Calculating the spousal benefit for a spouse who also has their own Social Security benefit is an important process to understand. Your own Social Security benefit and your spousal payment are NOT calculated the same when it comes to reductions for filing early or increases for filing later.

Knowing the correct way to calculate your spousal benefits in this situation isn’t something that a rare few need to worry about. According to the Congressional Research Service, there are 3.2 million individuals who are entitled to a social security benefit from their own work as well as a spousal benefit.

This situation is referred to as “dual entitlement” to benefits. In this article, we’ll dive into calculating spousal benefits with dual entitlement so you’ll be able to accurately plan the amount of benefits you can expect to receive.

(Looking for a full explanation of spousal benefits? Don’t miss this video and article for a deeper dive into the broader subject.)

The Concept of Dual Entitlement in Social Security Benefits

The simplest way to understand the concept of spousal benefits is to think of them as an assurance that if the lower-earning spouse files for Social Security at full retirement age, they will not receive less than half of the higher-earning spouse’s full retirement age benefit.

We can look at an example to see how spousal payments could work in the real world.

Let’s assume we have a couple where the husband worked outside the home and paid into Social Security over his career. The wife managed the home and thus did not pay into Social Security.

At full retirement age, the husband has a monthly Social Security benefit of $2,000. Because the wife did not work in a role that allowed her to earn the required 40 credits, she won’t have a benefit of her own.

However, as an eligible spouse, she’d be eligible for a benefit of $1,000 per month as a spousal payment at her full retirement age. (If she filed for that benefit early, it would be reduced based on her age.)

But what if the wife did earn the required 40 credits for her own benefit, and earned less than the husband? This is where dual entitlement rules come into play.

If the husband in our example has a full retirement age benefit of $2,000 per month and the wife has her own benefit of $800 per month, dual entitlement says the wife is still eligible for a total benefit of $1,000.

Remember, at full retirement age, the lower-earning spouse can get the greater of her benefit or one half of the higher-earning spouses’ benefit. In this case, the wife can still have a total benefit of $1,000 — but, she’ll receive her own benefit of $800 first and then a “spousal payment” of $200 to get her to the full $1,000 she is eligible for.

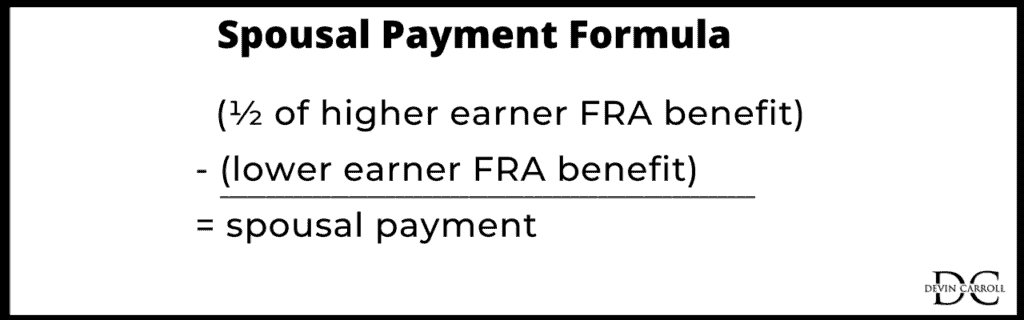

The Simple Formula for Figuring Out Dual Entitlement

What’s critical to understand with dual entitlement is that these are really two separate benefits all rolled into one. The easy way to understand how this may apply in your situation is a simple formula:

(½ of Higher Earner FRA Benefit) – (Lower Earner FRA Benefit) = Spousal Payment

If we go back to the husband and wife in our example, we know that half of the higher earner’s benefit amount is $1,000. We can then subtract the lower-earner’s benefit amount of $800 to see what the spousal payment would be: $200.

Now, you may be thinking, “Devin…if the result at the end of this calculation is still one half of the higher-earning spouse’s benefit, why does it matter?

