If you work for an employer who does not participate in Social Security but has their own pension instead, you probably know that your Social Security options can be complicated with tricky rules that only apply to teachers and other public servants. These rules include the Windfall Elimination Provision (WEP) and the Government Pension Offset.

If you work for an employer who does not participate in Social Security but has their own pension instead, you probably know that your Social Security options can be complicated with tricky rules that only apply to teachers and other public servants. These rules include the Windfall Elimination Provision (WEP) and the Government Pension Offset.

Individuals often look for a way to soften the impact of these rules. Time and again I hear individuals wondering if they can sidestep these rules by simply taking their pension in a lump sum. After all, in just about every reference to these rules, the Social Security Administration (SSA) says that the rules apply to individuals with a pension from work where no Social Security taxes were paid.

So…if there’s no a ‘pension’ being paid, do the rules still apply?

They do, but with a few exceptions. For certain individuals, taking a pension out in a lump sum can be a valid method of sidestepping these rules. If this interests you, read on. The rules for when and how are complicated, and you don’t want to mess this up.

Does Your Pension Offer A Lump Sum Option?

Not all pension plans allow withdrawals of lump sums. Pension plans that do allow lump sum withdrawals may allow either partial lump sum withdrawals or allow you to withdraw everything in the plan. You can find this out by reading your plan documents or calling your plan administrator.

How Do Lump Sum Withdrawals Affect Social Security Calculations?

In most cases, if you take a lump sum withdrawal from a pension that is not covered by Social Security, the SSA will use an alternate calculation to determine the amount you would have received based on your age and the date you took the lump sum. So even though you take it in a lump sum, it’ll be viewed as if you took a normal pension.

The SSA website says: “When the entire pension is paid in a lump sum, the amount may represent a payment for a specific period of time or a “lifetime.” Generally, the pension-paying agency will prorate the lump sum to determine a monthly amount for WEP purposes. If the agency will not provide this information, prorate the lump sum to determine the monthly pension amount as follows:

- Specific Period – Divide the lump sum by the number of months in the period specified by the pension-paying agency. See RS 00605.360C.5.a. for when WEP application ends.

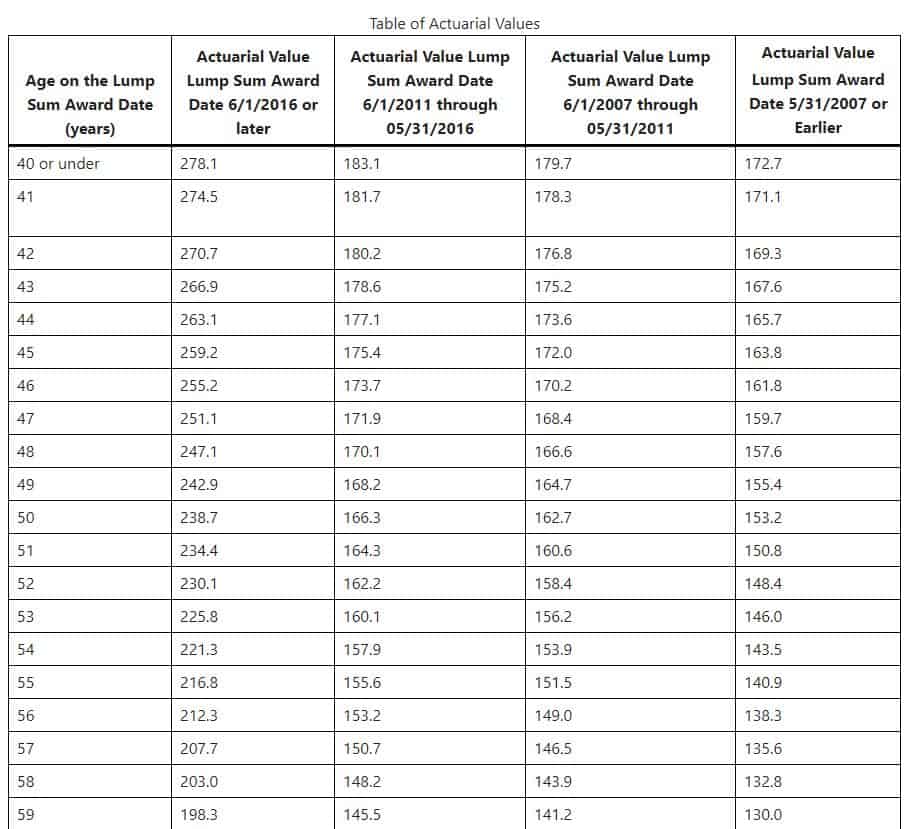

- Lifetime or Unspecified Period – Divide the pension lump sum amount by the appropriate actuarial value in the table that corresponds to the worker’s age on the date of the lump sum award.”

This language does two things. It directs the Social Security technician how to treat your lump sum pension, and it also directs the SSA as to when the WEP should no longer affect your benefit payment. It’s important to note that if you receive a payment in lieu of a pension for a certain period, the end of that period is when the WEP application will end. For example, if your lump sum payment was made in leiu of a 10 year payment period, the WEP would no longer affect you at the conclusion of 10 years. If no period is selected, the SSA will use a table on their website to determine how long the payments should have lasted. At the end of that period, the WEP would no longer be applied.

Below is the partial chart showing how they convert your lump sum amount to a monthly amount for their calculation. The full chart can be found HERE.

So, even if your plan will allow you to do a full or partial withdrawal of your pension, that alone will not help you get around the rules.

The only way to sidestep the rules is to take out only your contributions plus interest. Even then, the timing has to be just right and there are separate rules for getting around the Windfall Elimination Provision and the Government Pension Offset.

