Worries and rumors and complaints about a broken system on the verge of collapsing have been the norm when it comes to talking about Social Security since as far back as the 1980s — and that shows no signs of slowing down today.

With current projections showing the Administration’s trust funds run out in 2035, it makes sense that people are still concerned and clamoring for a solution. Wouldn’t it be nice if we could just fix Social Security once and for all?

It sure would be — and it might be easier than most people currently think. In fact, I believe there is a solution to fix Social Security. Not only would it repair a broken system, but it wouldn’t even require extensive legislation and the infrastructure is already in place to start administering this today.

Sound too good to be true? Keep reading and I’ll give you all the details on the most obvious fix for Social Security’s current woes.

We CAN Avoiding Cutting Social Security Benefits

It’s no secret that Social Security is facing financial challenges ahead. Again, we know that within the next 15 or so years, there will not be enough money coming in to pay out benefits.

Something has to change, and fast, or we can expect benefits to be cut by around 25% across the board. Maybe that’s not a big deal for some people… but for many others, losing a full quarter of your benefit payment could be devastating.

This would be a good place to pause before I share my solution, and give a quick warning to politicians who would like to stay in office:

There are nearly 50 million individuals in the United States over the age of 65. 25 million households get half of their family income from Social Security. More than 12 million get 90% of their income from Social Security.

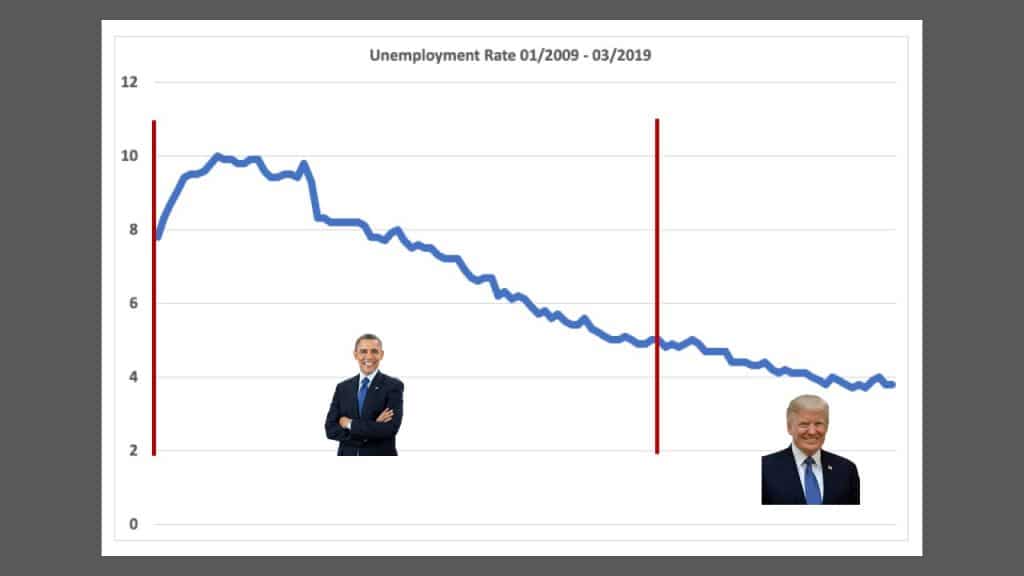

That’s a lot of people — and this many people can easily swing election outcomes one way or another. Since 1900, the average popular vote difference between the winner and loser of a presidential election has been 5.8 million votes.

Clearly, there are more than enough voters here — voters who have the majority of their income at stake — to easily swing an election to the side of someone who can fix this system before benefit cuts happen.

My idea would not be difficult for politicians or the government to implement, because the systems are already in place to put this plan into action. So what is this great fix?

It’s very simple: it’s an extension of the Social Security earnings limit to all ages.

Here’s how it would work.

