If your Social Security earnings have been recorded incorrectly, it could make a big difference in your benefit amount. You need to check for errors yourself — and you need to do it now. Today!

Whether you are close to retirement, or in your early working years, this is something that absolutely cannot wait.

Why the rush? Because the Social Security Administration imposes time limits on correcting your earnings record — even if the mistake on your record is not your fault!

Mistakes in the Social Security earnings record are fairly common. For proof, look no further than the Earnings Suspense File. This is where earnings reports with a mismatched name and SSN combination are stored.

Since the inception of Social Security, there have been a total of $1.2 trillion in wages that could not be matched to an earnings record. Because sthey couldn’t be matched, they were added to the Earnings Suspense File. In tax year 2012 alone, the Social Security Administration reported $71 billion added to the file!

Those numbers are astronomically high, which begs the obvious question: why are there so many mistakes within the Social Security earnings records?

Why Mistakes Tend to Happen With Social Security Earnings Records

To be clear, most of these mistakes are not the fault of the Social Security Administration. A good number of the mismatches are due to employer reporting errors or administrative errors that happen when people change names. Others are due to the fraudulent use of Social Security numbers.

The Social Security Administration has a pretty good system for figuring these mistakes out and assigning the earnings to the correct record — but even with their process, nearly half of the mismatches are never corrected.

Unless you’re vigilant about monitoring your earnings record, you could have earnings gaps that could have a substantial impact on your Social Security benefit calculation.

A mistake in your earnings calculation can make a big difference. How? It all goes back to how your benefit is calculated. The Social Security Administration uses your highest 35 years of earnings as a cornerstone of the benefit calculation.

If any of these 35 years are incorrect or missing altogether, the average is skewed. One year of missing earnings can make a big difference in your benefit amount.

Unless you’re vigilant about monitoring your earnings record, you could have earnings gap that could have a substantial impact on your Social Security benefit calculation.

Errors Can Dramatically Affect How Much in Social Security Income You Can Claim

Let me give you an example of how this can affect your benefit amount. For this example, I used the actual online calculator from the Social Security Administration. If you want to follow along, you can just go to the Online Calculator and crunch the numbers for yourself.

In the example calculation I ran, I assumed the following:

A worker has 35 years of earnings that started in 1984 and ended in 2018. Instead of going for a really high annual earnings amount, which would have exaggerate the effect, I assumed that this individual started in 1984 with a salary of $35,000 and had a 2% raise every year.

Under that assumption, this individual would have a full retirement age benefit of $2,418 dollars. That’s the baseline benefit amount we’d expect this person to receive.

But what happens if information is missing from the earnings record? I went back to our calculation and assumed just one year of earnings in 1990 wasn’t included on the worker’s record due to clerical error.

For one missing year, the benefit would decrease to $2,385 dollars. For two missing years, it would decrease to $2,353 dollars. For three, it would be $2,322. For four, it would be $2,291 and for five, it would be $2,260.

That’s a difference of $158 dollars per month.

Now, you might be thinking, Devin, that doesn’t sound like such a crisis. $158 extra per month would be nice, but that’s not paying for much.

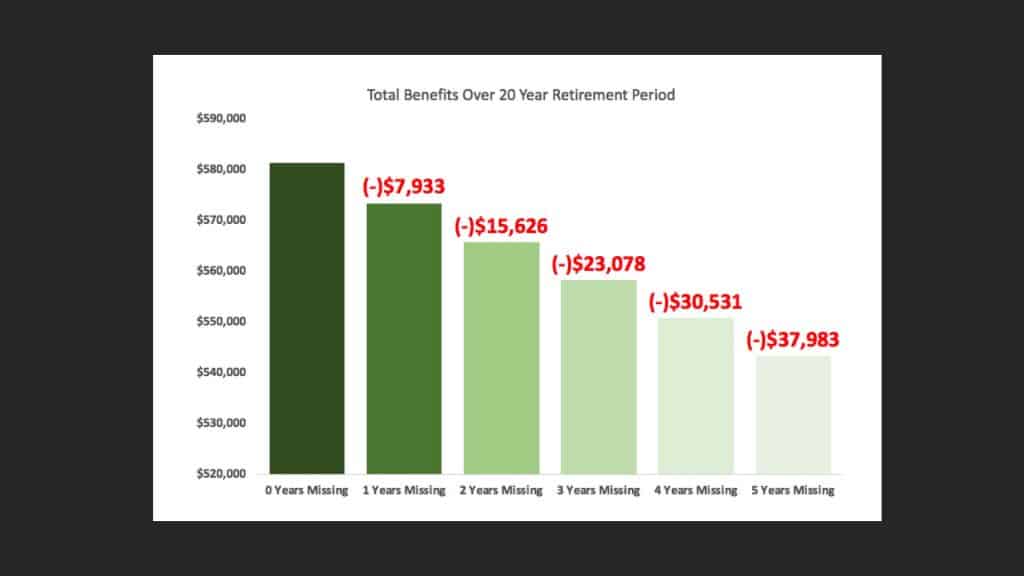

Maybe not when we look at it on a monthly basis. But how would this affect you over your entire retirement?

