If you are a minister, you have several key tax issues that makes you uniquely different from other taxpayers. These differences include the housing allowance, self-employed treatment for W-2 wage earners and the big one…the ability to opt out of Social Security.

All of these tax differences can create a great deal of complexity, and should only be handled with a team of competent tax and financial advisers. However, the ability to irrevocably opt out of Social Security is probably the most complex financial planning issue for new ministers as it carries a high degree of long-term consequence if the wrong decision is made.

If you are a new minister, I know this decision can be complicated. It’s more than just a financial decision. If you opt out, you must agree to the following language:

I certify that I am conscientiously opposed to, or because of my religious principles I am opposed to, the acceptance of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care.

That’s weighty for sure, but my focus for this article is not to debate the ethical and moral issues of opting out, the good Lord knows there’s already been plenty written about that. My goal is to examine the economic aspects of opting out. Specifically, I want to help quantify what it would take to replace the benefits that you’re walking away from.

What Dave Ramsey Thinks

Some would say that the decision to opt out of Social Security should be made solely on a religious and moral basis with little regard to the economics. Others, like Dave Ramsey, believe the decision should be based on financial reasons.

In a recent Q&A on Dave’s Website, he said this:

Pastor Opting Out Of Social Security?

QUESTION: John asks if he should opt out of Social Security if he’s a full-time pastor.

ANSWER: Pastors can opt out of Social Security on a religious basis. Under the tax law you can be a conscientious objector. God clearly tells us to manage our money well and Social Security is not a good money manager, so you have a viable reason for opting out of Social Security.

If you don’t put your money in Social Security, you have to do the following three things:

1. You have to save for retirement.

2. You have to get life insurance.

3. You have to get long-term disability insurance.

You’ll have thousands of dollars more if you save this way.

That last sentence sure caught my attention. “Thousands of dollars more” by opting out? Whoa! That sounds great, but I’m not so sure it’s accurate. Let’s take a deeper look at the numbers.

What Your Tax Pays For

So what exactly do you receive in exchange for these massive taxes? The FICA tax (or SECA for self employed people) is a person’s way of buying into the Social Security system. In exchange for a total 15.3% tax rate, you are eligible for benefits if you:

a) Retire (Social Security Retirement Benefits)

b) Die (Social Security Survivors Benefits)

c) Become disabled (Social Security Disability)

d) Need medical care (Medicare)

In order to determine whether or not you’d be better off to opt out, we have how much it would cost to replace the benefits that Social Security will pay for. Let me preface this comparison with the disclosure that these numbers are rough estimates. Your particular situation will likely differ based on your marital status, dependents, and household income.

How Much Would You Have?

Let’s consider the example of “John.” He’s 25 years old and married. He’s recently graduated Seminary and began his first ministry position which has a starting salary of $30,000. Not including his deductions, we know that in year one John will owe $4,590 in self employment tax; unless he decides to opt out of Social Security ($30,000 salary x 15.3% self employment tax).

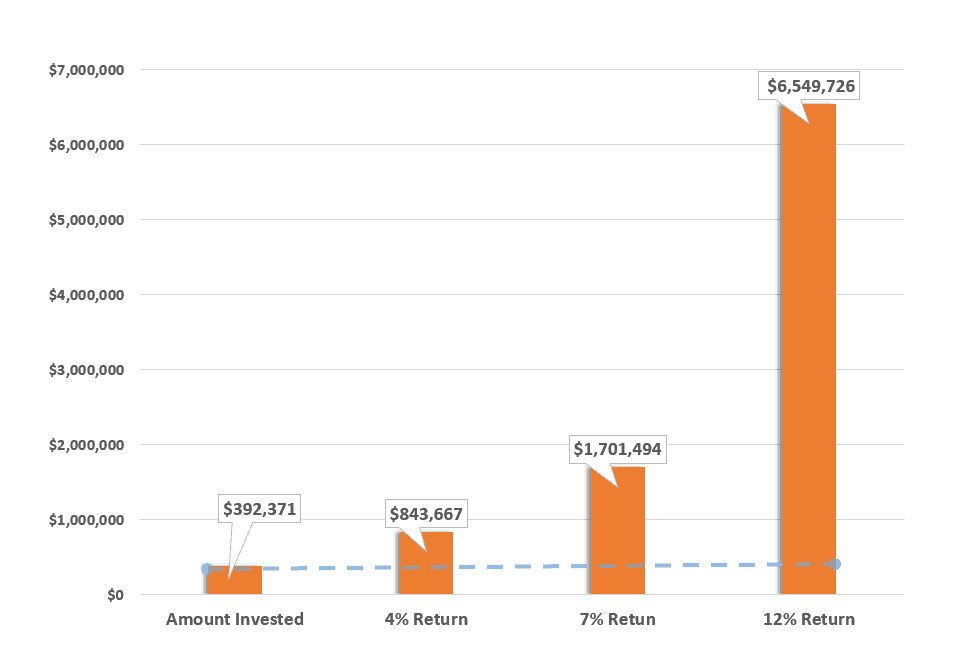

If we assume his salary simply increases at an average of 3% per year, he will be able to avoid a whopping total of $392,371 in self employment tax between now and his age 67 (the current Full Retirement Age for John). This also assumes that the tax rate doesn’t change.

