Social Security’s 8.7% cost of living adjustment is old news by now. There are a lot of sites that have covered it, and most of them have covered it more than once.

Considering how hot this topic has been for a while, it’s not surprising. According to the modern method of calculating increases, this was the fourth largest cost of living increase in the history of Social Security.

This cost of living increase will be good news for the moment, but it will have a high cost and accelerate the problems with Social Security.

The quick summary is that higher inflation, which caused this big cost of living adjustment, is going to shorten the lifespan of the Social Security trust fund.

How the 2023 COLA will lead to bigger problems

Every year the Social Security Trustees issue a report that dives into the nuances of the system and forecasts the longevity of the trust funds. When you hear people say that the trust fund is projected to be depleted in 2033 or 2034, this is the document they use as their source.

These trust funds work like a bank account. Income comes into the fund through payroll taxes and other revenue streams, and expenses (or benefits) are paid out to Social Security beneficiaries.

Over the past few decades, there have been multiple years where more income has come in than has been spent on benefits. This has resulted in a nearly $3 trillion cushion waiting in the trust funds for future use.

An easy way to think of this is to imagine that your living expense is about $4,000 per month. Let’s say that for several years you had a job that paid you $5,000 per month so you’ve been able to save $1,000 per month. But things change and now your job is paying you $3,000 per month. Now you have a $1,000 deficit but thankfully you have savings that you can draw from to supplement your $3,000 in income.

That’s exactly what’s going on with Social Security…just on a much larger scale.

The impact of price inflation

To arrive at this forecast, the Trustees have to estimate multiple demographic and economic assumptions. One of the key economic assumptions they use is the estimate they’ve made about inflation. This is important because the rate of inflation affects the amount of benefits that have to be paid out of the trust funds.

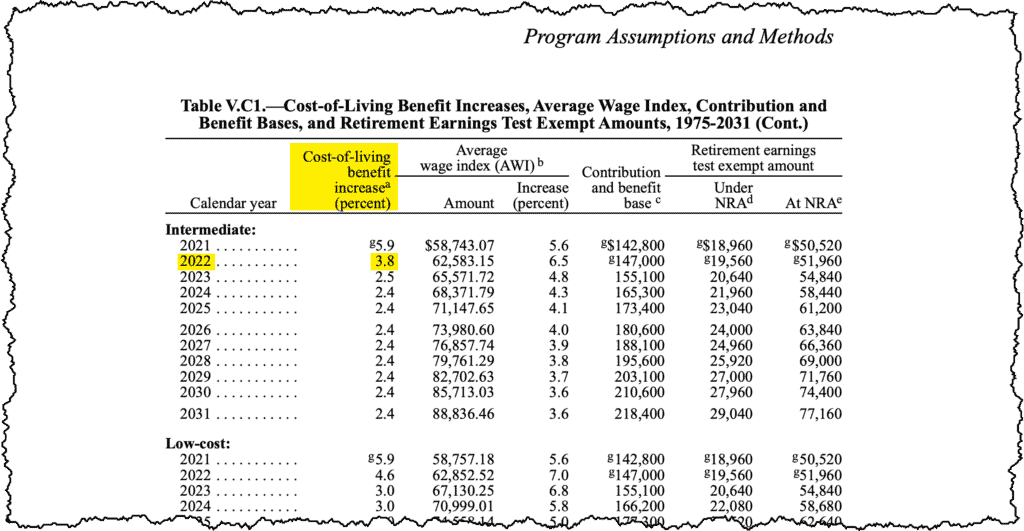

The number they used in the 2022 Trustees report was 3.8%. The actual 2022 number was 8.7%. That’s more than twice as high! Keep in mind, there’s no such thing as a negative COLA so these higher benefits will be here forever.

The impact of wage inflation

Another component of inflation that directly impacts Social Security is wage inflation, but it is not as commonly discussed. Wage inflation is measured by the year-over-year change to the average wage index (AWI). This index is what controls the indexation of historical earnings and the dollar amounts in the bend point formula.

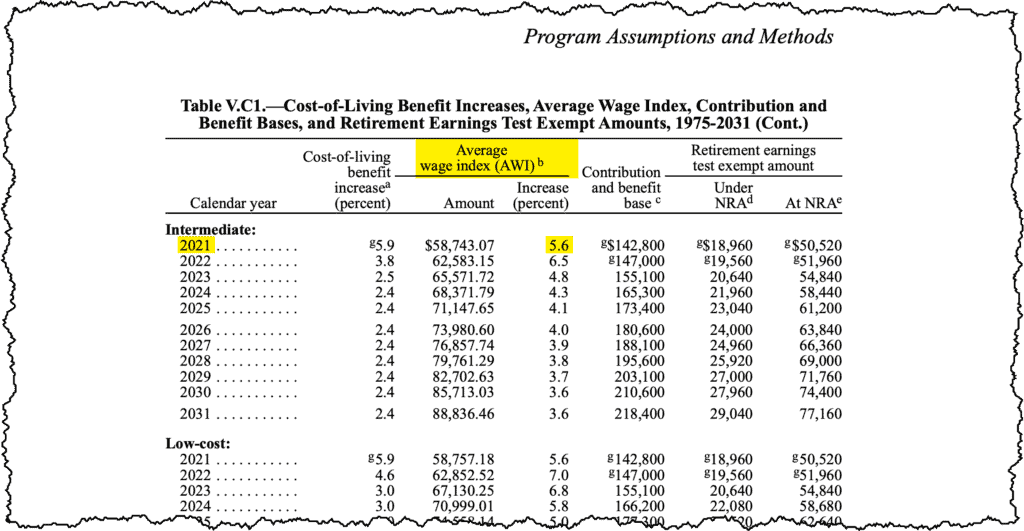

There’s a two-year lag on this so the pertinent number for the 2023 change is the 2021 average wage index. The Social Security Trustee’s report forecast was 5.6%. The actual increase was nearly 60% higher at 8.9%.

The problem: The outgoing money will accelerate

The end result of both the price inflation and wage inflation being substantially higher than the forecast means that the amount of money going out of the trust funds is going to increase at a faster pace than the Trustees thought it would.

Inflation can also help increase revenue

There are some inflation-based components in the Social Security system which could actually increase the revenue of the trust funds. For example, the maximum taxable earnings base is going to increase by more than expected. This means that the revenue from Social Security taxes will be somewhat higher than anticipated (as long as the employment rate holds steady).

But ultimately, a tax increase on a small segment of workers won’t be nearly enough to offset the increase that everyone on Social Security is going to receive.

One thing is for sure, the 2023 Trustees report is going to be fascinating! Stay tuned and I promise I’ll cover that as soon as that report comes out. You can follow along by joining the nearly 400,000 subscribers on my YouTube channel or following me on Facebook.