If we take those same amounts and assume a annual cost of living adjustment of 2%, you’ll see that the effect is now measured by thousands of dollars.

For one year, it’s nearly $8,000 in reduced benefits. For two, it’s over $15,000. For three, it’s slightly over $23,000. At four years, it’s more than $30,000, and at 5 years, it’s nearly $38,000.

I don’t think anyone would willingly give up any of those amounts.

The Burden of Proof Is on You When Correcting Your Record

If you did look at your earnings record and notice a mistake, the burden is yours to prove it. You might want to start by checking out the SSA’s Request For Correction of Earnings Record form.

You should be prepared to locate documents that prove the error such as tax forms, W-2 forms or pay stubs. If you can’t find these, don’t despair quite yet.

In the SSA manual, the Administration states that an oral or written statement from the employer can serve as primary evidence of wages. Or, the Social Security Administration also says you can take the following steps:

- Write down the name and address of your employer

- Note the dates you worked there and how much you earned

- Provide the name and Social Security number you were using while you were employed

The SSA will then use this information to investigate the problem. But even if they can help you investigate, you still have to remember there’s a time limit to making these corrections.

The Social Security Administration’s Time Limit For Corrections

The Social Security Administration’s language on the time limit for fixing an earnings record is incredibly clear:

“An earnings record can be corrected at any time up to three years, three months, and 15 days after the year in which the wages were paid or the self-employment income was derived.”

How’s that for clarity! Without an exception, you have a little over 3 years to fix earnings record mistakes. Unfortunately, the rules on those exceptions aren’t as clear.

Here’s what the SSA says about the issue:

After the time limit has passed, earnings records can only be revised under the conditions described below and in §1425:

-

To correct an entry established through fraud;

-

To correct a mechanical, clerical, or other obvious error;

-

To correct errors in crediting earnings to the wrong person or to the wrong period;

-

To transfer items to or from the Railroad Retirement Board (if reported to the wrong agency), or to add railroad earnings to Social Security earnings records when the law permits;

-

To add wages paid in a period by an employer who made no report of any wages paid to the worker in that period, or if the employer is increasing the originally reported amount for the period;

-

To add or remove wages in accordance with a wage report filed by the employer with IRS; or, if a State or local governmental employer, with SSA if the report is filed within the time limitation specified for assessment, refund, or credit under a State’s coverage agreement;

-

To add self-employment income in a taxable year if an individual or the individual’s survivor establishes that:

-

A self-employment tax return for that year was filed before the time limit ran out; and

-

Either no self-employment income for that year has been recorded in the individual’s earnings record, or the recorded self-employment income for that year is less than the amount reported on the self-employment tax return; or

-

-

To add self-employment income for any taxable year up to the amount of earnings that were wrongly recorded as wages and later deleted. This can be done only if a tax return reporting such self-employment income is filed within three years, three months, and 15 days after the taxable year in which the earnings wrongly recorded as wages were deleted. The self-employment income must:

-

Be for the same taxable year as the year in which the wages were removed; and

-

Have already been included on the individual’s Social Security record.

-

-

Prior to the expiration of the time limit the worker or the worker’s survivor has:

-

Applied for benefits and stated that the earnings for a year(s) were incorrect; or

-

Requested a revision of his or her earnings record for a year(s).

-

Here’s the boiled down version of the exceptions: The only case where an exception does not apply is when a self employed individual does not file his/her taxes within the time limit.

Like many of the Social Security rules, the rule on time limits are broad and sometimes not completely understood by the technicians at the Social Security Administration. I’ve seen cases where there was a clear exception, but the technician refused to enter the earnings because they did not understand the rule.

Thankfully, this client was able to get help from a financial planner who understood the rules and helped the client draft a request for review letter. A few weeks later, the earnings were back where they should be: on the client’s earnings history.

While that case had a happy ending, it should highlight the importance of not just checking your Social Security earnings report… but making sure you or the right professionals who can help you get the error corrected ASAP.

How to Check Your Social Security Earnings History

Checking your earnings history with the Social Security Administration is easy. You can find the details in your Social Security statement.

(If you’re younger than 60, you only get these every 5 years. For those over 60, you get one every year.)

If you don’t have a recent statement, don’t let that stop you. Go online and instantly print your most recent statement.

To create a My Social Security account, visit www.ssa.gov/myaccount. You’ll need to provide a Social Security number, mailing address and a valid e-mail address. You’ll also need to be able to answer questions that only you are likely to know and it needs to match the information on file with Social Security.

In addition to checking your earnings history, there are many other other reasons to set up your online account. You can:

- Get an estimate of your future benefits

- Get a letter with proof of your Social Security benefits

- Start or change your direct deposit

- Get a replacement SSA-1099 or SSA-1042S for taxes

- Change your address

Please, please, please…check your Social Security earnings history today! And don’t stop there. Urge your friends, family members and clients to do the same. Better yet, just share this article!

Ignoring this could cost you thousands of dollars in missed Social Security benefits, whereas checking your record only takes 5 minutes. It’s a worthwhile use of time!

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 100,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.