Those nearing retirement age have a lot to look forward to – including qualifying for Medicare. If you’re retired before the age of 65, you know paying for an insurance plan out of pocket can be quite expensive, costing $1,000 or more per month. When you hit 65 and qualify for Medicare benefits, you can reduce your healthcare costs significantly. Even when you combine the standard premium for Part B – $164.90 in 2023 – with Part D and a supplemental policy, Medicare is a cheap form of health insurance for most people.

However, there are certain situations where the Medicare Part B premium can increase that are important to understand in order to properly budget for healthcare in retirement. In many cases, you can appeal higher premiums and get surcharges removed. Read on to learn more about why the Medicare Part B Premium might be increased for you and what you can do to keep costs manageable.

Understanding Medicare premiums

The reason Medicare is so cheap compared to many other forms of health insurance is because you paid for it throughout your working life through taxes. In return for those taxes, the federal government will typically pay for most of the premium associated with Medicare.

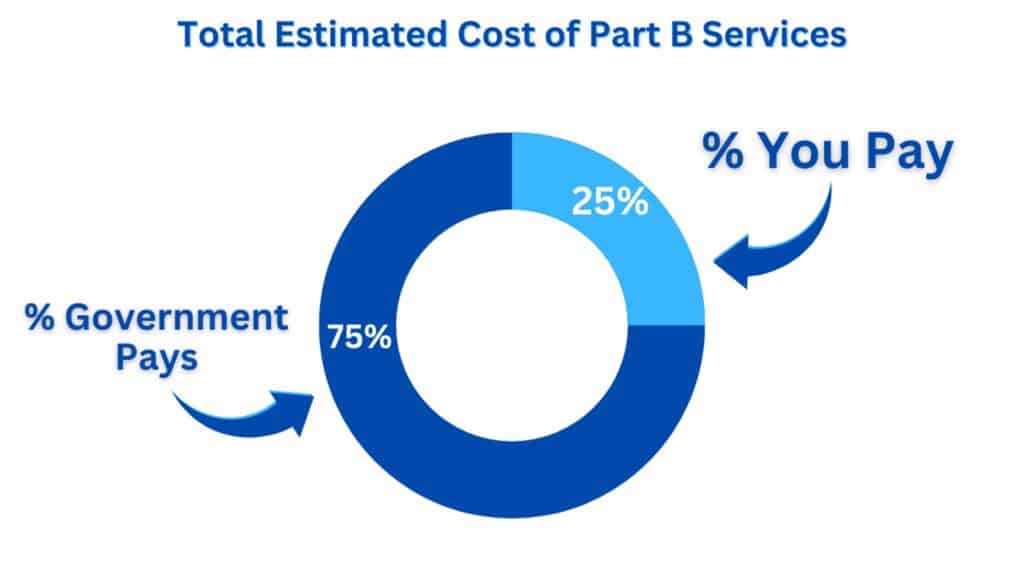

When you qualify, Medicare participants typically pay a certain percentage of the premium while the federal government picks up the rest. This percentage can change depending on certain conditions, but you must first understand how the annual premiums are set in the first place.

Part B Medicare is perhaps the most important part for most users, as it covers your doctor visits, outpatient care, medical equipment, and preventative services like vaccines. By law, the premiums for Part B have to cover 25% of the cost that will be incurred by that part of the program. Each year, the Centers for Medicare and Medicaid Services have to estimate the annual cost to pay for all of the services covered by Part B, and then set a premium to 25% of that cost.

That means that in most cases. Medicare users pay 25% of the estimated cost of Part B services, with the federal government paying the other 75%.

