Several thousand people have been underpaid by Social Security, according to a government watchdog report.

We’re not talking about small dollars here either.

According to estimates, the previous underpayments have been at least $131 million, and every year an additional $9.8 million will be added.

This comes from a 2018 report from the Office of the Inspector General. This is the agency that’s in charge of overseeing several of the big government programs like Social Security. Although this isn’t a new report, there has been an update that should anger those affected.

Before we get into the specifics, let’s first talk about who is affected by these underpayments.

Are you affected by the SSA underpayments?

The specific group that was affected were those that filed for survivor benefits and were also eligible for a benefit from their own work history. This is often referred to as dual entitlement.

The issue is that the Administration did not inform people that you could file for ONLY your survivor benefit and let your own benefit grow with the delayed retirement credits. This is what’s known as a restricted application.

The problem: A filing strategy was ignored

After some law changes in 2016, most of these Social Security filing strategies were eliminated.

The survivor benefits strategy, however, remains in place.

A general overview is that if someone is eligible for both a survivor’s benefit and their own benefit, they could file for one benefit and let the other benefit grow as they wait.

For example, it could make sense for someone to file for a reduced survivor’s benefit as early as 60. While they are drawing their survivor benefit, their own benefit grows every month they delay filing for it. At age 70, they simply switch back to their own benefit which is now higher.

The reverse of this would work as well. Someone could file for their own benefit as early as 62 and switch to a survivor benefit at full retirement age.

Example Case: Restricted application for survivor benefits

Let’s look at some examples to see how it works.

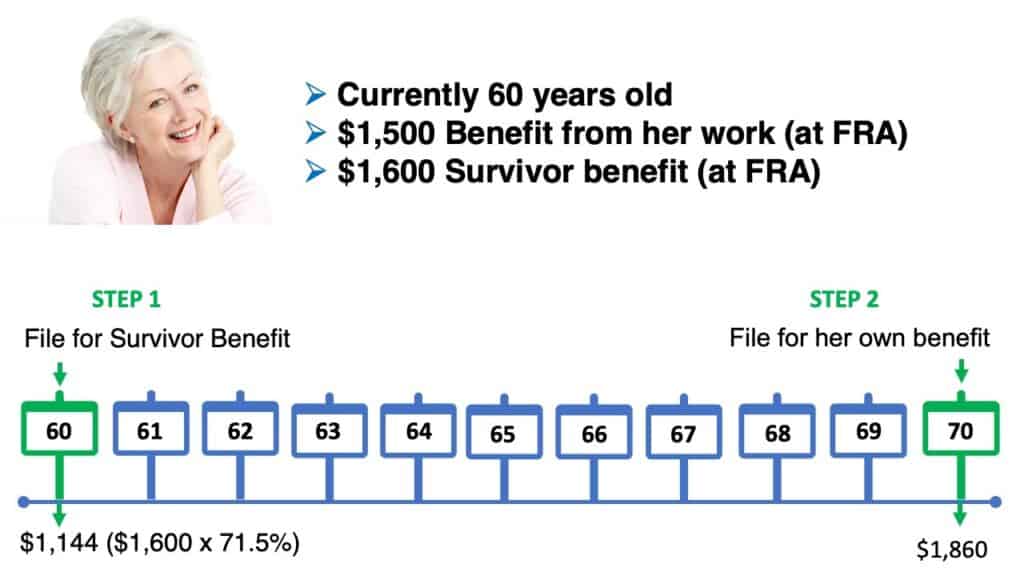

Let’s say Paula is 60. At 67, her full retirement age, she has her own benefit of $1,500 per month and a survivor benefit of $1,600 per month. One approach would be for Paula to file for survivor benefits at 60. That would result in a reduction of 28.5% which would give her a benefit of $1,144. But she’d be able to collect that amount while her own benefit was growing.

Once her own benefit has grown to the maximum, at age 70, she would simply switch to her own benefit and receive $1,860 per month for the rest of her life. That’s a massive difference in monthly benefits!

The reverse of this scenario could also be advantageous.