So how much would John have if he invested all of that money?

A lot! If he were to invest the tax savings annually, his hypothetical value at age 67 would be:

-$843, 667 @ 4% hypothetical average annual return

-$1,701,494 @ 7% hypothetical average annual return

-$6,549,726 @ 12% hypothetical average annual return (I would never project a 12% average return, but Dave Ramsey is fond of this number)

There’s no question, that’s a lot of money in any of the return scenarios! At face value, it sure seems like Dave’s advice on having more money is accurate.

But here comes the downer.

You don’t get to invest all of the tax savings. You’ve got to spend some of it to insure the risks that exist prior to retirement such as disability and death. That’s only fair since Social Security would also cover you on those items.

Let’s examine each individually.

Social Security Disability Benefits

Let’s begin by looking at coverage for disability. Under the Social Security system, you’d become eligible for disability coverage within a few years. It’s difficult to do a side by side comparison of Social Security Disability and private disability insurance due to the multiple factors that would have to be included. The numbers could be wildly in favor of Social Security due to spouse and dependent coverage or in the favor of private insurance. For our purposes, we’ll simply assume you immediately purchase a private policy. This will lock in a lower premium for your working life due to your age, but may pay you more than Social Security if you become disabled in your younger working years.

Most private disability insurance policies will replace 50 – 60 percent of your salary. The cost? $2,000 per year on average.

Social Security Survivor Benefit

The other benefit that exists prior to your retirement is the Survivor benefit. If you die early, your spouse and dependent children could receive payments from your participation in Social Security. Much like disability benefits, it’s nearly impossible to accurately suggest a “coverall” replacement for Social Security Survivor benefits. Under Social Security, the maximum eligibility for benefits would come with 10 years of work history. However, some benefits are available after only one and a half years of working.

So instead of confusing the topic with the various scenarios, let’s make the broad assumption that you simply buy a 20 year term policy with a death benefit of $500,000. At age 45, when the first policy term is over, you purchase another policy. This strategy will give you coverage until your are age 65.

If you are in decent health, the first 20 years should cost approximately $30 per month ($360 annually). The second term would increase due to age. It should be around $75 per month ($900 annually). On average, replacing Social Security Survivor Benefits should cost you about $630 per year.

Adjusted Investment Amount

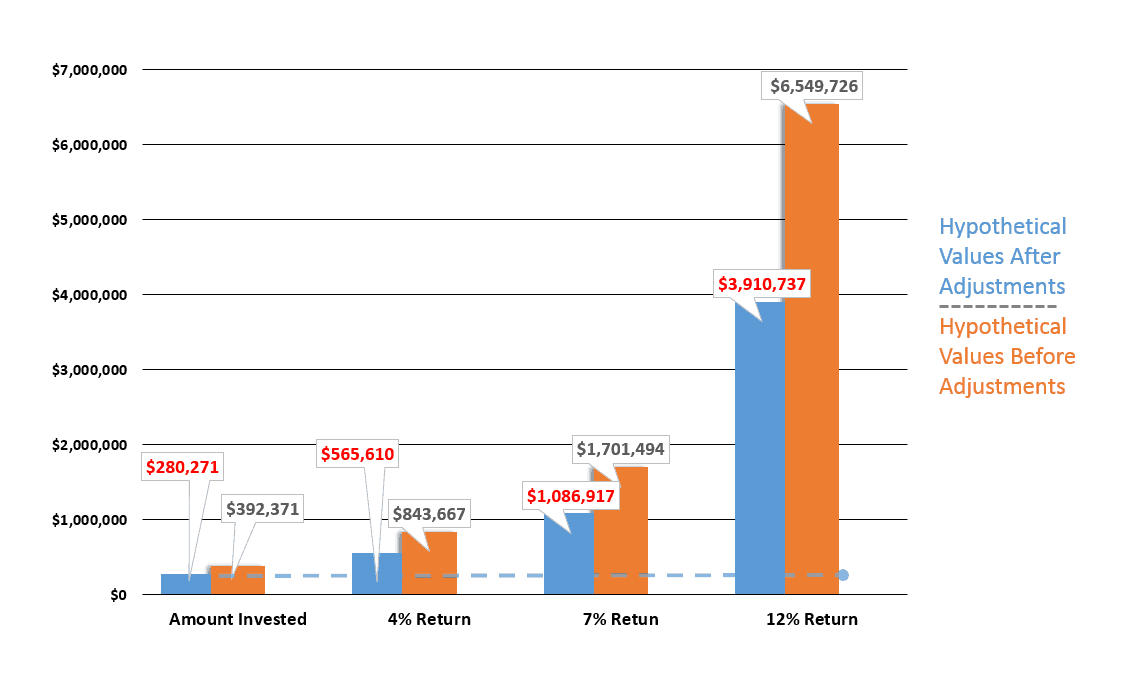

Now that we’ve quantified an approximate dollar value to replace the Social Security benefits available before retirement, we know we have less to invest. But how will that impact the investment returns?

