Is there a ‘donut hole’ for Social Security inflation adjustments for individuals 60 and 61 years of age?

I’ve been receiving lots of questions about benefits increases since the latest Social Security COLA was announced. The alleged donut hole for inflation adjustments to Social Security for individuals aged 60 and 61 is one of the questions frequently raised. During this period of high inflation, some members of this age cohort are upset that they may be missing out on significant benefits increases.

This thinking is based on the observation that if all wages are indexed through age 59, and the cost of living adjustments don’t start until 62, there are two years of no inflation.

Unfortunately, there is some truth to this, but it’s not as bad as it seems.

To get the full picture, let’s examine how the Social Security program uses inflation to increase current and future benefits.

How Social Security uses inflation indexes to increase benefits

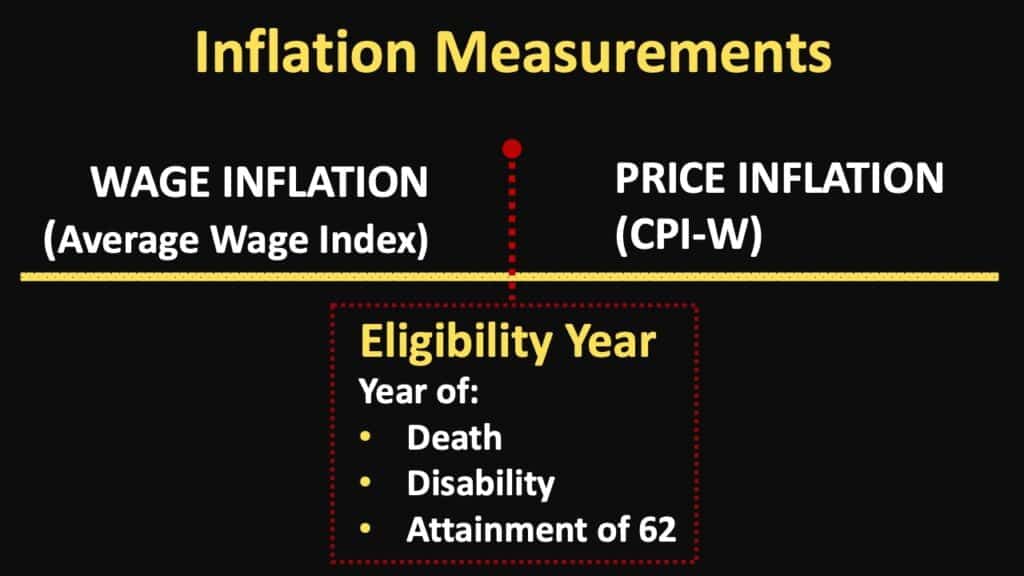

The Social Security program uses two distinct inflation indexes in the calculation of benefits.

- The National Average Wage Index (AWI)

- The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)

The index used depends on if someone has reached their “eligibility year.” This is defined as the year someone dies (if before 62), becomes disabled (if before 62), or reaches age 62.

Prior to the eligibility year, the inflationary increases are based on year-over-year changes to the average wage index (AWI).

After the eligibility year, the increases are based on changes to the consumer price index for clerical workers and urban wage earners (CPI-W).

For most retirees, this means that before you turn 62 your future benefit will be increased based on changes in wage growth (AWI), and after you turn 62 the increases are based on price-based inflation (CPI-W).

How the inflation indexes are linked to the benefit calculation

To fully understand the alleged inflation-based donut hole, let’s take a quick review of the Social Security benefit calculation. The relationship between inflation indexes and benefit formulas becomes easier to understand with this information.

The first step in the calculation is to establish your earnings history. This is important because your Social Security benefit is controlled by your historical earnings. Thus, the foundation of the formula is to calculate your historical earnings.

While this step may seem easy enough, they don’t use your historical earnings at face value. Instead, all of your earnings through age 59 are adjusted to account for the growth in wages. This indexation is meant to ensure that an individual’s future Social Security benefits reflect the general rise in the standard of living that occurred during their working lifetime.

The process for indexing these earnings is to take the national average wage index in the year you turn 60, and divide by the AWI in each of the other years you had earnings (but only up to the maximum earnings taxable for Social Security).

