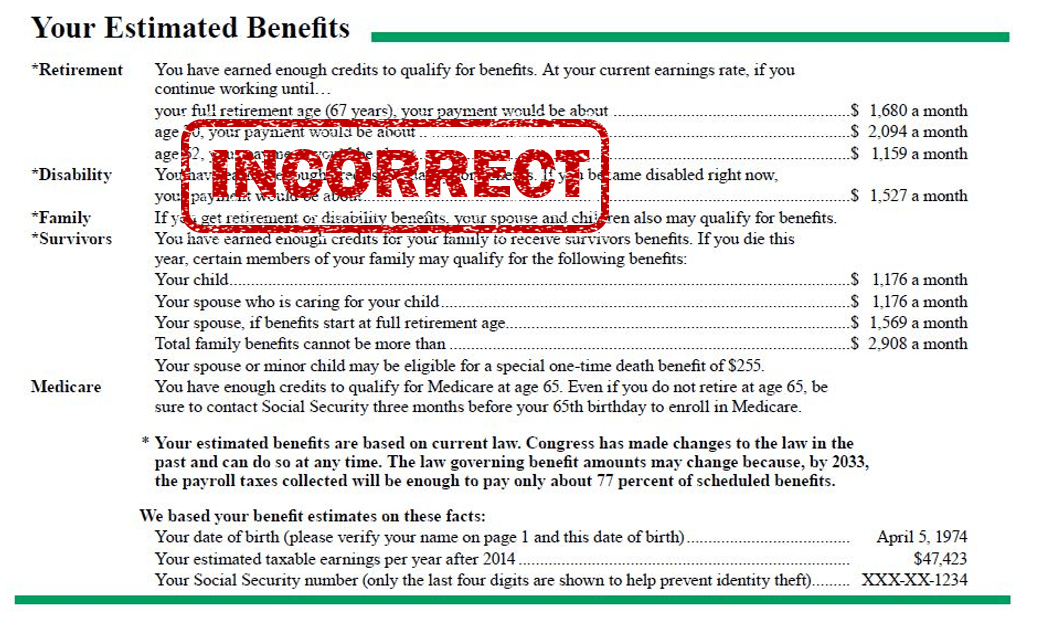

Subject to the WEP? Your Social Security Statement Is Probably Wrong!

Social Security retirement benefits often make up a large portion of an individual’s retirement income. Throughout your lifetime, you can keep an eye on your projected retirement benefits on your annual Social Security statement or by looking at your online mySocialSecurity account (mySSA). It’s a great tool for making educated retirement planning decisions.

But what if your Social Security benefit’s estimate is incorrect by several hundred dollars per month?

This isn’t too far-fetched. For some people, it is wrong.

Even worse, they probably don’t know it is wrong. What an awful retirement surprise!

Social Security and Lump Sum Pensions: What Public Servants Should Know

If you work for an employer who does not participate in Social Security but has their own pension instead, you probably know that your Social Security options can be complicated with tricky rules that only apply to teachers and other public servants. These rules include the Windfall Elimination Provision (WEP) and the Government Pension Offset.

If you work for an employer who does not participate in Social Security but has their own pension instead, you probably know that your Social Security options can be complicated with tricky rules that only apply to teachers and other public servants. These rules include the Windfall Elimination Provision (WEP) and the Government Pension Offset.

Individuals often look for a way to soften the impact of these rules. Time and again I hear individuals wondering if they can sidestep these rules by simply taking their pension in a lump sum. After all, in just about every reference to these rules, the Social Security Administration (SSA) says that the rules apply to individuals with a pension from work where no Social Security taxes were paid.

So…if there’s no a ‘pension’ being paid, do the rules still apply?

They do, but with a few exceptions. For certain individuals, taking a pension out in a lump sum can be a valid method of sidestepping these rules. If this interests you, read on. The rules for when and how are complicated, and you don’t want to mess this up.

How To Calculate The WEP & GPO With Mixed Earnings Under The Same Retirement Plan

In several states, most school districts do not participate in Social Security. Instead, they have their own pension plan to which they contribute. But over time, a few school districts in these states have adopted agreements with the Social Security Administration which allows them to participate in both Social Security AND their own pension plan.

Louisiana Social Security: What Louisiana State Public Employees Should Know

Louisiana state public employees face special challenges when it comes to figuring out their retirement benefits. Most Louisiana state public employees, who may be covered by LASERS, LSERS, TRSL, or other public employee retirement plans, don’t pay into the Social Security system. This means their ability to receive Social Security benefits is different from typical employment where the employee pays Social Security taxes. The situation gets more confusing when an eligible employee has some Social Security covered employment and some non-Social Security covered employment. Even worse, many people don’t learn about the rules until they reach retirement age, and they may have made decisions based on faulty information.

Thankfully, the rules aren’t too complicated, and I’m here to help you decipher them.

There are two rules that apply here: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These links give more detailed information about each rule, but here are summaries:

The Best Explanation of the Windfall Elimination Provision (2023 Update)

If you have a pension from a job where you did not pay Social Security taxes, your benefit may be reduced by the Windfall Elimination Provision (WEP).

How do you know if you’ll be impacted? Don’t expect it to be on your Social Security benefits statement.

This may surprise you but your Social Security statement does not reflect any reduction in benefits due to this provision. The Social Security Administration will wait until you file to tell you how much the reduction is if you qualify for both Social Security and a non covered pension.

Understanding if a reduction in benefits will apply to you, and how much that will be, does not have to wait until you file for Social Security. You can find out today. It starts by understanding the mechanics of the Windfall Elimination Provision.