Social Security is a complicated topic, especially when determining tax implications and how best to incorporate your benefits into your retirement plan. Many financial planners rely on data plugged into Social Security software to help their clients choose the best time to file for benefits, but depending only on a software program can mean that a lot of the details get missed and could cost you thousands in taxes during retirement.

Let’s look at how filing for Social Security benefits at age 65 versus 70 can affect your tax bill in retirement and how Social Security software is a one-size-fits-all solution to a highly individual decision.

The problem with Social Security software

Software that attempts to maximize your Social Security benefit generally only looks at your Social Security payment as a stand-alone entity without considering other factors. Most software programs do not consider assets or other retirement income; they only see your benefit amount and the personal information you provide about your work history. The program recommends when and how to file for benefits based only on that information.

In general, using Social Security software to evaluate and decide when to claim benefits is not a bad idea. The problem lies when the software is the only tool you use to help you make a decision. You should base your filing decision on the results of the software program and your personal circumstances and retirement savings so you get a complete picture.

Because of how the Social Security program is structured, there’s no way to make a good decision without considering your entire retirement picture, and the software programs aren’t structured to take that information into account.

Let’s look at a case where your typical Social Security software would get this wrong.

Case study: Mr. & Mrs. Johnson

Mr. and Mrs. Johnson want to retire at age 65, and their assets include the following:

- $750,000 in pre-tax 401K accounts

- $50,000 in Roth IRAs

- $150,000 in a brokerage account

In addition to these savings, Mr. Johnson has a pension that pays $1,500 per month. At full retirement age, Mr. Johnson’s Social Security benefit will be $2,700, and Mrs. Johnson’s will be $1,400.

They want to assume a 5% rate of return during retirement, and their retirement spending goal is to have $5,000 net per month.

Mr. and Mrs. Johnson purchased a subscription to a software program that would tell them when they should file for Social Security. As they use the software, they are prompted to enter their birthdates and earnings history, but none of the other factors, like 401k, Roth IRAs, or brokerage accounts, were considered. Based on the limited information, the software calculated that the most optimal filing strategy was to wait until age 70 to take their benefits.

While it is true that waiting until age 70 to file for Social Security will get them the highest benefit payment possible, it may not be the best age to claim once the other retirement assets and income, and the tax implications, are factored into the equation.

