If your income exceeds certain thresholds, you could be subject to the income-related monthly adjustment amount (IRMAA). This is a surcharge that is added on top of your standard premium for Medicare Part B and Part D.

What are the 2024 IRMAA Brackets?

The IRMAA for Part B and Part D is calculated according to your income. To determine whether you are subject to IRMAA charges, Medicare uses the adjusted gross income you reported on your IRS tax return two years ago.

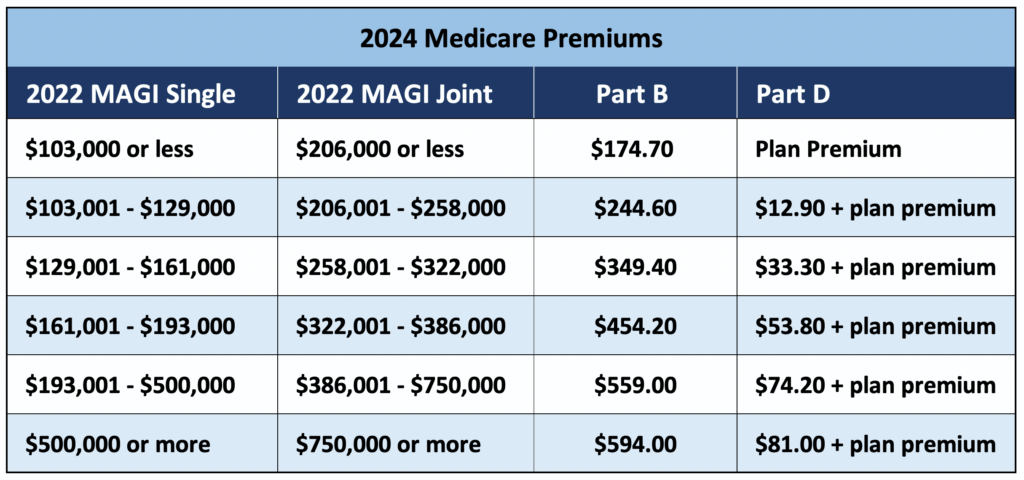

Here’s the breakdown of the 2024 Part B and Part D IRMAA.

Medicare Part B IRMAA

By law, Medicare Part B premiums must cover 25% of the costs incurred by that part of the program. The Centers for Medicare and Medicaid Services estimate the cost to cover all Part B services on an annual basis and set the standard premium to equal 25% of that cost. However, if you earn more than certain levels, you may have to pay up to 85% of the program costs.

In 2024, the standard Part B monthly premium is $174.70. Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a premium between $244.60 and $594.00.

Complete breakdown of income thresholds and the corresponding premium amounts in the chart below.

Medicare Part D IRMAA

For the Part D prescription drug benefit, there is no specified premium amount. Each insurance company determines its own premium. The additional charge from the IRMAA is added to the insurance company’s premium (but generally paid separately).

Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay an additional Part D premium between $12.90 and $81.00.

Income thresholds generally change annually in response to the CPI-U

Income thresholds generally change annually in response to the CPI-U

Does Medicare Advantage have an IRMAA?

Some people mistakenly believe that by opting for Medicare Advantage rather than Original Medicare, they can avoid IRMAA charges. However, IRMAA applies to all Medicare beneficiaries whose earnings exceed a certain threshold.

This is because everyone on Medicare Advantage still owes the Part B premium of $174.70 in 2024, in addition to any applicable IRMAA charges.

Also, if you have a Medicare Advantage plan that includes prescription drug coverage, the Part D IRMAA applies.

How to know if the Medicare IRMAA applies to you

To find out if you owe IRMAA, you won’t have to make any inquiries. You will receive a letter from Social Security. Here’s how the notification process works.

When you first enroll in Medicare, you will be charged the standard Part B premium along with the Part D premium.

Then, if your income is high enough for IRMAA to apply, you’ll receive a pre-determination notice from Social Security. This notice will explain that you are subject to the IRMAA and gives you a 10-day period to contact the SSA if you believe the information is incorrect.

Within a few weeks after the predetermination notice, Social Security will mail you an initial determination notice. This notice will contain much of the same information as the predetermination notice but will have the addition of an appeals process detailed.

How to appeal the IRMAA

If you feel the IRMAA decision is incorrect, you have the right to appeal.

To do so, contact the Social Security Administration to request that your initial IRMAA determination be reconsidered. This can be done over the phone by calling 800-772-1213 or in writing by filling out SSA-44.

To qualify for a change in IRMAA determination, you’ll have to show that

- your tax return was either out of date or inaccurate, or

- Your income has recently decreased significantly due to one of seven these life-changing events:

- Death of a spouse,

- Marriage,

- Divorce or annulment,

- Work reduction

- Work stoppage

- Loss of income from income-producing property

- Loss or reduction of specific types of pension income

How do I pay the Medicare IRMAA surcharge?

You won’t pay the IRMAA directly to your insurance company if you have Medicare Advantage or Medicare Part D.

You do not need to take action if you owe IRMAA if you receive Social Security benefits and have your Medicare Part B and Part D premiums deducted from your Social Security payment. A deduction will be made from your Social Security benefit for the IRMAA.

If you don’t have any Medicare premiums deducted from your Social Security payment, you’ll receive a separate bill for your Part B and Part D IRMAAs.

Additional resources…

If you’d like to continue reading and learning about the IRMAA, here are some resources that may benefit you.

Medicare Premiums: Rules For Higher-Income Beneficiaries

POMS Policy for Modified Adjusted Gross Income

POMS section on IRMAA Reconsideration

The SSA IRMAA Reconsideration Form