Initially, we calculated saving $4,590 per year and inflating that by 3%. Now, we know that prior to investing that amount, we would have to spend the following:

-$2,000 per year on disability

-$360 per year on life insurance (first 20 year term)

-$900 per year on life insurance (second 20 year term)

The results? Instead of a total of $392,371, you’d “only” have $286,271 to invest. Here are the age 67 hypothetical values after those adjustments.

-$565,610 @ 4% hypothetical average annual return

-$1,086,917 @ 7% hypothetical average annual return

-$3,910,737 @ 12% hypothetical average annual return (Again, I would NEVER project a 12% average return, but…Dave Ramsey is fond of this number)

Ok. There’s no question here. Those numbers are drastically different. But, they are still huge! The question is, are any of these amounts enough to self-pay the portion of your retirement expenses normally covered by Social Security?

Social Security Retirement Benefits

Let’s start by looking at the benefit that many immediately think of when the word Social Security is mentioned. A retirement benefit.

Currently, for those born after 1954, the full retirement age is 67. The current average benefit is $1,294. John’s benefit could be much higher depending on his earnings. But for our purposes, we’ll use the average. If we apply an inflation rate of 2%, the average benefit at John’s age 67 will be around $3,000 per month.

For this calculation, let’s use the following assumptions:

-Once he retires, John earns 5% as an average rate of return

-Every year he increases his income by 2%.

-He plans to for his retirement to last exactly 20 years (income from age 67-87).

With those assumptions, John will need approximately $525,000 in his investment portfolio on day 1 of retirement.

It’s also important to note that if his spouse does not have a Social Security benefit of her own, she will also be entitled to a spousal benefit of $1,500 per month. Using all the same assumptions, that would drive the total required assets on day 1 of retirement to $775,000.

Medicare

Here’s the big one that many don’t consider when opting out. Healthcare!

The good news here is that everyone is eligible for Medicare at 65. The bad new is that without sufficient work history, you’ll have to pay for everyone else receives free, and it’s not cheap. Currently, the part A premium is $426 if you don’t have any Social Security credits. The part B is currently $104. That’s a total monthly outlay of $530 in today’s dollars. If we assume a 2% inflation increase, by John’s retirement age the premium will be $1,193.

Using the same rate of return, time and inflation assumptions as we did with the retirement calculation, healthcare cost will add an additional $200,000 to the fund necessary on day 1 of retirement.

Again, if his spouse has not qualified for medicare benefits under her own work history, she’ll have to pay as well. Now the total would be $2,386 in monthly premiums. This increases the total funds required on day 1 of retirement by another $200,000 for a total of $400,000 just to pay healthcare insurance in retirement.

The Results?

In total, on day 1 of retirement, John would need $725,000 to replace what Social Security would pay. This means that after he paid for his disability policy and life insurance policy, he would need to invest his tax savings and earn an average of 5.25%.

If his wife had never worked, he would need a total of $1,200,000 to replace Social Security. This would require an average annual return of 7.5% on those same invested tax savings.

Is Dave Right?

So, how about this advice from Mr. Ramsey? Is it good advice? Well, sort of. If everything goes spectacularly right, yes, it’s excellent advice. If one thing goes wrong, it could be disastrous.

What could go wrong?

Here are a few examples:

Something comes up that keeps you from investing every penny that you would have paid in taxes.

Your rate of return doesn’t exceed 5.25%. Now you’re just breaking even…with a lot of risk!

Your rate of return is lower than 5.25%. Now you have no income.

You live longer than 20 years.

And the list goes on…

Here’s the determining question. How much is the risk worth? If you think you can have an extra million dollars at retirement, you may determine that it’s worth it. But is it still worth it if you think you’ll only have an extra $50,000? Probably not.

Please understand! Everyone’s situation is different. Slight nuances in your work history or family status could make big differences in planning whether or not this is right for you.

Be careful with this decision. Generally, once you are out…you can’t get back in.

2000 for disability insurance is rather pricey… Most people earning that salary can get for MUCH less (under $600 a year for sure, I would venture even cheaper).

Also most of the time if your wife works 10 years (or you work 10 years of secular income earning at least 5050 a year or so) you will still get free healthcare.

I became a pastor after retirement. I have been collecting S.S. for the last 10 years. If I op to do a 4361 would I still receive my S.S. which I had earned in the secular world? What benefit would I lose?