The push to privatize Social Security hasn’t been discussed much lately. That’s too bad. It’s probably the best (and least intrusive) option to save Social Security that NO ONE is talking about.

This option was almost used in the late 90s and if it would have been implemented, we probably wouldn’t have the issues with the solvency of Social Security that we have today. But it may not be too late!

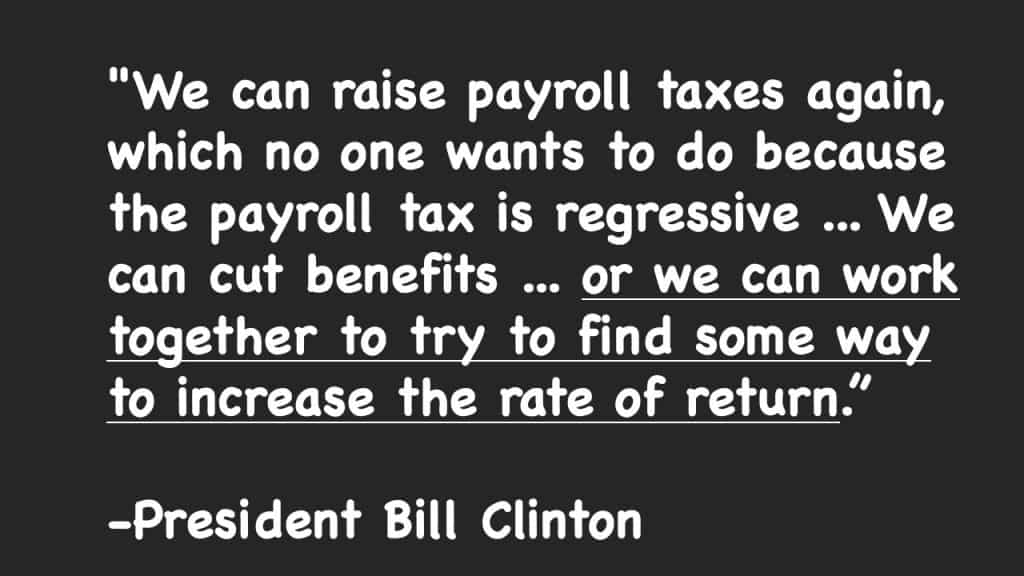

Over the past 10 years its been often repeated that the solvency issue of the Social Security trust fund can only be fixed by either increasing taxes or cutting benefits. Without one of these, there will be a 20% shortfall by the year 2034.

Wrong!

There is a third option that’s rarely discussed. In fact, its become a bit of a third rail. If you touch it your political career may be over. That third option is to privatize Social Security by investing part of the assets in the trust fund.

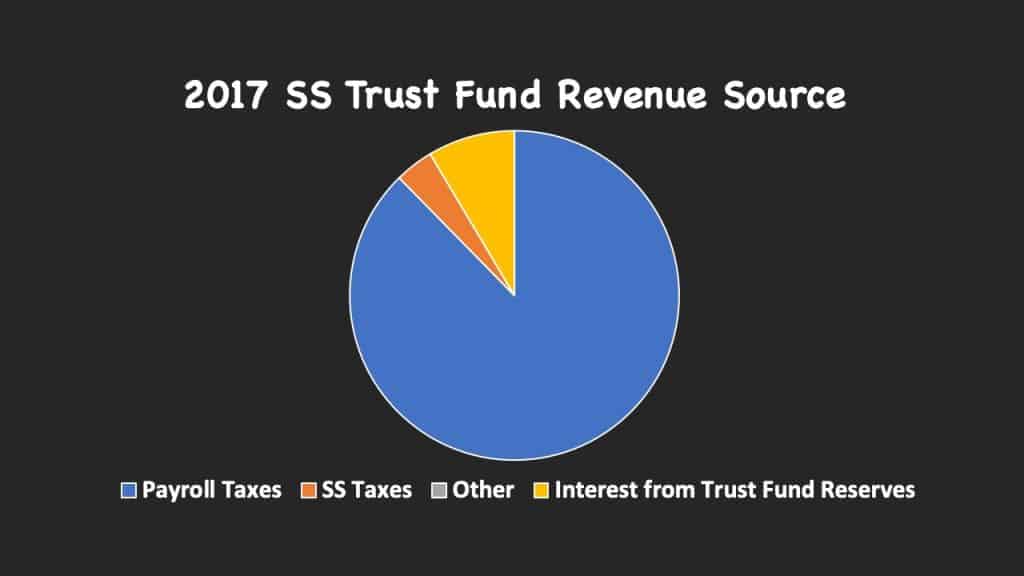

So how would it help to privatize Social Security? The quick answer is that there is a 2.9 trillion dollar balance in the trust fund that’s earning a measly 2.7%. If the rate of return could be increased, the funds would last longer.

