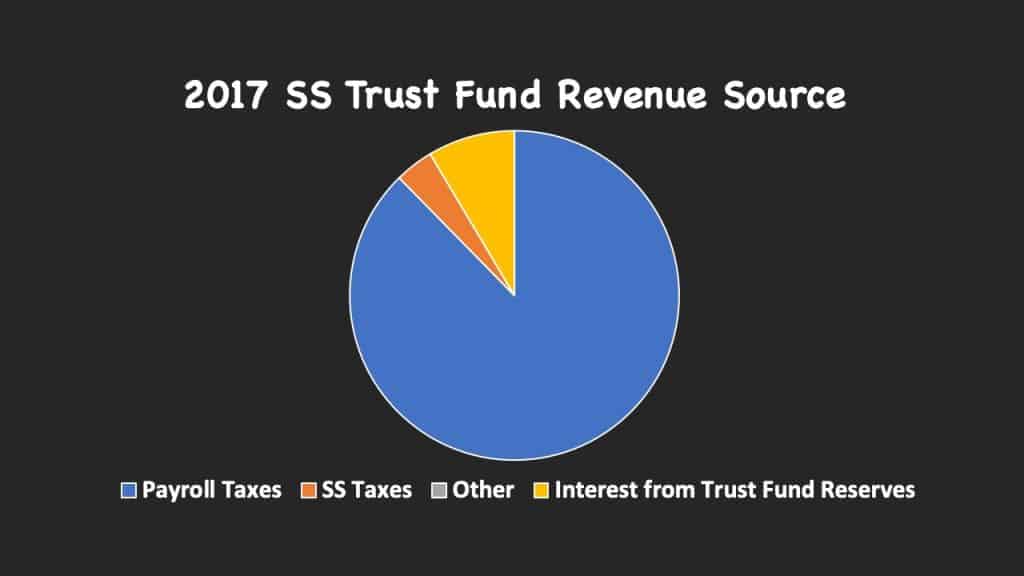

It’s no secret that the Social Security Administration is staring down a big problem: funding for the program is set to run out, and fast.

That’s a scary thought if you’re approaching retirement or plan to rely on Social Security benefits to handle your living expenses in the future.

And it’s tempting to think that what sound like common sense solutions could actually fix the problem.

One such “common sense” answer is also one of the most popular suggested fixes for Social Security that I hear. What is it?

Simply increase or eliminate the maximum taxable wage base, and make high-income individuals “pay the same as everyone else.”

The truth is that while “scrap the cap” makes a great political rally chant, it is not the conclusive fix for Social Security’s funding problems.

Can’t We Just Make The Rich Pay More in Order to Fix Social Security?

Many, many people believe that the Social Security system is broken thanks to income inequality. Others think that the Social Security program, something that was designed to help the poor, is actually stacked in the favor of the wealthy.

Do these claims have any merit?

While it’s true that income inequality does exist, I wanted to find out if the insolvency of the Social Security trust fund could really be fixed by raising taxes on the wealthy.

Thankfully, I didn’t have to launch my own research project or hire a room full of Ph.Ds. The Congressional Research Service has already done the heavy lifting for me in a report that was last updated in late 2019.