Extending the Social Security Earnings Limit to All Ages Could Fix the System

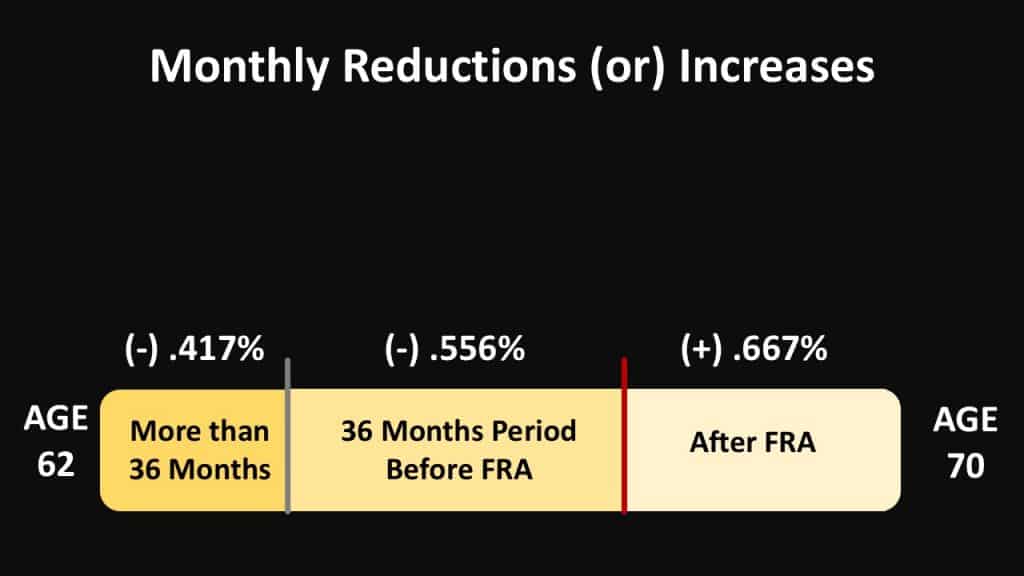

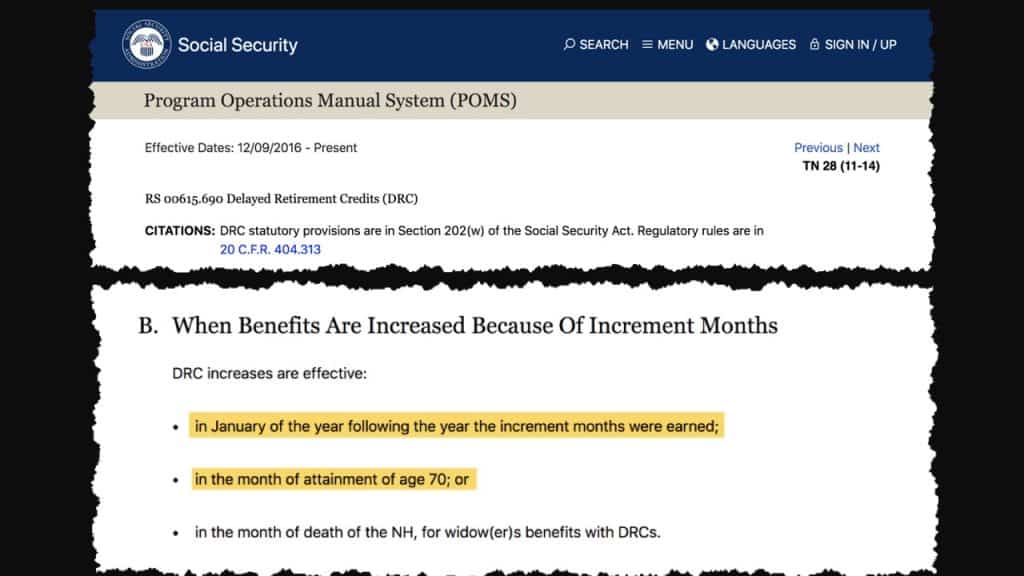

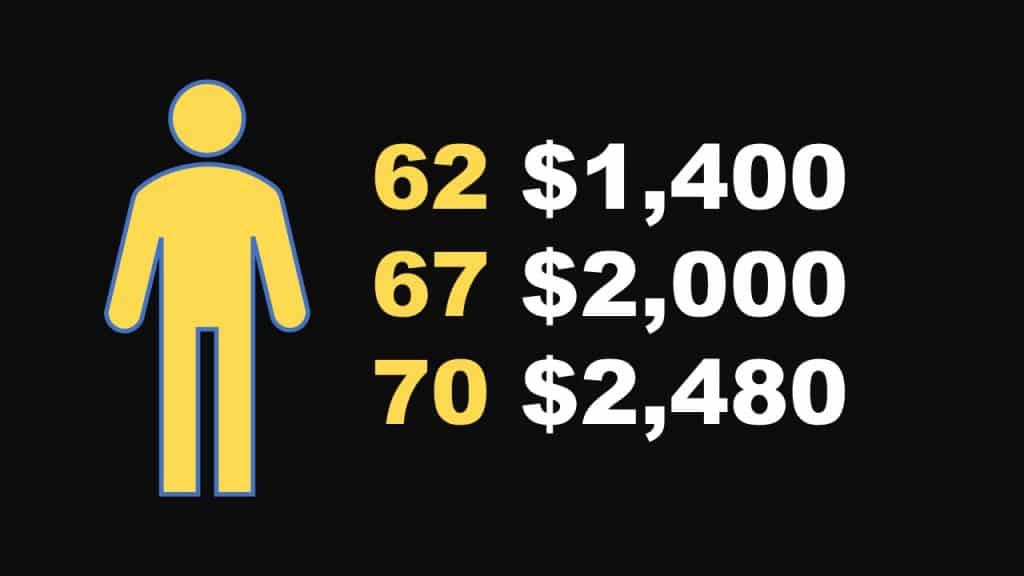

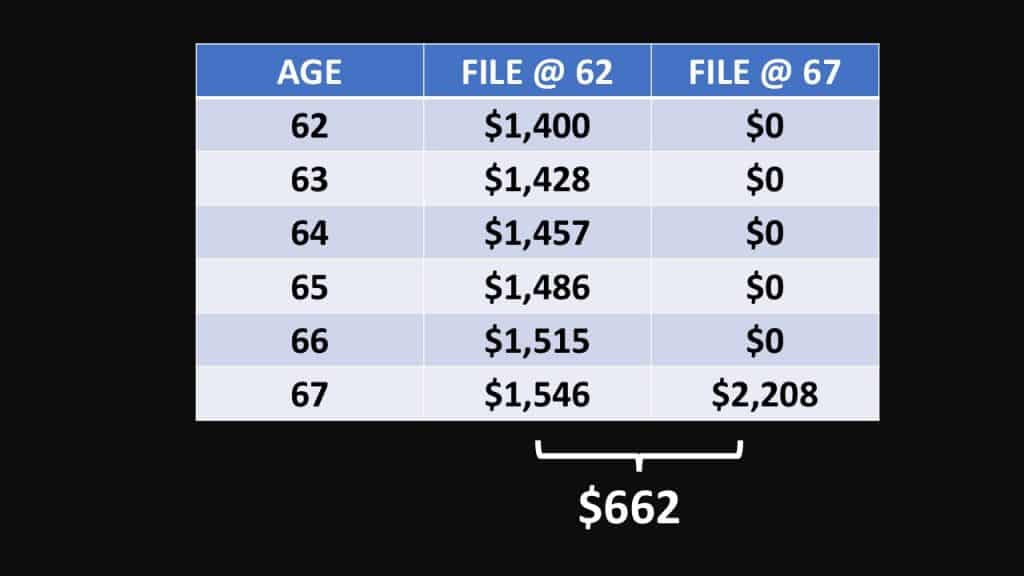