This huge balance was built up by having more workers than retirees. Thus, since Social Security collects from current workers to pay current retirees, there was an imbalance in the amount of money that came in vs. what needed to be paid out. This money built up over the years until it grew to its current massive size.

Now, the tables are turning and there are projected to be more retirees than workers. This means that to make the promised Social Security payments the Administration will have to start taking withdrawals from the trust fund. By the year 2034, this trust fund will be been depleted unless something changes. At that point, benefit payments will be funded solely by payroll taxes from current workers and a few other small sources. In short, there won’t be enough money to make 100% of benefit payments.

But what if we could make the trust fund last longer by increasing the rate of return?

The Clinton’s Disagreement on Privatized Social Security

Let me give you some reasons this hasn’t happened yet. Back in 2016, when Senator Hillary Clinton was running for President, she loved to bash the “Republican” idea of investing Social Security. But ironically, it was her husband, President Bill Clinton, who actually proposed the privatized version of Social Security.

During the late 90’s he had a study group that suggested multiple fixes for Social Security. The one he really liked? Invest part of the Social Security trust fund. This made perfect sense! In multiple academic papers that followed it was found that the deficit would be closed completely by doing this.

How The Blue Dress Stopped The Plan To Privatize Social Security

But then something happened that stopped everything. Monica Lewinsky and her blue dress. At this point, President Clinton’s political survival forced him to align with his party and abandon several of his big objectives. Putting safeguards in place that would protect Social Security and Medicare for the long term was one that had to be pushed aside. The push to privatize Social Security died alongside his pride.

It’s too bad it went that way. In retrospective data, a paper from the Boston College’s Center for Retirement Research illustrated that this plan would have been effective, and we would not be in the place where we are today. In this same report, they say that investing the trust fund would still fix the issue. At the same time, reports from the SSA say that it wouldn’t have much of an impact this late in the game. So there’s some disagreement there about whether or not this will work at this point. After all, the time value of money needs TIME to work and we’re waiting until the 11th hour to get something done.

My Perspective

So let me tell you where I stand. I’m a conservative and find most of my views to align with our conservative legislators. However, no one gets a blank check for my approval.

Even though I have comments on my YouTube videos saying I’m a flaming liberal, and other comments on the same video saying I’m a crazy right winger I think that I have a responsibility to support the legislation that makes sense… even if it is from the ‘other’ party. But everything is framed as good or bad, liberal or conservative, black and white. We’ve gotten to a point where we feel bad for agreeing with a proposal from a party we don’t like and feel like we have to agree with everything our chosen party likes. There is an in-between here. And unless we find it, were going to have a disaster on our hands with Social Security.

If we keep waiting the only way to fix it will be drastic benefit cuts or tax increases. Increased taxes on the rich do not create ANYTHING! Instead, the often-unintended consequence is of targeting rich people with more taxes will be a BIGGER gap between the rich and the poor. This is because companies, who are more often than not owned by rich people, are not likely to take a reduction to their net profit or pay. Instead, the increased costs of higher taxes get passed on to employees through pay and benefit cuts.

It’s your retirement!

Before we go I want to thank you for taking the time to get informed. So many people just float into retirement hoping everything will work out. Sometimes it does, but sometimes a lack of planning can ruin what should be your best years. This is your retirement! Please continue to stay informed!

I’d recommend staying connected with my content so you won’t miss anything. In many cases I’ll publish my newest stuff on YouTube and then share it on my Facebook page. Then my content team does their magic and cleans it up into an article for those who enjoy reading. (Again…the article is shared on my Facebook page.)

Be sure to subscribe to my site so you won’t miss any of the new content coming out, plus you will receive the blueprint version of my book for free. Alternatively, you can just head over to Amazon and buy the full version. I can’t guarantee this, but I’m pretty sure you’ll get more value than the $12 it costs.

Thanks for reading…have a great day.