Filing at age 70 vs. age 65

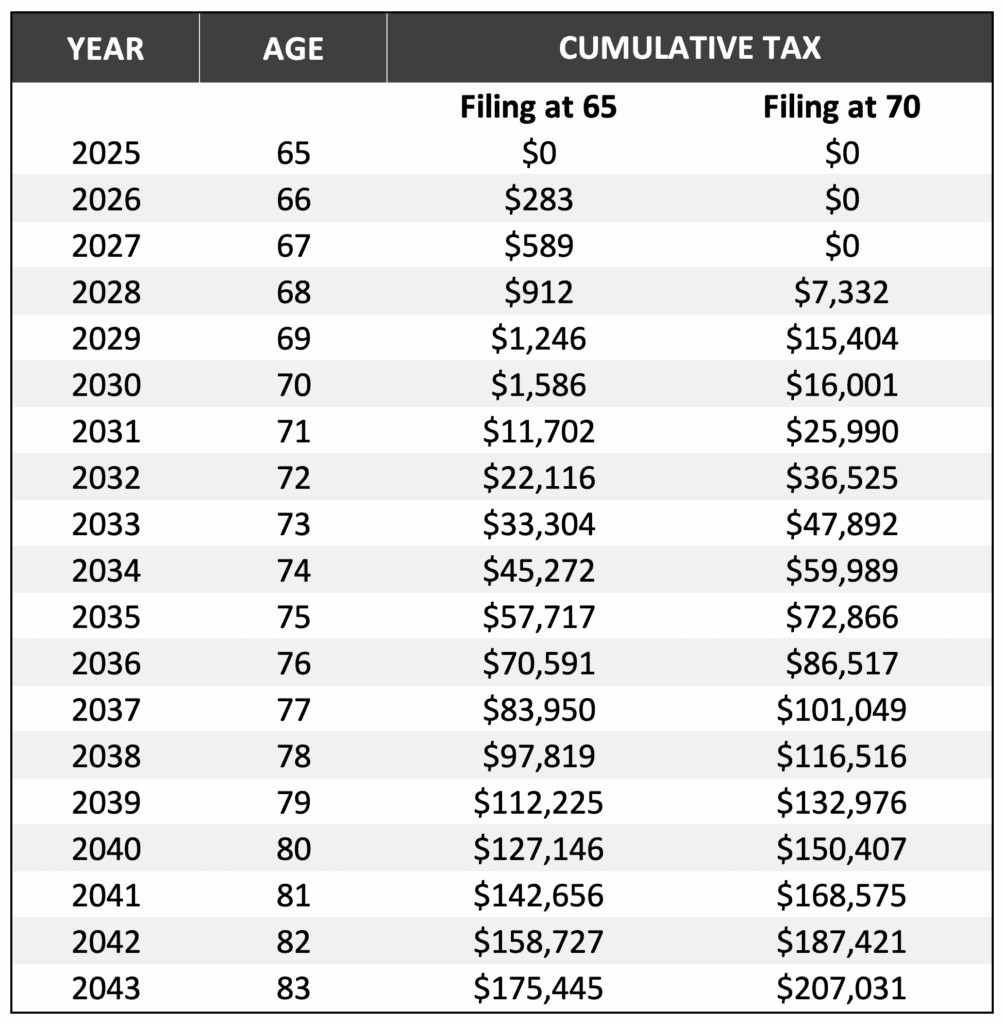

Let’s compare filing at age 70 vs. filing at age 65, when the Johnsons said they wanted to retire. We’ll discuss the differences between the cumulative taxes paid in each scenario and how the two filing strategies impact total account balances. The following charts will help us understand which filing age will cost the least in taxes and allow Mr. and Mrs. Johnson to keep more of their money.

Taxes

Using the chart below, you can see that filing for Social Security benefits at age 65 will mean paying a net total of $175,445 in taxes over the life of the benefit payments. Waiting until age 70 to file for benefits will mean a tax bill of $207,031. The difference between filing at age 65 and 70 is more than $31,000 in taxes paid throughout their Social Security benefits.

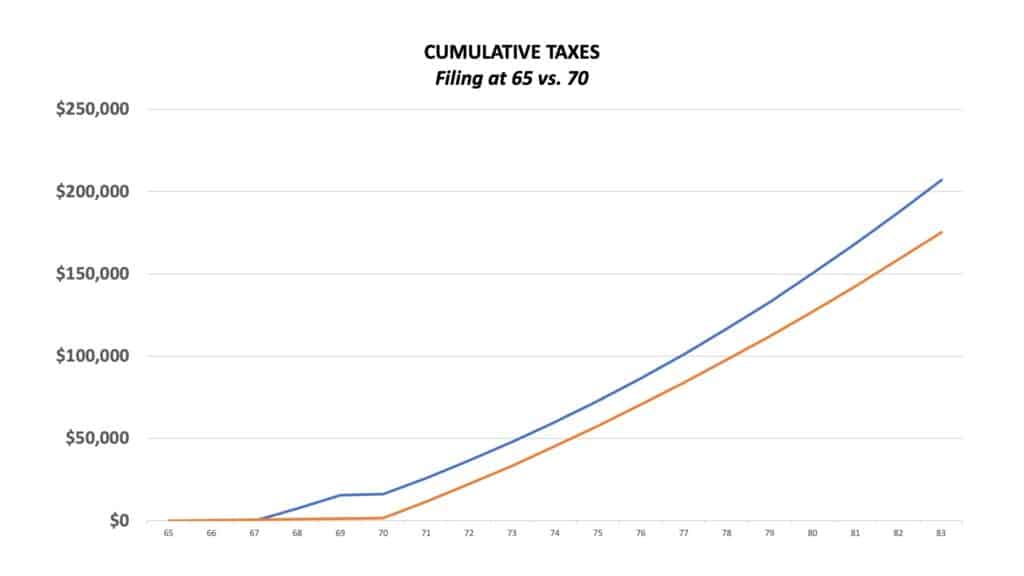

That may seem outrageous- how can there be such a difference? We’ll find our answer if we look at this same data in another way. In the following chart, the blue line is the cumulative taxes owed if they file at age 70, while the orange line is the cumulative taxes if filing at 65.

Waiting for benefits at age 70

You can see that the blue line, representing filing for Social Security at age 70, jumps up quickly and stays higher for the remainder of retirement. This happens because, at the beginning of their retirement, the only income the Johnsons have is their pension of $1,500 a month since they haven’t filed for Social Security yet.

The remainder of their monthly goal of $5,000 is being funded by withdrawals from the brokerage and retirement accounts, meaning that they have to withdraw $3,500 a month (5,000 – 1,500 = 3,500) from their investments to meet their monthly income needs without Social Security.

As the brokerage account balance is depleted after a few years, the only place to start pulling money from is the 401K account, ultimately increasing their tax bill since 401(k) distributions are taxable.