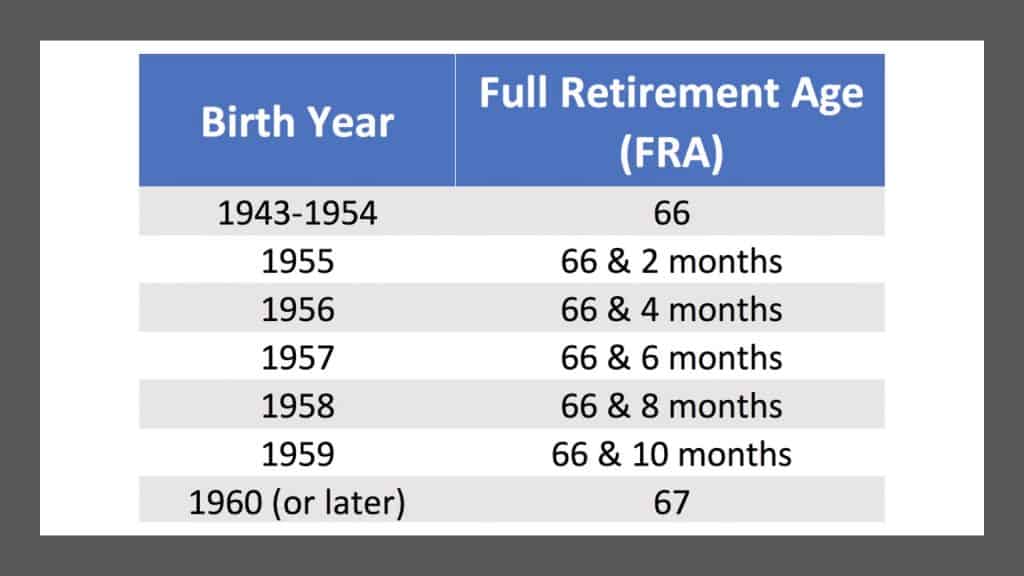

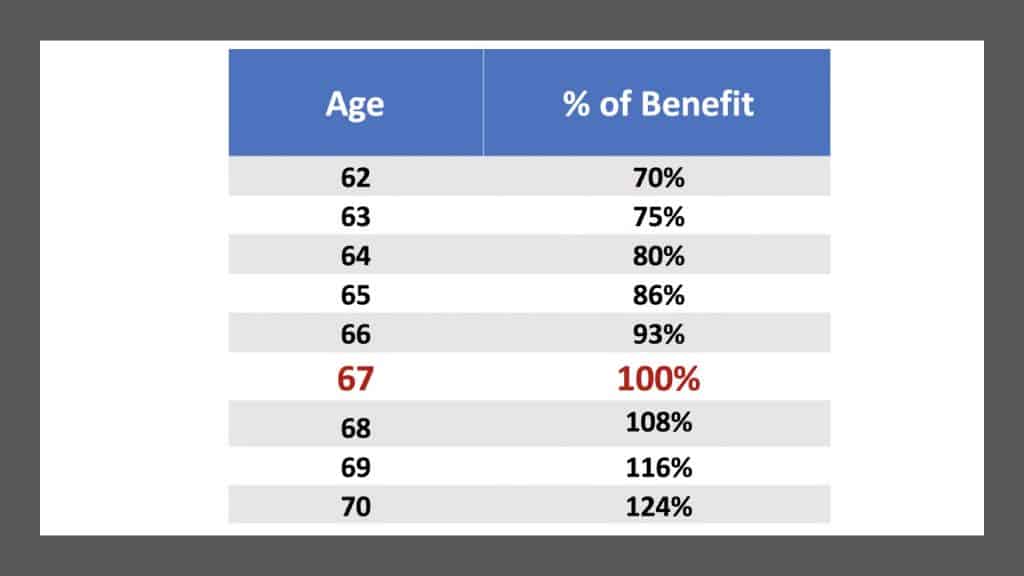

Under the current rules, if you’re younger than the full retirement age then you can only make a certain amount of income before your benefits are withheld. If you make over a certain amount in income, you don’t get benefits at all.

But once you reach full retirement age, there is no limit on the amount of earnings you can have outside of your Social Security benefit.