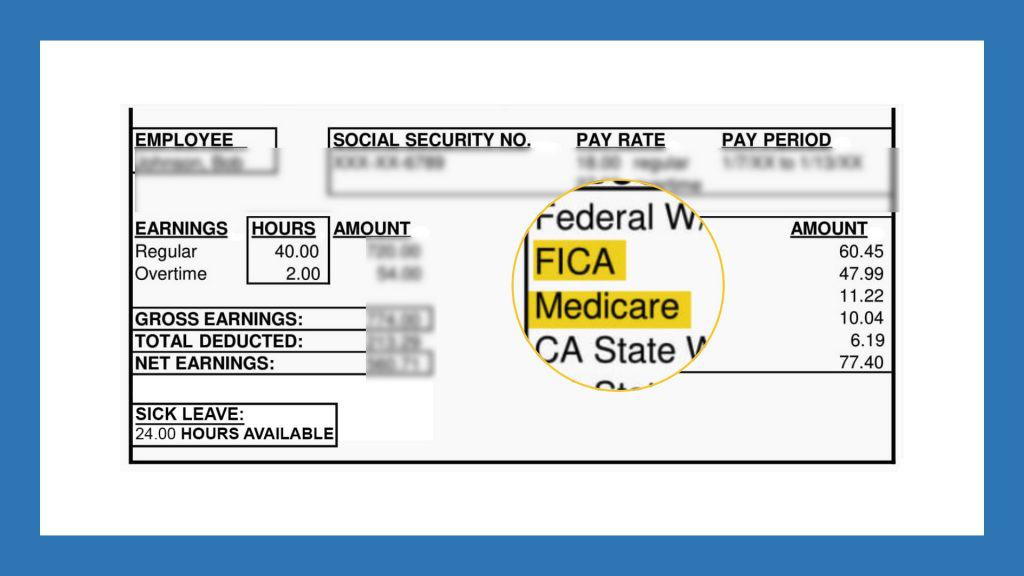

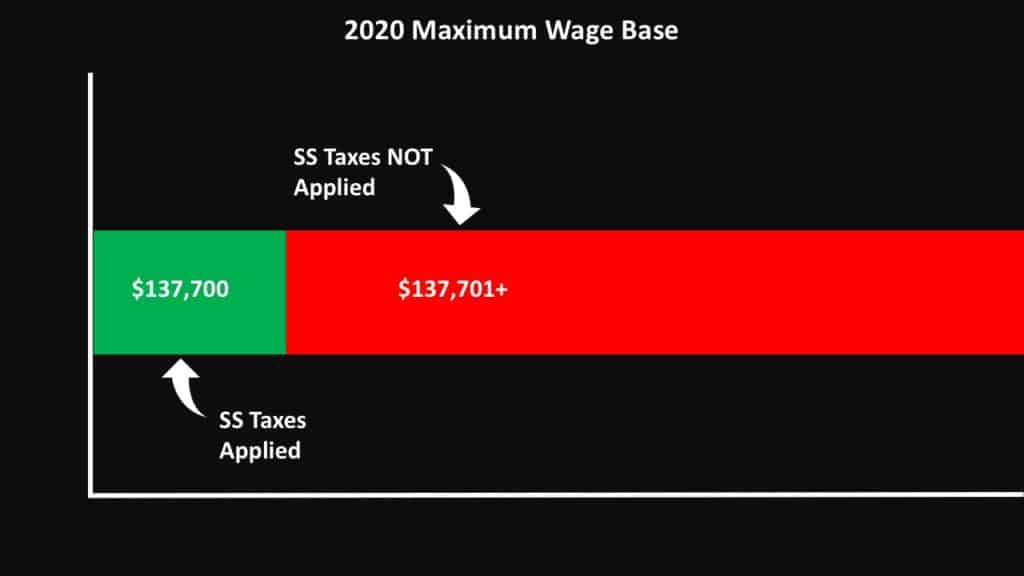

Before we get into their findings, let’s take a look at what the issue actually is. In 2020, the first $137,700 dollars in wages are subject to a 12.4% social security tax. Wages over that amount are not subject to that tax.

The fact that wages over a certain amount aren’t taxed led (and still leads) lots of politicians and talking heads to suggest that the easy fix to all of the Social Security funding issues can be found within two options, both of which involve raising the amount of maximum taxable earnings:

- Option 1: Completely Eliminate the Minimum Wage Base: In other words, this solution essentially says, “if you make a million dollars you should pay Social Security taxes on that full million in income.”