That’s a good question. Here’s my answer: it’s important to know the formula and how the calculation works because your own benefit and your spousal payment are NOT calculated the same when it comes to reductions for filing early or increases for filing later.

Let me show you what I mean.

How Filing Early or Late Impacts Benefits Under Dual Entitlement

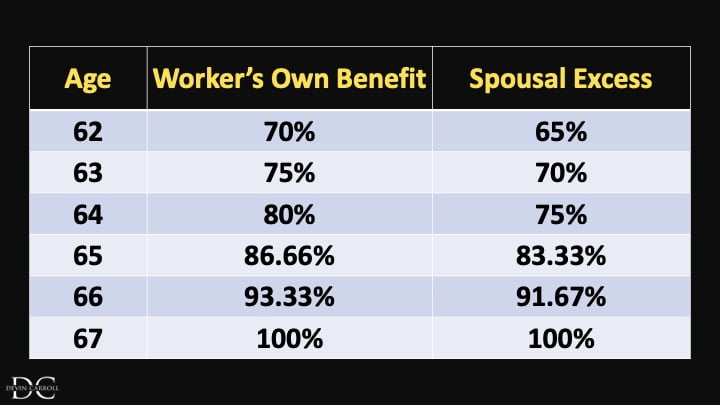

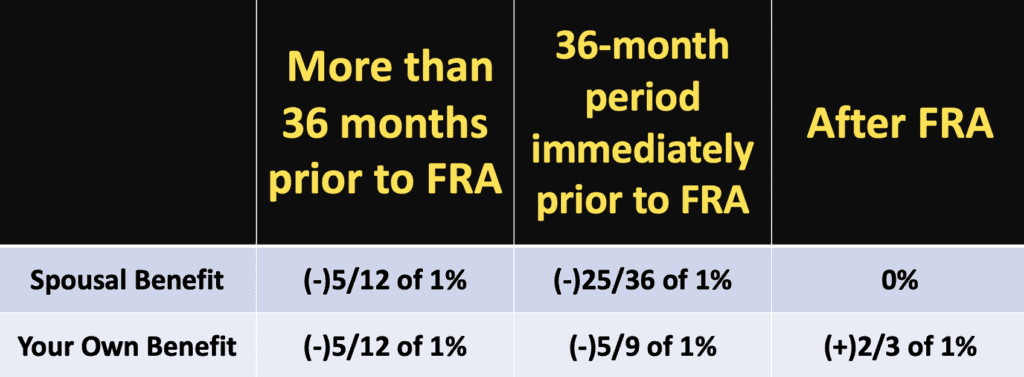

I’m going to assume that you are the one who will be receiving the spousal benefits. If you look at the chart below, that means that the center shows your filing age. The left-hand column shows reductions or increases to your own benefit. The column on the right shows the reductions or increases to your spouse’s payment.

Let’s assume that your full retirement age is 67 (which it is, for anyone who is born 1960 or later). At full retirement age you would receive 100% of your own benefit. You would also receive 100% of your spousal amount.

If you file a year early, at 66, you would receive 93.33% of your benefit and 91.67% of your spousal amount. At 65 it would be 86.66% of your benefit and 83.33% of your spousal amount.

You can see that the difference in reductions between your benefit and the spousal benefit continue to widen all the way back to the earliest age of filing, which is age 62.