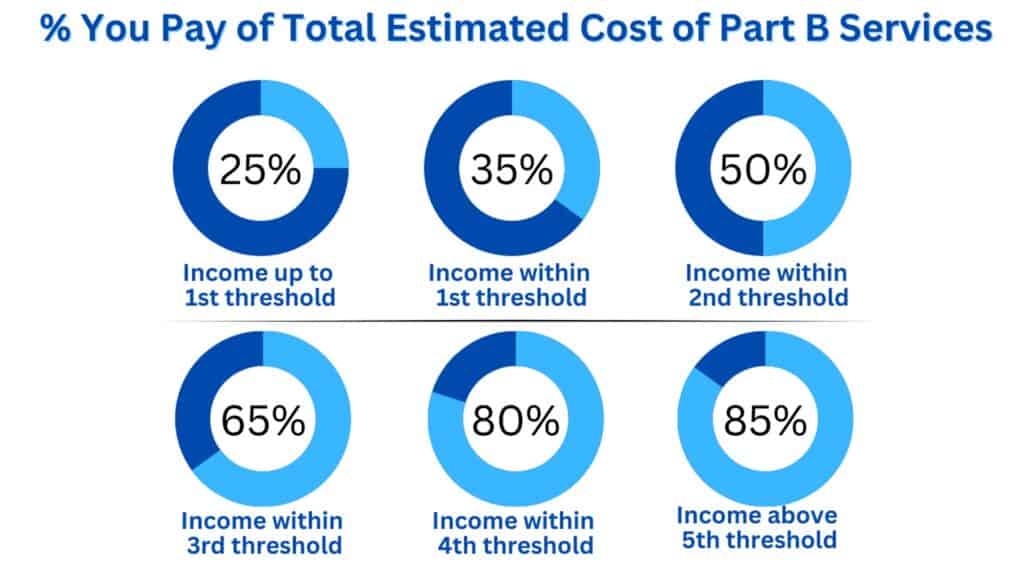

However, there are exceptions to this rule. If your income increases beyond designated thresholds, the ratio you pay in comparison to the government shifts. Depending on your income, you might even pay up to 85% of the cost, with the federal government paying only 15%.

That can add up to expensive premiums, and even make Medicare just as much as private health insurance.

Medicare Part B percentages by income bracket

If you are planning to rely on Medicare for your insurance needs, you should take a look at your income and estimate what your premium might be. As discussed, the ratio you pay compared to the federal government is typically 25% to 75%, respectively, but that can change depending on your income.

Your income related monthly adjustment amount, or IRMAA, is the number used to determine which bracket you fall into when calculating Medicare Part B premiums. This is determined based on a modified adjusted gross income, or your adjusted gross income plus tax exempt interest.

The standard ratio for Medicare Part B in 2023 is 25%. There are six income thresholds that each have a progressively higher percentage share of the program cost. For these thresholds, we used a couple who is married and filing jointly, but you can also locate numbers for single filers below.

- Those who make at or under $194,000 pay the standard 25% of program cost.

- Those who make between $194,001 to $246,000 pay 35%.

- Those who make between $246,001 and $306,000 pay 50%.

- Those who make between $306,001 and $366,000 pay 65%.

- Those who make between $366,001 and $750,000 pay 80%

- Those who make $750,001 or more pay 85%.

Medicare Part D premium 2023

One quick note – while Part B is most commonly discussed when it comes to adjusted premiums for different incomes, Part D is affected as well. Part D of Medicare, which covers prescription drugs, also uses the IRMAA to determine what percentage of the program you pay for.

Medicare Part B premiums 2023 by income

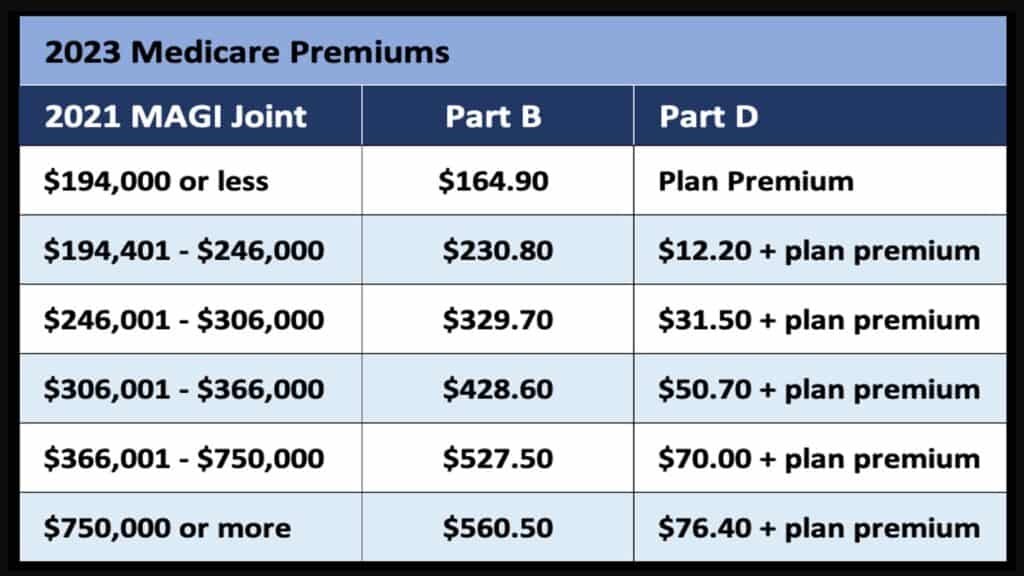

These percentages can help you understand why premiums increase depending on your income, but it is important to know the actual dollar amount you can expect to pay as well.

To determine which income bracket you fall in, the federal government uses your modified adjusted gross income from two years prior. That means that in 2023, your premiums are determined based on your 2021 tax returns.

In this example, we’ll use a couple who is married and filing jointly to show how each threshold shapes up in terms of actual cost.