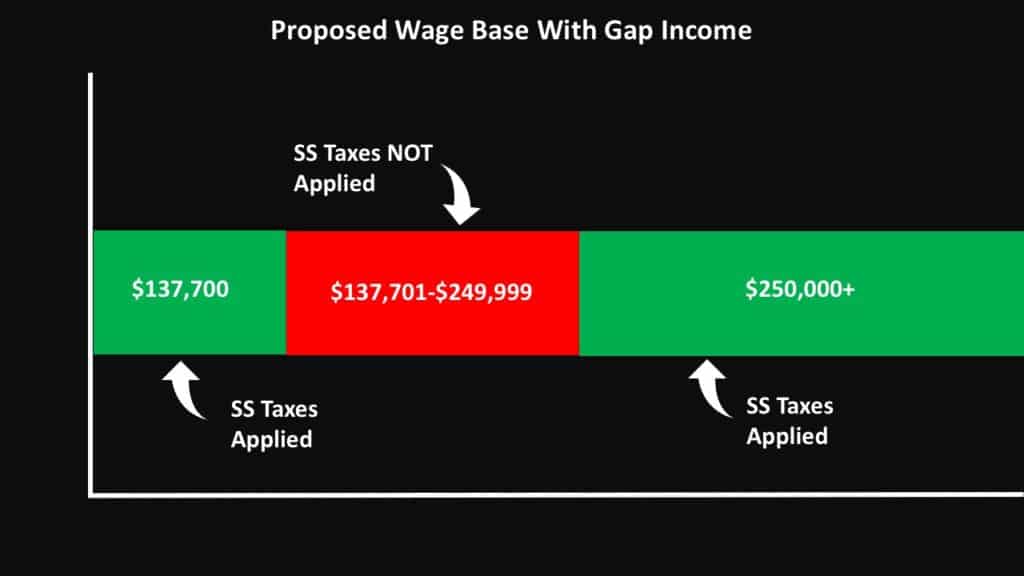

- Option 2: Have A Gap On Taxable Income: In this scenario, the current maximum would stay in place but there would be an earnings gap where the tax would not apply. Once earnings exceeded a certain level the tax would become applicable again. This method is really the same as completely eliminating the wage, it just takes more time to get there. Because the first number is generally increased every year to keep up with the annual increase to average wages, and the second number would not change, it would only be a matter of time before the first number caught up to the first number thus eliminating the gap.

Why Taxing the Rich Will Not Fix Social Security

One of the big unanswered questions of increasing the wage level at which Social Security taxes are applied is that, if the cap is modified, do increased taxes add to Social Security benefits?

For example, if I begin having to pay additional taxes for social security… do I get credit for that? Will the additional taxes increase my future social security benefit?

Currently, there are at least three suggested methods for calculating how these additional tax will, or will not, contribute to a future social security benefit.

Option one is where there is no credit given for the additional taxes paid in beyond what the maximum taxable cap would have been under the old calculation method. If there is no credit given to benefits, and those tax dollars paid in have no benefit returned, it would fix 83% of the 75-year shortfall.

Option two is to continue crediting the higher earnings to a future benefit the same way it is now. Currently, an individuals earnings history is broken into three bands. The lower earnings are credited to a future benefit at the rate of 90%, the mid earnings are credited at a rate of 32% and the higher earnings are credited to a social security benefit at a 15% rate. In this scenario the 15% crediting rate would be applied to all of the additional earnings.

Using the current formula, this would fix 68% of the shortfall.

The third option is to use a new formula, which would credit the increased taxes above what the maximum taxable cap wou;d have been to your benefit at a 2-3% rate. This option would fix 76% of the shortfall.

Does it seem like something is missing? The closest that any of these get to fixing the shortfall is the super-harsh method where the taxable wage base is completely eliminated and there would be NO credit to the contributor’s future benefit amount.

Is it likely that a Social Security payroll tax increase will be part of the overall solution? Yes, but by itself it will not fix the problem. Next time you hear someone shouting that, tell them you know better.

It’s Your Retirement. Shouldn’t You Take Control?

Before we go, I want to thank you for taking the time to get informed. Don’t be one of the people who just float into retirement and hope everything will work out.

Sometimes it does, but sometimes a lack of planning can ruin what should be your best years. This is your retirement! Please continue to stay informed!

Be sure to subscribe to my site so you won’t miss any of the new content coming out, plus you will receive the blueprint version of my book for free.

Alternatively, you can just head over to Amazon and buy the full version. I can’t guarantee this, but I’m pretty sure you’ll get more value than the $12 it costs.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 100,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.