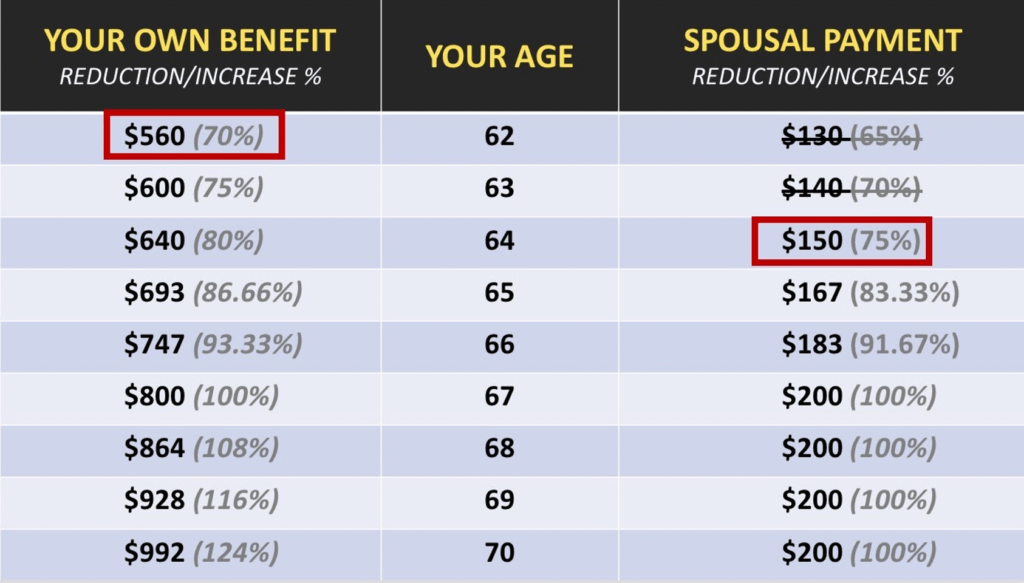

So just to make sure we are clear on how a spousal benefit will be reduced, let me walk you through an example where we use dollars.

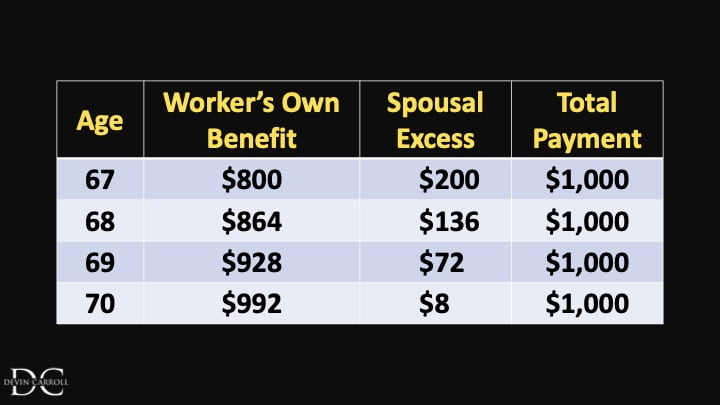

Let’s continue with our assumption from earlier, that the higher-earning spouse has a full retirement age benefit of $2,000 and the lower-earning spouse has a benefit of $800.

From what we’ve covered so far, we know that the lower earner is entitled to a total benefit of $1,000 at full retirement age because that is one half of the higher-earning spouse’s full retirement age benefit.

However, that benefit would be paid as $800 for the lower-earning spouse’s own benefit, and the other $200 comes as a spousal payment. These two benefit amounts would be reduced or increased separately based on age of entitlement. (Just for this example, we’ll assume that both spouses are entitled to both benefits at the same age; we’ll take a closer look at this nuance in a moment).

As you move back through earlier filing ages in the chart below, you can see how each benefit is reduced all the way down to age 62. At this point, the total payment would be $690.

But what about increases? For example, what if the wife in this case waited until she was 70 to file for benefits? Would she receive her increased benefit PLUS the full spousal excess? No. The rules say that any increases to the worker’s own benefit from delaying filing will be deducted from the spousal excess. So in this example, let’s assume that the wife delayed her benefit to age 68. That would mean that her $800 would have grown to $864. So instead of receiving the full $200 spousal excess, $64 would be subtracted leaving her a spousal excess of $136. When you add these together, the total benefit payable is the same as it was at full retirement age. $1,000. The same thing would hold true even if she filed at 69 or 70. This means that if the lower-earning spouse’s benefit is less than one-half of the higher earner’s benefit, it usually does NOT make sense for the lower-earning spouse to delay beyond full retirement age because the increased benefit is simply subtracted from the spousal excess. The easy math for increases is (high earner’s benefit / 2) – (low earners benefit + delayed retirement credits) = spousal excess.