- If you are under the first threshold amount, your Part B premium is $164.90 and there are no additional premiums added to your Part D.

- If your income falls in the second threshold, your Part B will increase to $230.80 and you’ll have $12.20 added to your Part D premium.

- In the third threshold, your Part B premium will increase to $329.70. and you’ll have $31.50 added to your Part D premium.

- In the fourth threshold, your Part B will increase to $428.60, and you’ll have $50.70 added to your Part D premium.

- In the fifth threshold, your Part B will increase to $527.50, and you’ll have $70 added to your Part D premium.

- In the sixth and final threshold, your Part B will increase to $560.50, and you’ll have $76.40 added to your Part D premium.

And an important note, if you are a couple who is filing jointly, that is the premium amount that you would each pay.

If you want to see the full threshold table, you can download my Retirement Planning cheat sheet.

How to plan for your Medicare Part B premium and appeal the IRMAA

As you can see, high earners can end up with Medicare premiums that are very expensive. You begin to pay the higher percentage if you make just $1 above each threshold, so you should be careful to avoid tripping into one accidentally.

These thresholds change on an annual basis in response to inflation, with the exception of the last threshold, which won’t be adjusted until 2028. That makes it difficult to guess what the threshold will be in two years – when your current income will be used to calculate your premium.

For instance, assume you reach the end of 2023 and are considering taking an additional distribution from your IRA, but you are near a threshold for a higher premium and don’t want to trigger one in 2025. How do you actually predict what the threshold will be two years down the line?

Our suggestion is to use the brackets in place this year. While in reality, inflation means the threshold will likely be higher two years in the future, a conservative approach is the safest way to ensure you don’t end up with higher premiums down the line. The last thing you want is to be just a few dollars over the threshold and receive an initial determination letter from Medicare saying you owe more than you predicted.

That said, there are some reasons you may voluntarily subject yourself to higher premiums. For example, if you are doing Roth conversions and have a large IRA balance you are converting, it might be difficult to avoid.

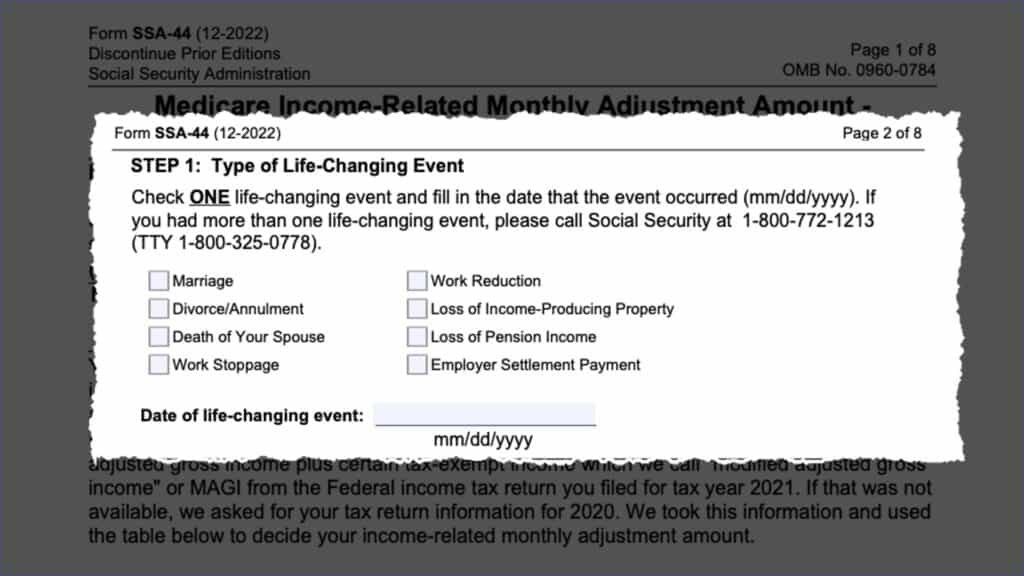

If you do end up getting a letter in the mail saying you are subject to the IRMAA, you shouldn’t automatically assume you have to pay the higher premium. In some cases, you can appeal and ask for a reconsideration. The Social Security Administration has a specific form you can use to request a reduced premium, as well as certain qualifying events in which that is justified, outlined below.

One of the more common reasons that people appeal the higher premiums is work reduction or work stoppage. If you were working and earning a high income, but then retired or had your work reduced enough to lower you in the income thresholds, you can appeal.

Ultimately, navigating higher Medicare premiums is something that a lot of retirees will have to plan around. This is yet another reason why I think it’s critical to get a written income plan before you retire, or at least within the first few years of your retirement. The cost of being inefficient with how you take your retirement income can extend beyond just the cost of increased federal taxes. If you want some help with your own plan, you can click here to get started.