Have you ever tried to use a power of attorney for Social Security purposes? If you haven’t, save yourself the trouble. The Social Security Administration will not accept it.

After multiple clients experienced frustration at the Social Security office, I reached out to John Ross, an elder law attorney and co-host of our podcast (Big Picture Retirement) for an explanation and guidance on why powers of attorney (or POAs) don’t fly with the Administration.

Here’s what he told me.

There’s No Such Thing as a Social Security Power of Attorney

John Ross explained that there is no “Social Security Power of Attorney.” Powers of attorney are creations of state law and vary wildly from state to state, Ross added.

“Since the federal agencies like the SSA do not want to have to separately review POAs based on both the facts and circumstances of their creation and the various state laws that may be applicable, these agencies have taken the position that they will not accept a POA under any circumstances,” said Ross.

He explained that the Social Security Administration developed federal regulations related to incapacitated beneficiaries of federal programs and established criteria under who the agency will deal with. “Since federal law trumps state law,” he added, “there is nothing an agent under a power of attorney can do to alter this structure.”

How to Help Someone with Their Social Security When POAs Don’t Work

That’s reason for concern if you’re a friend or family member of someone who struggles to manage their Social Security 100% on their own. How do you help someone with their Social Security issues if the SSA won’t accept a POA?

Essentially, anyone who wants to assist someone receiving Social Security benefits who needs help will have two options:

- Obtain a court appointment as the Social Security beneficiary’s guardian.

- Apply to the SSA to become the representative payee for the Social Security benefits.

Let’s look at each option in more detail:

Option #1: Obtain a Court Appointment as Guardian

Warning: This is not your best option.

One way to approach the Social Security Administration is with a court-appointed guardianship. This is an expensive, time-consuming process — but agencies such as the SSA are required to deal with a beneficiary’s court appointed guardian.

First, you’ll have to hire an attorney to file a petition for a guardianship hearing. Depending on your state, this process could take a long time.

The court will have to examine expert findings, such as doctor’s statements, declare that the individual is incompetent, and appoint a guardian. The court then transfers the responsibility for managing all living arrangements, and medical decisions to the guardian.

Then, in many cases, the court will require the guardian to provide regular, detailed financial accounting reports to the court. In most cases, becoming a court-appointed guardian is a complicated, expensive solution.

There’s a much easier way to help someone who may need it:

Option #2: Become a Representative Payee

The second option is applying to become a representative payee. This program is specific to the Social Security Administration, and it allows an individual to manage the Social Security payments of a beneficiary who is incapable of managing his or her own Social Security.

Thankfully, this option is nowhere near as burdensome as applying for guardianship. This is the best solution! It is faster, free, and doesn’t come with all of the encumbrances of a court appointment.

The steps to becoming a representative payee is as follows:

- Fill out (or least review) SSA 11 Request to be Selected as Payee form.

- Schedule a meeting with your local Social Security office.

- Wait on the review process performed by the SSA.

Here are the instructions that the Social Security gives to their technicians in deciding who the payee will be:

“Each payee application must be reviewed and evaluated individually to determine the best payee. All applicants must be carefully screened and considered before a selection is made to ensure that the beneficiary’s best interest is served. In determining the best payee choice, consider all factors, including the applicant’s relationship to the beneficiary, the applicant’s interest in the beneficiary’s well being and whether or not the applicant has custody of the beneficiary.”

Once you are approved as a representative payee, you should receive the publication titled A Guide For Representative Payees.

The Advance Designation of Representative Payee

In the past, a representative payee could not be appointed until the point of need. But now, an individual can designate up to three people who could serve as a representative payee if the need ever arises.

This designation can be updated or withdrawn at any time and the SSA will send a notice each year listing the advance designees for review.

