Have you ever wondered how the Social Security Administration calculates your benefits? We have countless resources on this site that explain the various formulas, rules, and exceptions if you’re curious.

But we haven’t discussed one big exception to the main calculation for arriving at your Social Security income amount, and that is the fact that the Administration doesn’t always use all of your years of historical earnings to figure your benefit.

Instead, they only use the years designated as “computation years,” This refers to the number of earnings years used to calculate your Social Security benefit… and it’s why even if you’ve worked for at least 35 years, not all of those years may be included in the average.

Using 35 Years of Work History Is a General Rule… But It’s Not Always Used to Figure Your Social Security Benefits

How many computation years the Administration uses can be a point of confusion. Some have mistakenly thought it’s the three highest-earning years of your working career, or the highest five years.

This isn’t true when it comes to Social Security, although it’s a common measure for many pension calculations.

Another common perception is that the Social Security Administration will take 35 of your highest-earning years and get an average earnings level from those numbers. And while that is the general rule, it’s not always 35 years that’s used in the calculation.

To help you determine how many years of earnings will be used for your benefit calculation, it is helpful to briefly cover how Social Security benefits are calculated.

How Social Security Retirement Benefits Are Calculated

The Social Security Administration will take all of your historical earnings and index them up for inflation, and then they’ll take out a certain number of computation years.

For retirement benefits, the number of computation years always equals 35, and these computation years are the only ones used when calculating your Social Security benefit.

If there aren’t 35 years, zeros are substituted in until the calculation has 35 years’ worth of income. For example, if someone only has 25 years of work history, their historical earnings would be calculated with 25 years of earnings and 10 years’ worth of zeros to determine their Social Security retirement benefit.

This is where the “general rule” of using 35 years comes from, but this may not apply if you’re looking at benefits other than retirement benefits from Social Security.

It’s important to note that 35 years isn’t automatically used to figure amounts for disability benefits or survivor benefits. For these, we need to know a little bit of Social Security lingo and a very simple formula.

How Social Security Disability and Survivor Benefits Are Calculated

Here’s that simple formulas: Computation years = (elapsed years – dropout years)

As you can see, “computation years” for disability and survivor benefits is not automatically 35 total working years’ worth of income.

If Social Security used a straight-line amount of 35 years for everything, it wouldn’t really be fair for those who were disabled or died before they had the opportunity to accumulate 35 years.

And since survivor benefits and disability benefits don’t use the same number for everyone like retirement benefits, it’s important to go back to our formula (computation years = elapsed years – dropout years) and understand what those terms actually mean.

How Computation Years Are Defined for Social Security Disability and Survivor Benefits

Computation years is the number of earnings years used to calculate your Social Security benefit. This is what we’re solving for.

Elapsed years is simply the number of years from the calendar year you turn 22 through the year you turn 62 (or up to the year of death, if that’s earlier), or the year the Social Security disability waiting period begins.

Dropout years allow a certain number of the lowest-earning years to be dropped from the calculation. Dropping these lowest earnings reduces the effects that these lower earnings could have on a benefit amount.

For retirement and survivor benefits, the number of dropped years is always five. It changes somewhat, though, on Social Security disability benefits, but I’ll cover that in just a moment.

Before I cover a few examples, let me clarify something that gets people confused every time I talk about this: Folks will often say, “Devin, does this mean that my earnings before age 22 are not even counted towards my eventual benefit?” Let me be real clear on this. They are counted.

The SSA will pull the highest computation years from your “base years” which is simply all the years in your earnings history.

Examples of How These Social Security Calculations Work for Various Benefits

Let’s go over a few examples here. First, take retirement benefits.

Elapsed years are simply the number of calendar years from the year you turned 22 through the year you turn 62, which is the first year of eligibility for retirement benefits. This always gives you 40 elapsed years.

Then you have five dropout years where you drop off the lowest-indexed earnings, and you’re left with 35 years of index earnings to be used as your computation years. So for the formula, which is computation years = elapsed years, it means that computation years are always 40. Then you minus dropout years, which is always five years. This means that for retirement benefits, the formula always results in 35 years.

For survivor benefits, you simply take the number of calendar years from the year you turn 22 up to the year of death, and then minus five years. So for example, if someone dies at 41, there would be 20 years of elapsed earnings. You would still have five dropout years to apply, which would leave you with the 15 highest-indexed earnings years to use as your computation years.

For disability benefits, you take the number of calendar years from the year you turn 22 and the year your waiting period for disability benefits begins. Those years are considered your elapsed years. The Social Security Administration will still drop up to five of your lowest-earning years from the calculation, but five years is not automatic for disability.

Instead, you get one dropout year for every five years of elapsed earnings. This is known as the one for five rule. For example, if you have five years of earnings after age 21 and when you became disabled, only four years will be used in your calculation. You get one dropout year.