Claiming Social Security benefits at age 65

Assuming that the full retirement age is 65 for both Mr. and Mrs. Johnson, their Social Security benefits will add $4,100 a month to their pension income ($2,700 +$1,400= $4,100). Receiving their Social Security benefits earlier makes it less likely that the Johnsons would have had to draw as much from their retirement accounts, thus significantly reducing their tax bill in retirement.

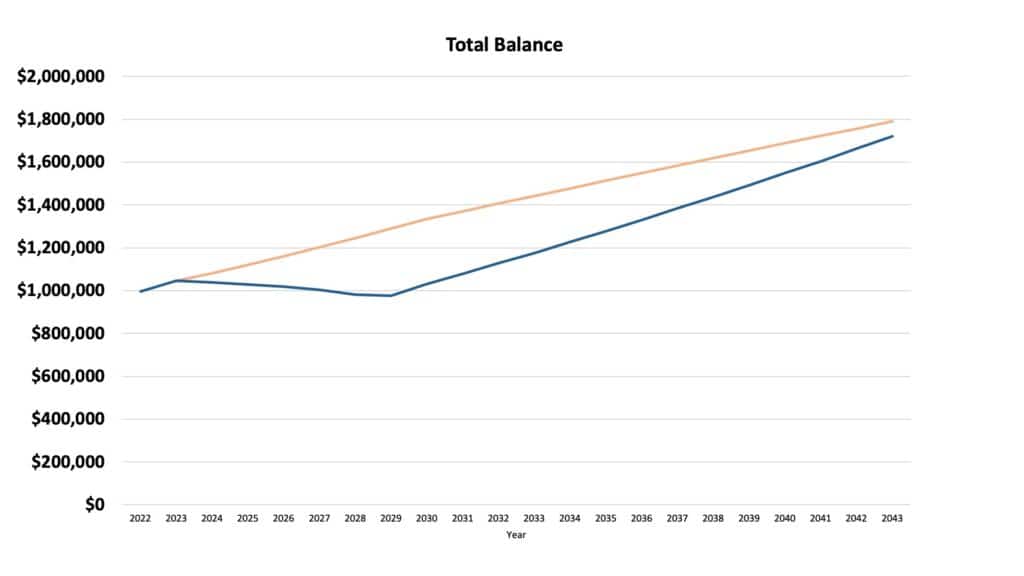

Looking at the total savings balance can help you better see the long-term results of filing for Social Security benefits at an age before the tax software recommends. By filing at 65, the overall retirement account balance never declines.

For the person who files at 70, the drawdown from their savings happens faster in the first few years of retirement because they have to make up the difference by using their brokerage and 401(k) accounts. Even at 83 years old, the total balance of claiming at 70 never exceeds the balance of the scenario where they filed at 65.

No one-size-fits-all answers

If we extend the life expectancy further by another 20 years, the balance slowly begins to catch up. So there is a point where, from an account balance perspective, it would be better to delay until age 70. However, by the time the Johnsons reach that point, they would be well beyond the Social Security Administration’s life expectancy projections.

The scenario above directly opposes the Social Security software that suggests people delay until age 70. If you factor in the possibilities of Roth conversions and other tax-saving measures, the potential savings missed by one-size-fits-all software can have a significant impact on how long your retirement savings last.

It’s important to understand that no two scenarios are alike. You can’t take hypothetical results and assume that everyone needs to file as soon as they retire. Most people probably won’t need to file for Social Security as soon as they retire, but in this example, filing at age 65 would result in lower taxes and a higher overall account balance.

Social Security software can be a valuable tool if someone has less than $500,000 saved for retirement. Those with smaller retirement account balances may not have the flexibility to make a strategic plan about when and how to draw down their investment income. Once someone reaches the $500,000 mark in retirement savings, there are more possibilities and factors to consider, making things more complicated, and that’s where software may miss some of the nuances.

Working with an advisor

Unfortunately, many financial planners don’t understand the Social Security system well enough to integrate it into an optimal retirement strategy tailored to the individual.

The two largest Social Security software programs currently on the market have a financial advisor edition. Your advisor may have plugged your information into a program and taken the recommendation at face value. Be sure to ask your advisor how they arrived at the information they provided, and ask questions if you don’t understand the process. You only get one shot at retirement planning, so don’t let avoidable mistakes cost you more than necessary.

How to know the RIGHT age to file for Social Security

Everyone’s situation is different, so working with a retirement professional who is well-versed in Social Security is vital. Remember that there is no one-size-fits-all rule of thumb about when to file for Social Security benefits, and it’s essential to consider your circumstances.

Check out my retirement roadmap plan to help you make the most of your Social Security decisions. Ensuring that you’re making the best choices about your retirement strategy and considering all the moving pieces can provide peace of mind on your retirement journey.