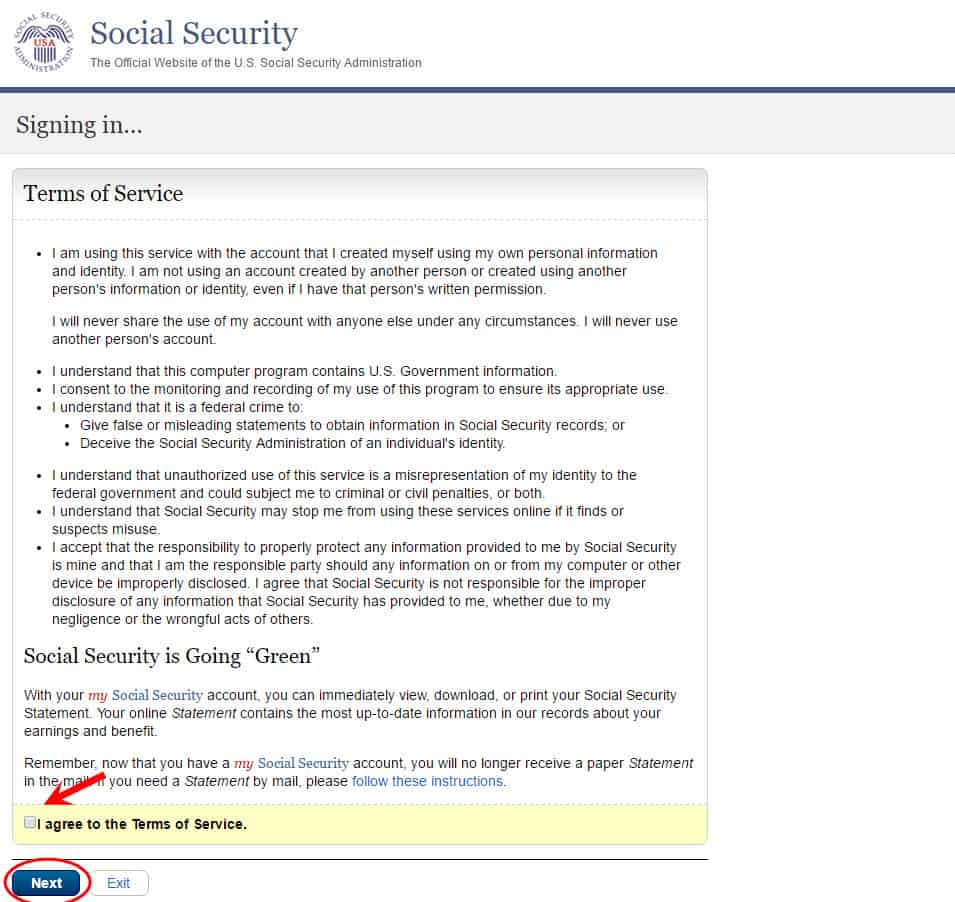

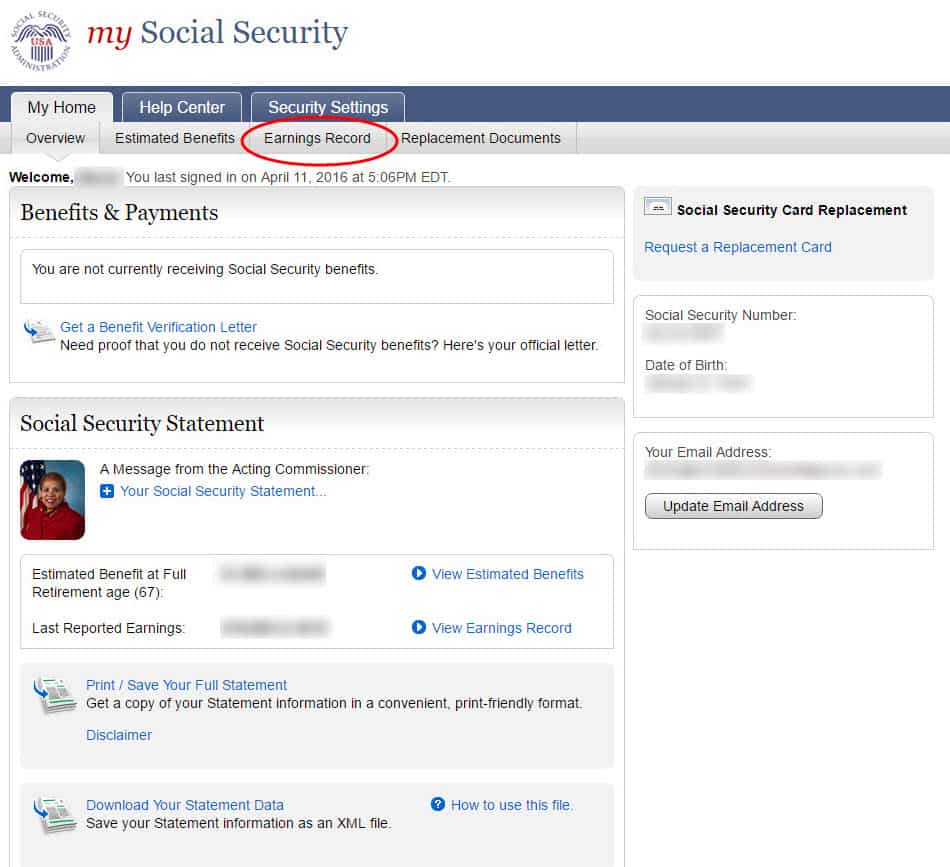

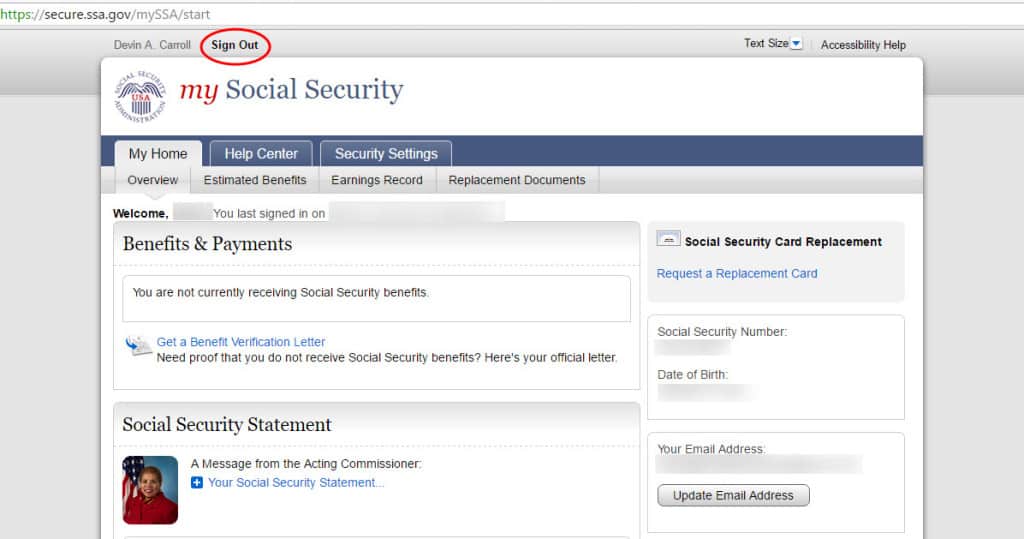

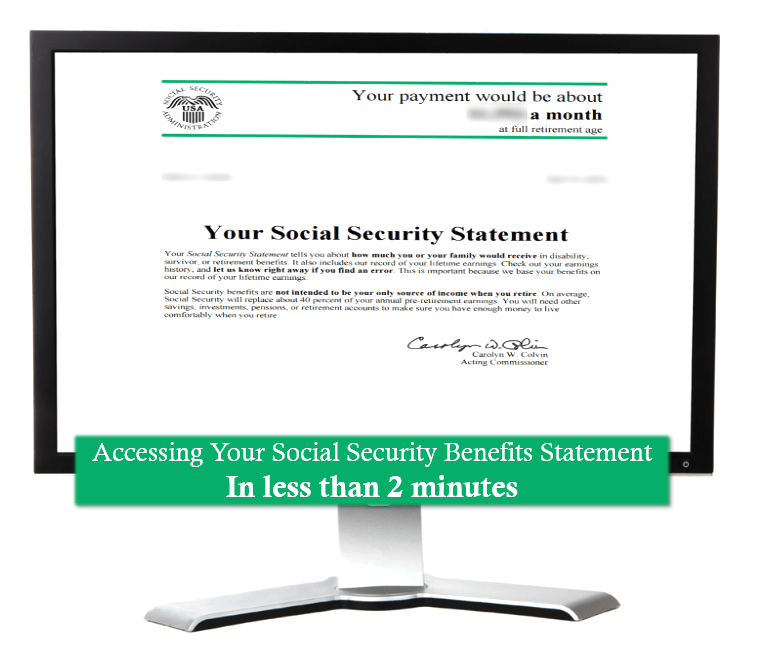

The good news is that it’s really easy to get this done. On the mySSA account, simply navigate to the link

Understanding Your Responsibility as a Representative Payee Report

The SSA requires that a representative payee file an annual accounting called the Representative Payee Report. This report details what you, as the representative payee, have done with the beneficiary’s funds during the previous year.

If you have kept accurate records of the beneficiary’s funds over the course of the year, the report will be very easy to fill out. Commingling funds, or not keeping accurate records of expenditures, can lead to an incredible headache when it comes time to file the report. And not filing the report at all could lead to your removal as representative payee.

So who can become a representative payee? The Administration maintains a list of preferred individuals. This list is in their preferred order of representative selection.

Payee Preference List For Adults

When you determine that the beneficiary needs a representative payee, select the best payee available from this list of preferred applicants:

- A spouse, parent or other relative with custody or who shows strong concern;

- A legal guardian/conservator with custody or who shows strong concern;

- A friend with custody;

- A public or nonprofit agency or institution;

- A Federal or State institution;

- A statutory guardian

- A voluntary conservator

- A private, for-profit institution with custody and is licensed under State law;

- A friend without custody, but who shows strong concern for the beneficiary’s well-being, including persons with power of attorney;

- Anyone not listed above who is qualified and able to act as payee, and who is willing to do so;

- An organization that charges a fee for its service.

Payee Preference Lists For Minor Children

When the beneficiary is a minor child, select the best payee available from this list of preferred applicants:

- A natural or adoptive parent with custody;

- A legal guardian;

- A natural or adoptive parent without custody, but who shows strong concern;

- A relative or stepparent with custody;

- A close friend with custody and provides for the child’s needs;

- A relative or close friend without custody, but who shows strong concern;

- An authorized social agency or custodial institution; or

- Anyone not listed above who shows strong concern for the child, is qualified, and able to act as payee, and who is willing to do so.

When you’re dealing with a relative or friend who can no longer manage their own financial matters, everyday activities are complicated. It would be really nice if the Social Security Administration would just accept a power of attorney. But since they won’t, being designated a Social Security Representative Payee is the simplest way to help with Social Security issues

That being said, if you’re dealing with Social Security benefits as a representative payee and feel overwhelmed, I know how difficult and isolated it can make you feel.

It can seem that no one understands your predicament and can’t give you the answer you need. What may help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the nearly 400,000+ subscribers on my YouTube channel. For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.