For many retirees, the taxable income generated by their Social Security benefits is a shock. Now they are wondering how to reduce taxes on Social Security.

Although they were aware that some of their benefits would be taxable, they were not aware of the complexity in determining the percentage that would be taxable.

Thankfully, there are a few moves that can reduce taxes on Social Security. Before we talk about how to reduce taxes on Social Security, let’s cover a quick refresher on how taxes on Social Security benefits are calculated.

How Taxes on Social Security Are Calculated

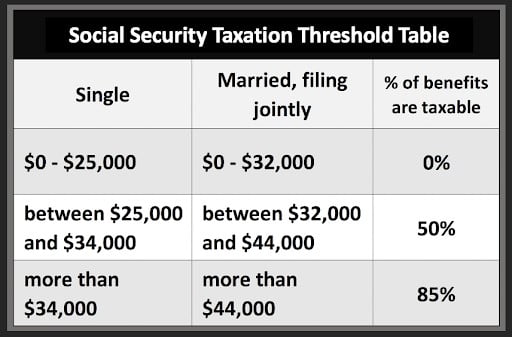

The broad overview of taxes on Social Security is that somewhere between 0% and 85% of your benefit payments could be counted as taxable income. To determine the percentage that applies to you the IRS uses your “combined income” and applies it to a specific threshold used only for this purpose.

The first step is to determine your combined income. According to IRS Publication 915, you simply count ALL of your income plus ½ of your Social Security. The result is your combined income.

For example, assume a married couple has $20,000 in IRA distributions, $24,000 from pension payments, and a combined Social Security benefit of $36,000, they’d have a combined income of $62,000 (see chart below).

Once you have your combined income, you simply apply it to the threshold tables to determine the percentage of your personal Social Security which will be taxable (see threshold table below).

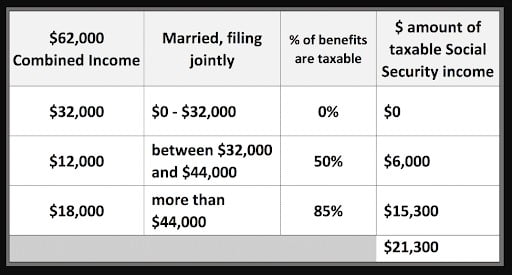

In the example of the married couple with $62,000 of Combined Income, they would have a total of $21,300 (59%) of their $36,000 Social Security benefit counted as taxable income (see chart below).

Now that you know some of the basics of Social Security benefits taxation, the next step is to learn how to reduce or even eliminate these taxes.

Strategy #1) Strategically organize your retirement distributions

When you retire, there’s no rule that says you have to turn on all of your retirement income sources at the same time. If you have the flexibility you may be able to exercise some strategy in selective timing of the distributions.

For example, assume you are single and retire at 67. You have $750,000 in your IRA and a full retirement age Social Security benefit of $3,000 per month. To meet your retirement living expenses you need to receive $7,000 per month in gross income.

One way to achieve this would be to simply file for Social Security as soon as you retire. This would provide $3,000 of the monthly income you need toward the $7,000 monthly amount. The additional $4,000 would come from your IRA. This strategy would result in approximately 69% of your Social Security benefit being counted as taxable income and out of that $84,000 in gross income, you’d have a total of around $65,000 in taxable income.

Another option to consider would be to delay filing for Social Security until 70. This would increase the monthly benefit to approximately $3,720 which means that to meet your total goal of $7,000 per month you’d only need to take out $3,280 from your IRA.

Remember that only one-half of your Social Security benefit is included in the formula which determines the taxable amount of benefits. So if you increase the amount that is counted at 50% and decrease the amount that is counted at 100%, this has the potential to make a big difference in your taxes. In the example above, this would mean that only 47% of the Social Security benefits would be taxable and you’d have a total of around $53,000 in taxable income. So just by changing up the order of distributions, you’d reduce your taxable income by $12,000.

Strategy #2) Qualified Charitable Distributions (QCD)

If you give money to your church or other charity, the qualified charitable distribution (QCD) strategy can provide multiple tax benefits. This rule allows taxpayers age 70½ and older to donate up to $100,000 annually directly from their traditional IRA to an eligible charity without counting that amount as taxable income.

Here’s a quick example of how this could work.

John gives his church around $10,000 per year. He’s retired and receiving distributions from his IRA of $2,000 per month. Typically, he’ll just write a check at the end of the year for his annual contribution. When it’s time to file his taxes, he’ll receive a 1099R from the IRA custodian and have the $24,000 added to his other taxable income. In past years he’s itemized his taxes and has always taken a deduction for the amount he contributes to the church. But now, thanks to the Tax Cuts and Jobs Act’s higher standard deduction he can no longer itemize. This means that he’ll have to pay taxes for the full IRA distribution and won’t get to exclude the contribution to his church from his taxable income.