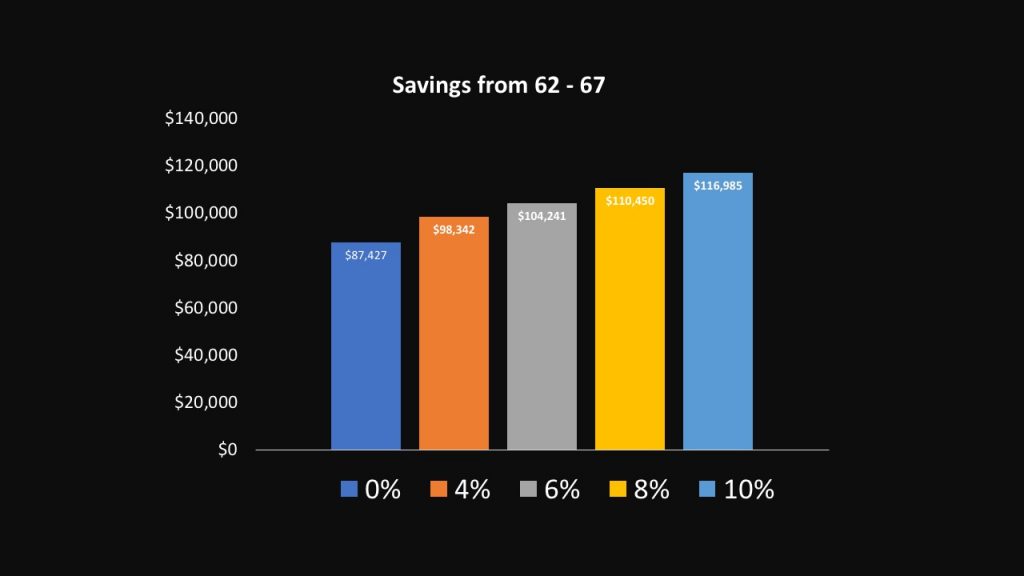

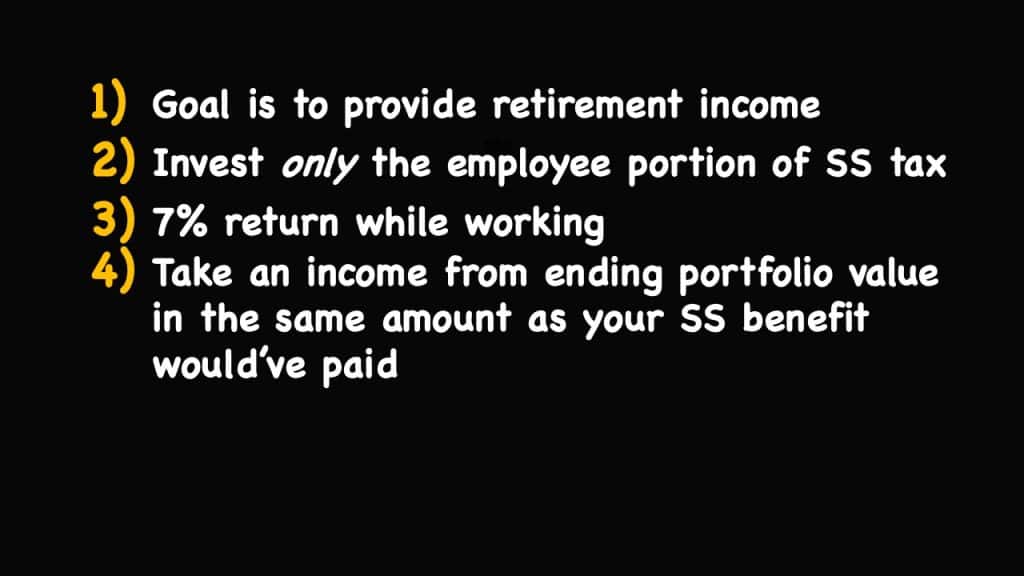

My fix would simply extend this current rule around the earnings limit to apply that limit to all ages. If your earnings exceed a certain amount — which would mean you don’t actually need Social Security in order to get by or afford your lifestyle — you would not be eligible to receive benefits.

This would actually realign the system with the original guidelines. It would also free up funds to go to those who truly rely on their Social Security benefits to survive in retirement and have little or no other sources of income to use.

Shouldn’t Social Security Go to Those Who Need It Most?

When Social Security first began, the earnings limit applied to all ages. In 1950, the earnings limit was eliminated at age 75.

In 1954, this was changed to age 72. Another change happened in 1983 when the age was dropped to 70. Finally, in 2000, the rules changed for a final time to make the earnings limit drop off at your full retirement age.

I’m certainly not the first to suggest this specific fix to Social Security — although my simplified method of extending the earnings limit may be new.

On the campaign trail in 2015, now-President Donald Trump said, “I would be willing to say I will not get Social Security. But the fact is that there are people that truly don’t need it, and there are many people that do need it very, very badly.”

In the same campaign season, then-Governor Chris Christie said, “We need to save this program for people who have paid into the system and need it. This government doesn’t need more money to make Social Security solvent. We need to be not paying benefits to people who don’t really need it.”

A Word on Fixing Social Security with Means Testing

Although a means test has been suggested before, I haven’t seen the research on the impact of such a change. One of my big questions about this is, where would the earnings limit be set under this solution?

Ultimately, there is an earnings amount where cutting benefits to individuals above the line would completely fix the system. Is that number $15,000 in income? $25,000? Who knows?

To my knowledge this topic hasn’t been researched enough to have a complete answer, which is where the means test seems most problematic to me. It’s a big puzzle piece that’s missing and really needs to be known before this proposal can get serious.

I know some people will say that even my proposed solution of making the earnings limit something that applies to everyone regardless of age is a form of means testing — and that it unfairly punishes success.

As much as I agree with that, the entire Social Security system is already built on means testing. My fix doesn’t present a huge change due to the progressive Social Security benefits formula.

Under that formula, lower-earning individuals receive a benefit that is a higher replacement of pre-retirement earnings than higher earning individuals. And once benefits begin to be paid, lower earning individuals usually don’t have to pay any taxes while those with higher incomes have to give some of it back through taxes.

Adding a “means test” like the earnings limit applying to all ages wouldn’t really represent a monumental policy shift.

The fact is, any solution we can use now will likely impact anyone under 50 with a higher than average income. Even I don’t love my solution, as it impacts me, too!

This is probably something we need to get used to — and I think a solution like the earnings limit applying to everyone is preferable to a convoluted fix that only fixes part of the problem through half measures and complex law. Let’s keep it simple so we can rip the bandaid off and get it over with!

As this and other policies develop, I’ll be here to give you the details.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 100,000+ subscribers on my YouTube channel!

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.