In the past, a $3,000 Social Security benefit might have seemed unattainable – even for high income earners. This equates to $36,000 of Social Security in a year, or more than the maximum benefit for those who filed at 66 until 2020.

But recent increases from inflation have changed the game, and now, $3,000 per month from Social Security isn’t out of the question. Here are some things to know to maximize your benefit and understand the tricky progressive nature of the Social Security formula.

Who qualifies for a $3,000 Social Security benefit?

Social Security payroll taxes can be a bit difficult to understand. Here’s what you need to know:

First, there is a limit on the amount of earnings that are subject to tax. If you surpass that threshold, you don’t pay the Social Security portion of payroll tax. But, you don’t get credit for your future SS benefit either.

That seems simple enough – to earn the maximum Social Security benefit, you just need earnings that were at or above the maximum for 35 years. Say you started working at age 22 in 1983, with an income of $35,000 or higher. At age 62, you earned $160,000 or more. With that earning trajectory, you’d therefore earn the maximum Social Security benefit.

But unfortunately, most people won’t meet this requirement – making an income at the maximum threshold. If that’s the case for you, you might think a $3,000 (or close to the maximum) Social Security benefit would be out of your reach.

Luckily, that is not entirely true. With the SS formula, lower earnings matter more than higher earnings. The return on investment for Social Security taxes is actually better for lower income people than higher.

When calculating your benefit, SS takes all of your historical earnings and adjusts them for inflation. Then, they take out the highest 35 years to determine the average monthly amount of earnings. They call this your average indexed monthly earnings or by its acronym, AIME.

Then they run your personal AIME through the bend point formula in place the year you turn 62.

For example, the bend point formula in 2023 looks like this: for the first $1,115 of AIME, you get a 90% credit to your benefit; for the amount between $1,115 and $6,721 you get a 32% credit; and for the amount over $6,721 you get a 15% credit.

The result of this formula is that relative to the amount of taxes someone pays into the system, a lower income person will receive a higher benefit than someone who was a higher income earner.

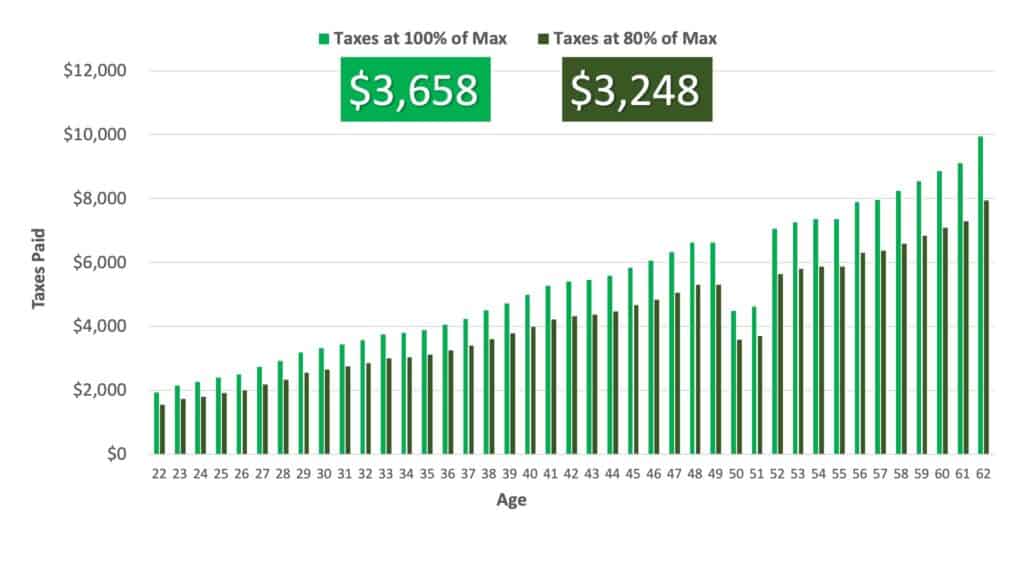

Let’s use the same example as before – a worker who made right at the maximum cap every year, from age 22 to 62, beginning in 1983. That equates to about $216,000 paid in Social Security payroll tax, and a retirement age benefit of $3,658.

Now let’s use that same timeline with a worker earning 80% of the maximum. That equates to $172,000 of Social Security tax, and a retirement age benefit of $3,284.

As you can see, someone earning 80% of the maximum would have paid just a little over 20% less in SS taxes, but their benefit would only be 10% lower.

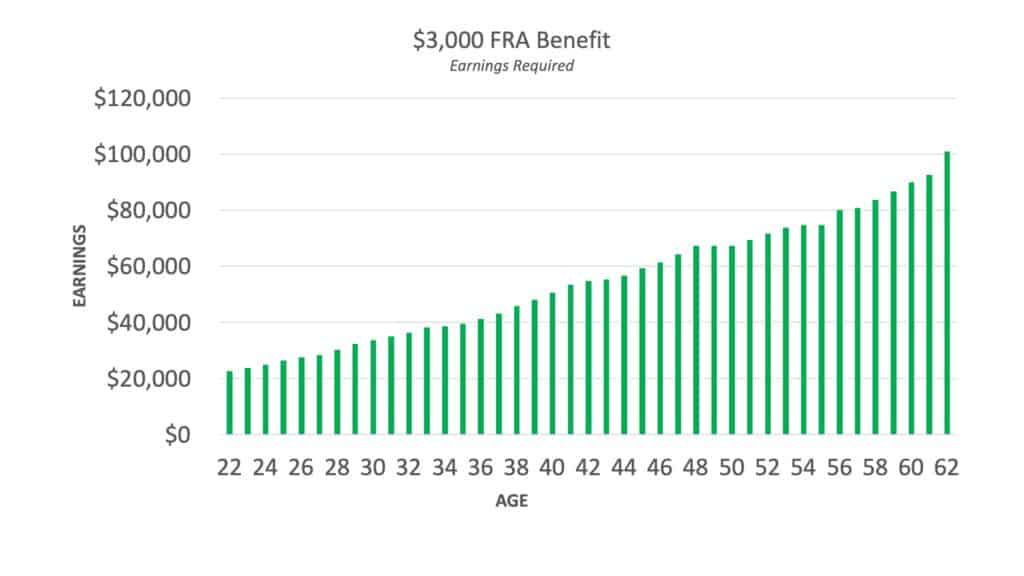

So what does this mean in theory? Exactly how much in earnings do you need to get a $3,000 benefit? Well, you just need to have averaged about 70% of the taxable maximum. In our example case, that means that your earnings in 1983 were about $22,000 and increased every year to where they ended at about $100,000 at age 62.

Should you work toward a $3,000 Social Security benefit?

I’ve been helping people with retirement planning for a long time and I can tell you, a $3,000 guaranteed income stream, or anything even close to it, is probably going to be a substantial part of your retirement income.

My free online workshop, How To Choose The Right Time To File For Social Security, can help you get there. In this workshop, we talk about how to identify the nine factors you should consider before you file for Social Security, how to coordinate your Social Security filing decision with your other income and assets for a tax-efficient distribution strategy, and how to avoid making the big mistakes that give no second chances.