This is where the QCD comes in…

Instead of taking the full $24,000 from his IRA, John would direct his IRA custodian to send $10,000 directly to the church. This would exclude that amount from being included in his taxable income for the year. So not only would he not have to pay taxes on that $10,000, but it could also decrease his AGI and thus decrease the amount of Social Security that is subject to tax.

There’s a lot to know about the QCD strategy so if you decide to pursue this strategy, be sure to read the IRS page that covers this and talk to a tax advisor.

Strategy #3 Tax Loss Harvesting

Due to capital gains being included in your AGI and thus the formula that determines how much of your Social Security benefit is taxable, it makes sense to minimize your capital gains as much as possible.

One easy way to do this is through tax loss harvesting. This strategy only works in a taxable account, not tax deferred accounts like IRAs and 401(k)s.

Here’s an example of how this may work. Assume you invested $50,000 in a tech stock. This stock has decreased in value and now it’s worth $30,000. You could sell the stock and wait 30 days before buying it back or you could immediately repurchase another investment. Now you have $20,000 in losses on paper, but your money is still invested.

These losses can be used to offset up to $3,000 of your personal income ($1,500 if you are married filing separately) and can offset an unlimited amount of capital gains. Any losses that aren’t used will roll over for use in future years.

Just be careful to not violate the wash sale rules. The wash-sale rule states that your deduction from the loss will be disallowed if you buy the same security, a contract or option to buy the security, or a “substantially identical” security, within 30 days before or after the date you sold the loss-generating investment.

If you’re thinking about doing tax loss harvesting in your accounts, it’s always a good idea to talk to a tax pro. It’ll be well worth your money just to make sure you aren’t making a misstep that could cost you thousands of dollars.

Strategy #4 Change Investment Allocation

This is somewhat similar to the last strategy, but vastly different at the same time.

If you have a taxable account (not an IRA, 401(k), Roth, etc.), certain investments can create a capital gain even if you never sell them!

This is most common with mutual funds that are actively managed, but can occur in other types of investments as well.

A simplified example of this would be as follows:

20 years ago your mutual fund bought XYZ stock. During the course of the prior year, they sold it at a steep gain. Since you “mutually” own the investments with other investors, a certain amount of the gain is passed along to you to pay your “mutual” share of the capital gains tax.

Now when you multiply this over the few hundred companies often owned in these mutual funds, along with the strong stock market we’ve experienced since 2010, these gains will likely be an ongoing issue into the foreseeable future.

According to CapGainsValet, a website that consolidates this information, there were multiple funds in 2021 that had distributions in excess of 30%! This means that if you had a $100,000 position in one of them, your distribution could have meant an additional $30,000 in capital gains taxes.

The good news is that this distribution is typically announced in the later part of the year. Attached to this announcement are certain dates. One of these dates is the “record date” which essentially works as the “sell by” date to avoid that year’s capital gains distribution.

If you have a financial advisor, talk to them about either getting rid of these types of investments or developing a strategy to monitor the gains and ensuring you understand the implications of either selling, or not selling, by the record date.

Strategy #5 Roth Conversions

The last strategy is perhaps the most powerful.

If you can build up a balance in a Roth IRA, this can go a long way towards reducing or even eliminating the taxes you pay on Social Security. This is because distributions from a Roth are not counted in the formula that determines the taxable amount of Social Security.

If you are still working, it may be possible to make your ongoing contributions to the Roth portion of your company retirement plan. Many plans will even allow you to convert your pre-tax portion of the plan to a Roth.

If you’ve saved like the majority of Americans, your retirement dollars are likely in a pre-tax 401K or IRA. These balances can be converted to a Roth IRA, but there are a few things you need to know.

The first thing is that any balances you convert will be subject to taxes in the year you convert. For this reason, the decision to convert should only come after careful analysis of the benefit from having the Roth vs. the cost to convert.

The second thing to know is the Five-Year rule. If you are younger than 59 ½, Roth conversions are subject to a five-year waiting period before any converted funds can be withdrawn. Taking money out before the five years has ended will result in a 10% penalty when you file your tax return. This five year period will apply separately to each conversion.

A positive note is that the conversion clock starts on the first day of the year, regardless of the day the conversion took place. As an example, converting on Dec. 15, 2020, would stop the five-year period on Jan. 1, 2025.

All of us enjoy minimizing our taxes, especially those we can avoid easily. However, it’s important to keep the big picture in mind. In your retirement plan, tax efficiency is an important component, but it should never be the only focus.

Please don’t hesitate to contact us if you would like some assistance in examining your retirement plan and spotting possible blind spots.

[…] greater detail on tax-saving strategies, see my article How To Reduce Taxes on Social Security. In that article, I go into the five best strategies to reduce (or even completely eliminate) your […]