There are some cases where you can receive a lump sum Social Security payout.

Overall, this may seem like a good deal. Having a lump sum means you can use that money right away instead of waiting for it to come in monthly installments.

But is a lump sum Social Security payout really a good idea? Read on to understand the pros and cons of this decision for yourself.

A Lump Sum Social Security Payout isn’t a Gift from the Government

Because there are many very narrow cases where an individual can receive a lump sum Social Security payout , it’s easy to get lost in a rabbit hole here.

For the purposes of this article, I want to focus on one specific area: The lump sum Social Security payout you may be offered when you go in to file for your retirement benefits.

An email I received from a reader the other day said they got a surprise after filing for Social Security. “The Social Security Administration offered to pay me 6 months of benefits as a lump sum payment,” the reader said in the email. It surprised him that this “generosity” would be offered by the agency.

I had to email my reader back and tell him that generosity may not have been the primary motivation of the Administration in offering the lump sum Social Security payout — and this wasn’t the first time someone told me the Administration gave them a lump sum when they filed for benefits.

Furthermore, I shared a few reasons with this reader why accepting this lump sum may not be the best decision.

So you’ll be fully prepared, here’s what you need to know about where this lump sum Social Security payout is coming from and whether or not you should take it.

How to Determine If You Should Take the Lump Sum Social Security Payout

First, it’s important to understand two key concepts:

- Your full retirement age and the increases for every month beyond your full retirement age.

- A lump sum Social Security payout for retirement benefits can only be paid to individuals who have reached full retirement age.

As a result, it’s crucial to understand when you’ll attain full retirement age, as without knowing this information you won’t be able to do the math to determine whether a lump sum is worthwhile.

Here’s what to know:

First, your full retirement age is dependent on your year of birth. For anyone born in the years 1943 and 1954, the full retirement age is 66. If you were born between 1954 and 1960 you simply add two months for every year up to 1960 when the full retirement age is fixed at 67.

The amount of your benefit increases by two-thirds of 1% every month that you delay filing for benefits beyond your full retirement age. That works out to .667% per month.

The next crucial concept to grasp is that the Social Security Administration states that anyone who files for retirement benefits after full retirement age may receive up to six months benefits payable in a lump sum…but not for months that occurred before your full retirement age.

For example, if your full retirement age is 67, and you file at 67 & 6 months of age, you’d be able to receive the full 6 month lump sum Social Security payout. If you file at 67 and 3 months, you’ll only be eligible for 3 months of lump sum payments because payments can’t be paid for months before your full retirement age.

Understanding the Impact of the Lump Sum Payment

For a better understanding of how this works, let’s look at an example.

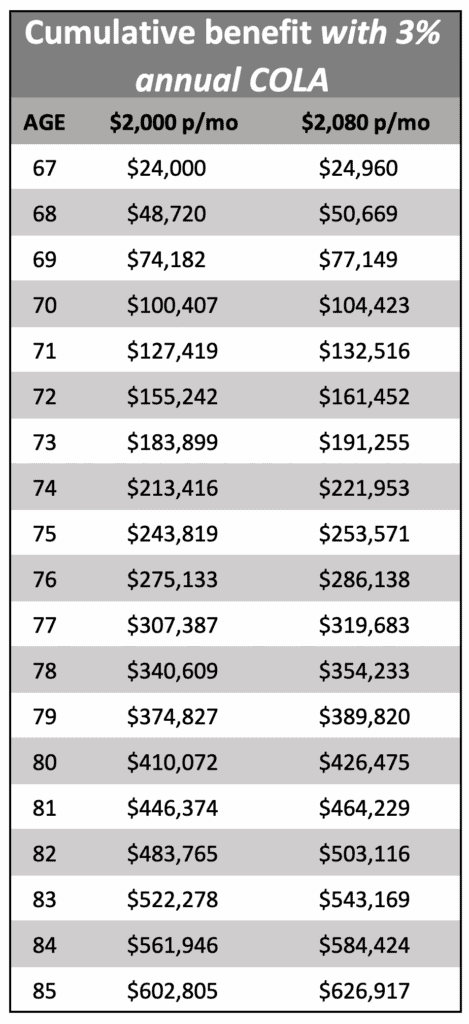

Assume your full retirement age is 67 and your benefit at that age is $2,000. But you decide to wait to file for benefits until you are 67 and 6 months old.

You have done the math in your head and realize your full retirement age benefit has increased for each month of delay – so instead of $2,000 per month, you will get $2,080.

Yet when you go to the Social Security office to file for benefits, they tell you your benefit will be $2,000 a month and you should expect to receive a lump sum payment of $12,000.

In essence, what the Social Security Administration is saying is, “We’ll give you 6 months of benefits upfront — if you’ll allow us to cut your benefits by 4% for the rest of your life.”

This option is certainly tempting, as you may feel as if you have a higher need for funds at this point since you’re giving up a paycheck and starting lots of new projects you’ve had planned for your retirement.

While you were busy working you might have deferred a lot of fun, so the idea of getting a big lump sum right away is pretty exciting, especially when you’re not expecting it.

Before making this decision, keep in mind that it might look great at first glance, but there are a few other things to consider.

What to Think About BEFORE Taking a Lump Sum Social Security Benefit

The first thing you must understand about taking the lump sum is that it lowers the amount of the annual cost of living adjustment that you will receive. This means that not only is your monthly benefit lower, it doesn’t grow as fast as it would from the compounding effect of the increases.

Additionally, you must consider the fact that both lump sums and monthly benefits are counted with your other income when determining how much you owe in taxes. This means that taking a lump sum may result in you having to pay back more of your benefits in taxes.

Perhaps more importantly, taking the lump sum when you go to file for your retirement benefits will lower the amount of eventual survivor benefits if you’re the higher earner. Depending on your financial and health situation, this could be an important consideration.

I go back to that all the time in reminding people that your filing decisions will likely affect more people than just you while you’re alive. Optimizing for the survivor benefit has to be a part of your decision!

But now I want to hear from you: if you file after full retirement age, will you take the lump sum with a lower monthly payment or no lump sum with a higher monthly payment?

Before you go, if you haven’t already, you should join the nearly 400,000 subscribers on my YouTube channel! This is where I get into detail about the latest news and policy changes that impact Social Security.

And one last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.