If you are eligible for a survivor benefit from a deceased spouse (or ex-spouse), you need to know about a strategy that can supercharge your Social Security benefits.

This can be powerful if you learn how to use it.

Up until 2016, switching between Social Security benefits was possible through several popular filing strategies. For example, an individual could file for spousal benefits and later switch back to their own benefits. This strategy would allow this person to collect a benefit while waiting on their own benefit to grow with the 8% per year delayed retirement credits.

After some law changes in 2016, most of these Social Security filing strategies were eliminated. One of these strategies, however, is still in place, and it benefits those who are eligible for survivor benefits.

A general overview is that if you are eligible for both a survivor’s benefit and your own benefit, you file for one benefit and let the other benefit grow as you wait.

For example, it could make sense to file for a reduced survivor’s benefit as early as 60. While you are drawing your survivor benefit, your own benefit grows every month you delay filing for it. At age 70, you simply switch back to your own benefit which is now higher.

The reverse of this would work as well. You could file for your own benefit as early as 62 and switch to a survivor benefit at full retirement age.

Let’s look at some examples to see how it works.

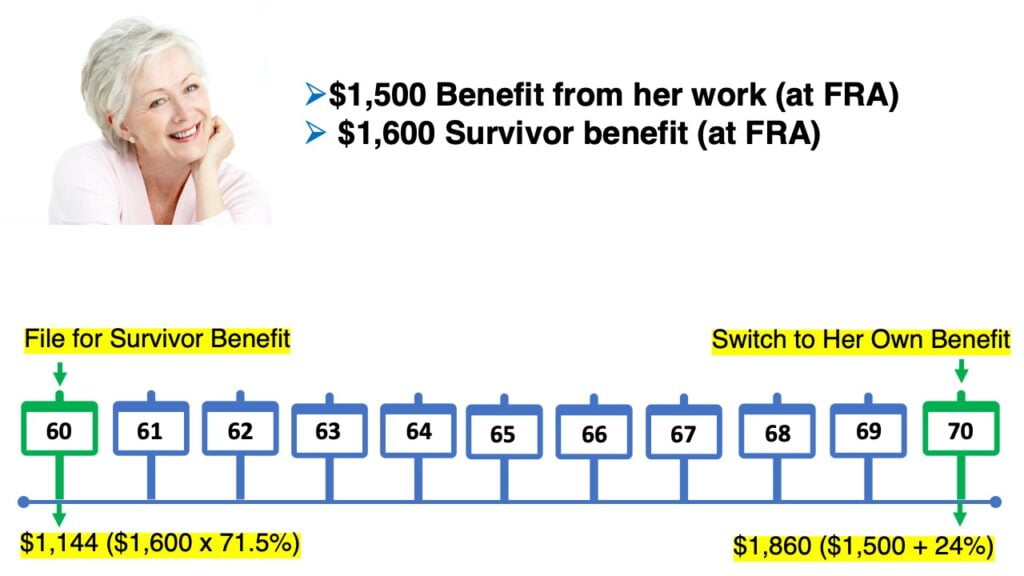

Let’s say Paula is 60. At 67, her full retirement age, she has her own benefit of $1,500 per month and a survivor benefit of $1,600 per month.

One approach would be for Paula to file for survivor benefits at 60. That would result in a reduction of 28.5% which would give her a benefit of $1,144. But she’d be able to collect that amount while her own benefit was growing. Once her own benefit has grown to the maximum, at age 70, she would simply switch to her own benefit and receive $1,860 per month for the rest of her life.

That would make a big difference in monthly benefits!

The reverse of this scenario could also be advantageous.

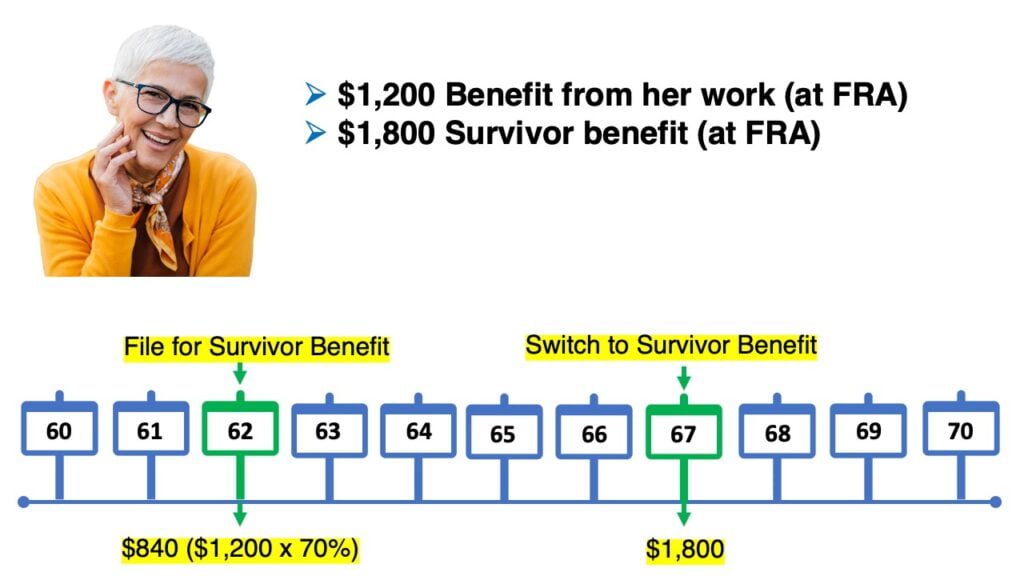

Let’s assume that Jean is currently 62 years old (the earliest age you can claim your own benefit). At full retirement age, she has her own benefit of $1,200 and a survivor’s benefit of $1,800.

The easy decision here is to file for her benefit first, even though it would be reduced to $840. At her full retirement age of 67, she would switch to a survivor’s benefit. That way she could receive a benefit while she was waiting to get her full survivor’s benefit. Just a quick tip here… survivor’s benefits won’t continue increasing beyond full retirement age so there wouldn’t be any reason to delay.

If you’re going to be eligible for survivor benefits, don’t stop with this article.

There’s a lot more to know before you file for any benefits. You need to know about the widow’s limit, the windexing calculation, how full retirement age is different for those that receive survivor benefits, how the earnings limit could impact your benefit, and a lot more.

I discuss all of this at length in my articles on this topic. Here are a few you may want to read next:

Social Security Survivor Benefits: The Complete Guide

If You Die Young: How to Calculate Social Security Survivor Benefits (what everyone between the ages of 22-55 should know)

Survivors’ Benefits: Exceptions to the Marriage Length Requirement