How the average wage index accounts for inflation

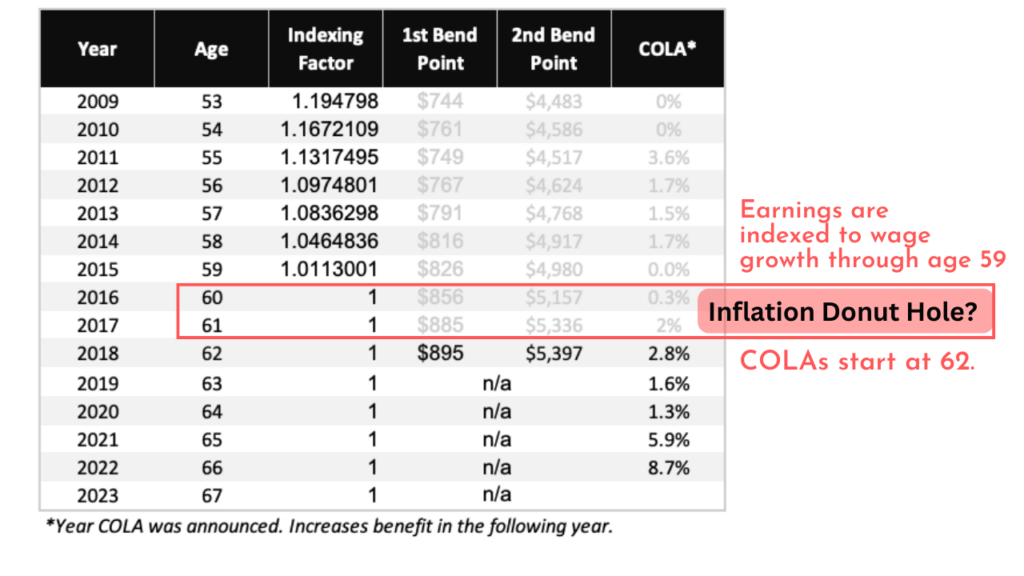

Let’s go through an example and assume that you’ll reach 67 in 2023. That would mean that you were 60 in 2016. In 2016 the average wage index was 48,642.15. That’s the wage level to which your historical earnings will be indexed.

To get the specific indexing factor, you simply divide the average wage index in the year you turn 60 by the average wage index in all the prior years where you had earnings. For example, if you divide the 2016 wage index by the 2015 index, you get a ratio of 1.0113001.

Then you would simply take your 2015 earnings at face value and multiply by that indexing factor. For example, if your actual earnings for 2015 were $75,000, you would multiply that by the indexing factor which would result in an indexed earnings amount of $75,847.

You would simply repeat this step for all the years you had earnings.

Once you had all of your earnings indexed, you would simply take out the highest 35 years of earnings. And then you would need to reduce these 35 years to a monthly amount because the Social Security formula is meant to calculate your monthly benefit. To do that, you’d simply add up the highest 35 years and divide by the number of months in 35 years which is 420. The result is your averaged indexed monthly earnings, better known by its acronym – AIME.

So now that you’ve calculated your AIME, it’s time to run it through the formula in place the year you turn 62.

There are two bend points in this formula, but they are separated into three bands to which your AIME should be applied.

Those bands are:

- The amount up to the first bend point,

- The amount between the first bend point and second bend point, and

- The amount over the second bend point.

This is another place where the average wage index comes in since these bend points generally change every year in response to the change in the average wage index. And there is a two-year lag so the formula that’s in place the year you turn 62 is based on the average wage index that was announced in the year you turned 60.

For example, the 2023 bend points are $1,115 and $6,721. So an individual who turns 62 in 2023 would apply their average indexed monthly earnings as follows.

- The first $1,115 would be multiplied by 90%,

- The amount between the first and second bend point would be multiplied by 32%, and

- The amount over the second bend point would be multiplied by 15%.

You’d simply sum up the result of each of these bands to arrive at your Primary Insurance Amount which is typically called your PIA.

Now that we’ve covered the process to calculate benefits, it’s easy to see that the average wage index controls two very important pieces:

- The indexation of prior earnings through age 59, and

- The increase of the bend points in the PIA formula

Where the COLAs enter the calculation

The next place where inflation comes in is the cost of living adjustment that is based on the CPI-W. This annual adjustment doesn’t start applying to a benefit until age 62. (And it’s important to note, the cost of living adjustment will increase your PIA whether you have filed for benefits or not.)

Considering that COLAs only begin at age 62, and earnings indexation ceases at age 59, it certainly does appear that ages 60 & 61 don’t receive any adjustment through wage-based inflation or price-based inflation.

But let’s dig a little deeper and break this down by specific ages to see what, if any, inflation is applied.

Is there a donut hole?

So far, we’ve established that through age 59 inflation is added to benefits through the indexation of prior earnings. At 62 and thereafter, inflation is added to benefits through the annual cost of living increase.

So this leaves ages 60 and 61.

Is age 60 an inflation dead zone?

At 60, the average wage index level is used to determine two separate pieces:

- First, All prior earnings will be indexed based on the average wage index level in the year someone attains 60

- The wage index from the year someone attains age 60 will determine the PIA formula which will be used at age 62.

So, a higher (or lower) average wage index at age 60 directly impacts the final benefit amount.

It’s clear that the wage index at age 60 most certainly makes a difference and thus age 60 does have inflation applied.

What’s different about age 61?

So how does this differ for someone who is 61?

At this age, the average wage index counts toward neither the indexation of earnings nor the bend points in the formula. Additionally, the inflation increase from the cost of living adjustments doesn’t apply until the following year.

The verdict? Age 61 is in an inflation donut hole.

However, this isn’t necessarily bad news.

For example, those turning 61 in 2023 may be upset that the big jump in the average wage index in 2021 isn’t going to directly apply to their benefits, but it likely will. This is because the average wage index generally doesn’t go down. It can, as it did in 2009, but it generally increases every year. This means that the average wage indexed in the next year should stack on top of the most recent index amount and thus provide an even higher benefit.

So ultimately, there is an inflation donut hole for those who are 61, but it’s not really bad news, just another funky nuance of how Social Security benefits are calculated.