So far, this is relatively easy to follow. We’ve established that a dually-entitled spouse will receive their own benefit first and then a spousal payment to get them up to one half of the higher-earning spouse’s full retirement age benefit amount — and that both of these payments would be reduced separately for filing before or after full retirement age.

But now there’s a small wrench I’d like to throw into the machine here to make this interesting.

What Happens If You File for Your Own Benefits Before You’re Eligible for a Spousal Payment

What happens if someone files for their own benefit, but is not yet eligible to receive the spousal payment? The answer, and the next calculation I’m going to show you, has confused a lot of people.

This actually happens fairly often, due to the rule that says before a spousal payment can be paid, the higher-earning spouse must file first. We can figure out how this works by using the chart from above and continuing our example of a higher- and lower-earning spouse in a marriage where each is entitled to their own benefit but the lower-earning spouse may also get a spousal payment.

Let’s assume that the lower-earning spouse has reached full retirement age and they file for their benefit of $800. If the higher-earning spouse has already filed, they’ll get the spousal payment of $200, but if they haven’t already filed, they will not get the spousal payment. That would keep their total payment to $800.

This goes for any age at which the lower-earning spouse files as long as the higher-earning spouse has not yet filed. The lower-earning spouse can’t get the spousal payment in this scenario, so their total payment would only be their own benefit, reduced or increased for filing age.

Now, let’s step this up to a more likely scenario where the lower-earning spouse files for benefits — and two years later, the higher-earning spouse files for benefits. When the higher-earning spouse files, it entitles the lower-earning spouse to the spousal payment.

But how would this be calculated?

It’s simply based on the age of entitlement. Let’s go back to the chart and look at an example: assume the lower-earning spouse files for their benefit at 62. That spouse would start receiving $560, which is 70% of the full retirement age benefit.

Since the higher-earning spouse has not yet filed, the lower-earning spouse would not receive a spousal payment. But if the higher-earning spouse files two years later, the lower-earning spouse would become entitled to a spousal payment:

And here’s the important part:

It would be the lower-earning spouse’s age of entitlement to the spousal payment that would determine how that portion would be reduced — NOT when the lower-earning spouse filed for their own benefit.

I’ve gotten a few emails and messages from people who have told me that their financial advisor didn’t agree with the way I calculate this, so in the description below I’ll put some links to the pertinent section of the Social Security Administration’s website where these calculations are discussed.

Bonus: How Reductions Are Calculated on a Monthly Basis

One last thing I think is important for those who really want to grasp the fine details of this calculation is understanding how the reductions are calculated on a monthly basis since you may want to file in between birthdays.

There are three separate bands that you have to know about:

- The band of 37+ months from full retirement age

- The band of 1-36 months for full retirement age

- After full retirement age.

For the band of more than 36 months away from FRA, the spousal payment and your own benefits are reduced the same. 5/12 of 1% per month.

Within the band of 1-36 months before FRA, spousal benefits are reduced by 25/36 of 1% percent and your own benefits are reduced by 5/9 of 1%.

After full retirement age spousal benefits are not increased at all but your own benefits are increased by 2/3 of one percent.

I know we’ve covered A LOT of ground in this article but I hope it’s helpful when you are planning how to file for social security.

Before you leave… be sure to join my FREE Facebook members group. It’s currently at 9,000+ members and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. You should also consider joining the 273,000+ subscribers on my YouTube channel!

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

My video on Spousal Benefits

Congressional Research Service “Social Security Dual Entitlement”

https://crsreports.congress.gov/product/pdf/IF/IF10738

Entire POMS Chapter on Computation of Monthly Benefits

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615000

Dual Entitlement

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615020

“A RIB is figured independently of any past or present spouse’s benefit reduction except if DIB is involved”

+

“The amount payable as a spouse will be the difference between the spouse’s benefit and the RIB.”

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615240

The big chart on benefit reductions

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300615010

The SSA quick calculator on early retirement spousal benefits.