If you have 10 years of earnings after age 21 and when you become disabled, you’d be eligible to drop two of the lowest earning years and thus have eight computation years.

Additionally, there are some childcare dropout rules that allow you to drop out the years you were taking care of a child. The eligibility for the childcare dropout years is very specific in that the beneficiary had to have no earnings and have a child under three living with him for at least nine months.

Also, if you have less than three dropout years, you can receive up to two additional childcare dropout years if you meet the very strict eligibility requirements (but that’s getting pretty far into the details and probably best reserved for its own article).

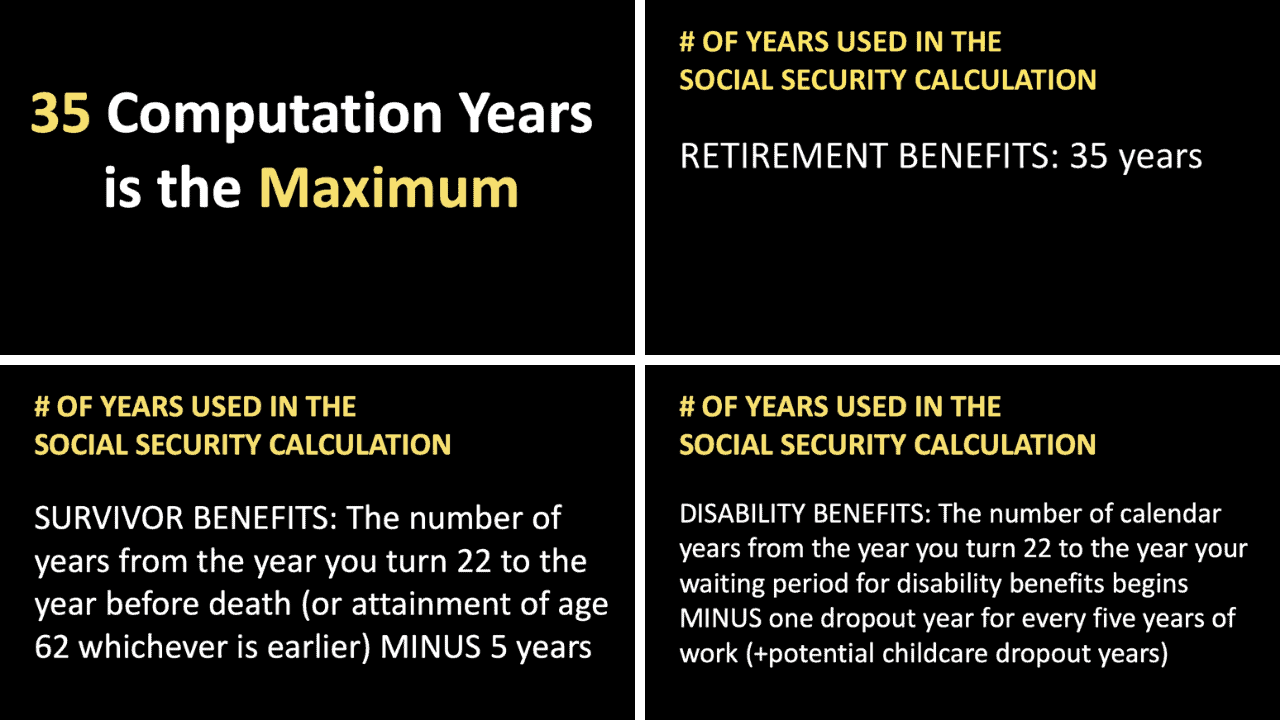

To summarize, the number of years used in the benefit’s calculation are as follows.

- Retirement benefits = 35 years.

- Survivor benefits = the number of years from the year you turn 22 to the year before death or attainment of age 62, whichever is earlier, minus five dropout years.

- Disability benefits = number of calendar years from the year you turn 22 to the year your waiting period for disability insurance begins, minus one dropout year for every five years of work with the possibility of childcare dropout years as well.

I know this article took us into the weeds, and we tossed around some terminology and lingo that I try hard to avoid because Social Security is complicated enough on its own.

But sometimes, you have to play by the rules, and if you go down to the Social Security office and ask for an explanation, I can guarantee you they would use those terms instead of plain English. My hope is that by getting into the details here, you’ll fully understand how Social Security computation years work in their formulas.

You’re making the right moves by reading articles like these, but don’t stop here! Continue to do your research and talk to your own advisors. Most importantly, continue to educate yourself.

Questions?

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

Also…if you haven’t already, you should join the 260,000+ subscribers on my YouTube channel!

[…] For a deeper dive in the years used in calculations, see my article Your Social Security Benefit Isn’t Always Based On 35 Years of Work History […]