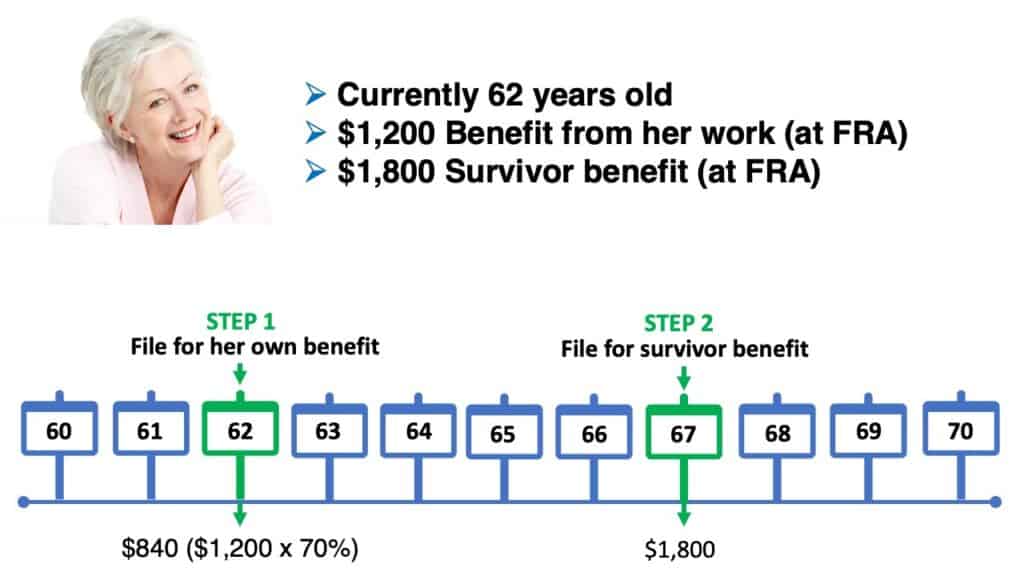

Let’s assume instead that Paula is currently 62 years old (the earliest age you can claim your own benefit). At full retirement age, she has her own benefit of $1,200 and a survivors benefit of $1,800.

The easy decision here is to file for her benefit first, even though it would be reduced to $840.

At her full retirement age of 67, she would switch to a survivors benefit. That way she could receive a benefit while she was waiting to get her full survivor’s benefit. (Author’s note: Survivors benefits won’t continue increasing beyond full retirement age so there wouldn’t be any reason to delay.)

Clearly, this strategy has a lot of potential to help people who desperately need income.

But, the Social Security Administration never told people this was an option.

It may be that the technician at the Social Security office didn’t know, or just didn’t care, but either way, they just took the application without telling anyone that they could increase their benefit.

Since this report by the Office of the Inspector General was issued, we’ve been waiting and watching to see how they would correct this.

And guess what? They haven’t done anything.

In fact, they are now saying that they’ve conducted an audit and have put safeguards in place to keep this from happening again, but they are declining to reimburse the people that were affected!

Their new position was buried on a footnote in a letter to the President from the office of Special Counsel. Here’s the specific language used in that footnote:

“SSA employees improperly enrolled widow(er) claimants for survivor benefits and Retirement Insurance Benefits simultaneously, to their potential financial detriment. After substantiating the matter, SSA conducted an audit to ascertain how many claimants were affected and initiated additional policy training and safeguards to address the issue. However, SSA declined re-open and reimburse affected claimants, citing the agency’s Rule of Administrative Finality.”

Basically, they are saying “we know we owe this money, but here’s this ambiguous rule that we are going to apply to this so we don’t have to pay back what we owe.”

I can ASSURE you of two things. First, if it were the other way around, and you owed THEM money, they would get it collected even if they had to stop your benefits. Second, they should know that citing “administrative finality” as their justification is bogus.

Some attorneys, thankfully, are willing to hold the Administration’s feet to the fire and are ready to fight to recoup the money these retirees are owed.

While suing is never the first option, in this case, the only way to get the Social Security Administration to do the right thing is through the legal system.

How you can get involved

In this case, attorneys are looking for individuals who have been negatively affected by the administration’s position of turning a blind eye to benefit underpayments.

If you think that you may be affected, fill out this short form. (Just know that if you fill this form out, there is the possibility that these attorneys may contact you for further questions.)

If you want to stay informed about the progress of this case as it moves through the system, be sure to join the nearly 400,000 subscribers on my YouTube channel or follow me on Facebook.