Sidestep the WEP

To sidestep the WEP, you must take out your contributions before you become eligible for a pension. Once you’ve reached eligibility, it’s too late to withdraw your contributions and avoid the Windfall Elimination Provision.

Here’s what the Social Security website says in their section RS 00605.364 Determining Pension Applicability, Eligibility Date, and Monthly Amount.

- Withdrawals of the employee’s own contributions and interest made before the employee is eligible to receive a pension are not pensions for WEP purposes if the employee forfeits all rights to the pension. This rule applies even if the employer paid the employee contributions.

- Withdrawals of the employee’s own contributions and interest made after the employee is eligible to receive a pension are considered a lump-sum pension for WEP purposes.

- Any separation payment, withdrawal, or refund consisting of both employer and employee contributions is a pension; for WEP purposes whether made before or after the employee is eligible to receive a pension.

It’s crucial to understand the meaning of the word ‘eligibility’ as defined by the SSA. It DOES NOT mean that you have stopped work! In fact, you could still be working and deemed ‘eligible’ for your pension. This is disastrous to those individuals who planned to wait until a week before they retired to withdraw their contributions.

In another section of the SSA website, they define ‘eligibility’ as follows:

An individual becomes eligible for a monthly pension or a lump sum in lieu of a monthly pension the first month he or she meets all requirements for payment except stopping work and applying for the payment [emphasis added].

So could you still be working and technically eligible for your pension? Yes! If you plan to withdraw contributions and avoid the Windfall Elimination Provision, you’ll need to know exactly what it takes to become eligible for a pension at your employer.

For example, if you are working in Texas, you’ll become eligible for a pension at age 55 with 5 or more years of service credit. So if you are planning to stop working at 56 and withdraw your pension, it’ll be too late.

Sidestep the GPO

The rules on getting around the Government Pension Offset are slightly different in that you can take the withdrawal before or after eligibility for the pension. The SSA website says this:

- Withdrawals from a defined benefit plan, before or after eligibility for the pension, of only employee contributions plus any interest (i.e., none of the employer contributions are included in the withdrawal), and whereby the employee forfeits all rights to a pension, are not pensions for GPO purposes. This rule applies even if the employer paid the employee contributions for the employee (i.e., some employers may pay for the employee’s contribution).

- Any other separation payment, withdrawal, or refund that consists of both employer and employee contributions from a defined benefit or defined contribution plan is a pension subject to GPO.

Can It Make Sense?

In many cases, it just doesn’t make sense to withdraw your pension. Sure, you may receive a full Social Security benefit if you can avoid the WEP & GPO, but you’ll also forfeit your rights to the pension income.

However, there are some cases where this does make sense. Whether or not it does for you is dependent on a number of factors. You should consider your income needs, the amount of your pension vs. the amount of your spousal/survivor benefits, and a host of other factors. A high caliber financial planner can help you make sense of your options.

If you’d like to review some of the basics discussed in this article, I’ve created some resources that may help you. I’d get started with Video: Social Security for Educators (and other public servants). This gives a broad overview of the Windfall Elimination Provision and the Government Pension Offset. After watching that, I’d move on to my two articles The Best Explanation of the Windfall Elimination Provision and What You Need To Know About The Government Pension Offset.

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. You CAN simplify these rules and get every dime in benefits you deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 100,000+ subscribers on my YouTube channel!

Devin’s book on the WEP and GPO https://amzn.to/2YgivmM

My husband received $40k in 1997 from civil service in 1997 in a lump sum. Going to start getting social security in Jan but is being told he will have the Wep elimination calculated but they won’t tell him what the amount will be. He has over 20 years with wages having social security withheld. He was 42 when he received the lump sum. He is now 65. Do you know what amount will be withheld? His social security monthly will be around 1000.

I have taken early retirement at 62 and began receiving social security payments based on around 40 years of employment, not as a teacher. I worked for one full year as a teacher in 2003-2004, and therefore have a single-sum retirement benefit from TRS of Illinois of around $2,000 when I reach the age of 65 early next year. I am concerned about how taking that one-time lump sum may affect my monthly social security payment. I would hate for SSA to reconfigure my monthly benefit based on this. Can you help? Thanks!

Hi sir iam disability

My wife has 27 years paid into SS but now works for a company that doesn’t participate. Instead, they set up a 403b account where they make regular deposits on her behalf. For WEP, SS considers this a pension. But there is no set monthly payment, and no other rules on the account other than eventual RMDs. She can withdraw at will. How does SS treat a pension account that isn’t really a traditional pension for WEP purposes? We tried asking them. 5 calls. 5 different answers.

I will receive a lump sum of about 50,000 at 68 for a part time university job. Social Security says that since the university retirement system will not my lump sum into a monthly amount, they will use a table of factors to do it., AND, AND,….since this is not for a specified period they will deduct WEP every year. In other words, IT WON’T END. THIS DOESN’T SEEM RIGHT, AND WOULD FLY IN THE FACE OF NEVER TAKING MORE THAN HALF. Potentially, if I live long enough they could take more than 100%. I challenged, and they say appeal.… Read more »

I’m 71 and considering taking a lump sum from my retirement plan – I worked for Kaiser Permanente. The Social Security website indicates that if I’ve reached retirement age I can get full benefits no matter how much money I earn.

Is it correct that I will not have any change in my monthly Social Security payments?

I was born and worked in Canada until age 46, when I moved to the US. I will be 65 in a couple weeks, and applied for Medicare. While applying, I learned that due to my Canada Pension Plan to come (comparable to Social Security), I will be docked 40% of the Social Security I qualify for in the US, due to WEP. Doesn’t matter how much I earned in the US or how much I receive from Canada, my SS will be slashed by 40% off the top. Between the two, this will bring less than if I just… Read more »