When the news about a 3.2% cost of living increase to Social Security benefits for 2024 was announced, beneficiaries breathed a sigh of relief. But that relief was soon overshadowed by the revelation that Medicare Part B premiums would rise by 5.94% in the same year. At first glance, these numbers can paint a bleak picture. However, when you dive deeper into the figures, a different story unfolds.

Understanding The Percentages: It’s All Relative

While on the surface, it may seem that an increase in Medicare premiums will erode your Social Security benefits, the percentages need to be contextualized. The reason is that the base amount for Social Security benefits is much higher than the premiums of Medicare Part B. Therefore, an increase of 3.2% on Social Security benefits actually translates to a larger sum than a 5.94% increase on the smaller Part B premiums.

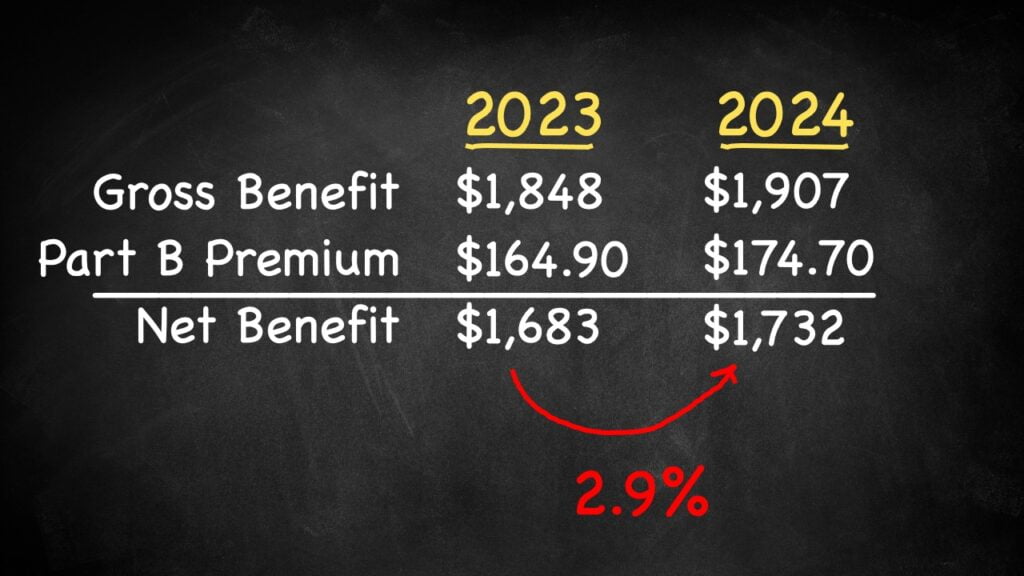

Let’s use the 2023 figures as a case in point:

In 2023, the average Social Security benefit was $1,848. With a 3.2% rise, the 2024 gross benefit amounts to $1,907. After deducting the Medicare Part B premium (which rose by $10 to $174.40 in 2024), the net benefit is $1,732. This represents a 2.9% increase from the previous year. Yes, the Medicare premium hike does bite into the rise in benefits, but not to the extent that one might think.

The Varied Impact of Fixed Medicare Premium Hikes

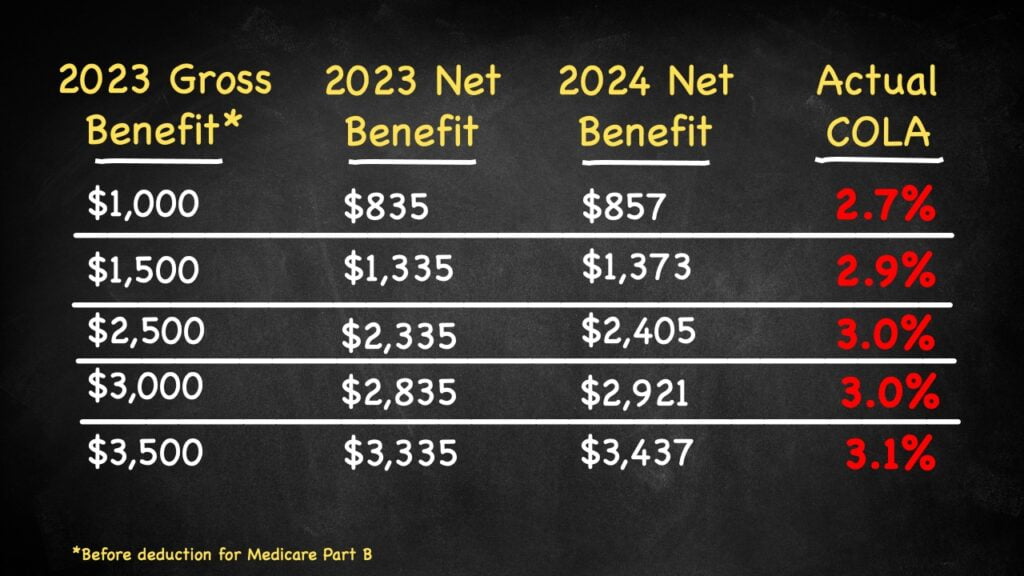

It’s essential to understand that the $10 increase in Medicare Part B will not impact all beneficiaries equally. While everyone will be paying the same premium in dollar terms, the percentage it represents of their benefits will differ based on the benefit’s size.

For instance, those with a $1,000 gross benefit in 2023 would see their net benefit grow by 2.7% in 2024. Those receiving a $3,500 gross benefit in 2023 would experience a 3.1% growth in 2024. As the benefit amount grows, the relative impact of the Medicare premium diminishes.

It should also be noted that your Social Security benefits generally cannot be decreased due to an increase in Part B premiums. This is due to the “Hold Harmless” rule and if you are covered, you have some insulation against the effects of increased healthcare cost. However, there are two distinct types of individuals who are not covered by this rule. For more information, see my article How the Hold Harmless Rule Really Works — and Who Is NOT Protected by It.

Other Medicare Changes to Keep in Mind

It’s important to note that the Medicare Part B premium is just one of the factors affecting retirees. Other changes, such as a $14 increase in the Part B deductible and a $32 rise in the Part A inpatient hospital deductible for 2024, can also impact the overall retirement budget.

Ultimately, contrary to the widespread belief, the increase in Medicare Part B premiums will not entirely negate the rise in Social Security benefits. While the hike does have an impact, it doesn’t swallow up the entire benefit. As with many things in finance, a deeper understanding and a closer look at the numbers reveal the whole story.